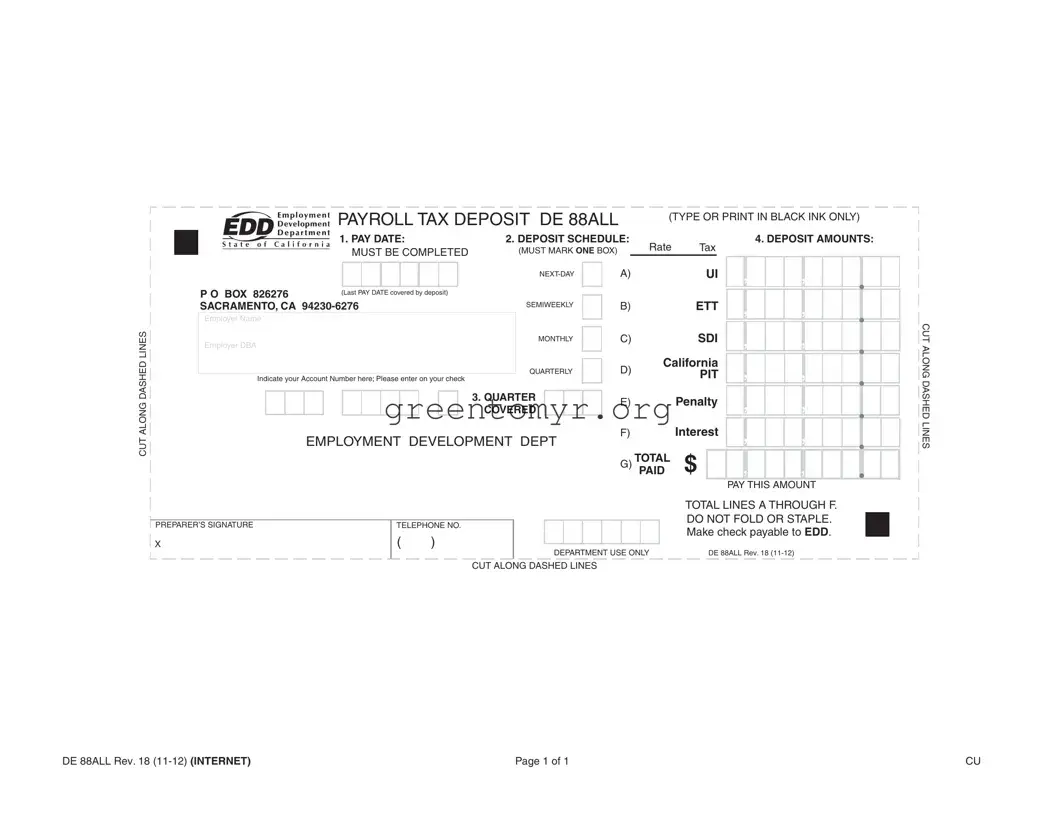

Filling out the DE 88 form correctly is crucial for ensuring timely and accurate payroll tax deposits. However, many people make common mistakes that can lead to complications. Here are seven mistakes to be aware of when completing the form.

One frequent blunder is failing to mark the correct deposit schedule. The form requires you to select a payment frequency—next-day, semiweekly, monthly, or quarterly. If you choose the wrong option, it can result in penalties for late payments. Always double-check your business's deposit schedule to ensure you're selecting the correct one.

Another common error is not including accurate deposit amounts. The section for deposit amounts must reflect the correct figures owed. Even a simple miscalculation can lead to underpayment or overpayment, which may cause issues with the Employment Development Department (EDD). Review your math carefully to avoid this mistake.

People often overlook the importance of the pay date. This date should correspond with the last payroll that the deposit covers. An incorrect pay date may raise flags with the EDD, leading to unnecessary follow-up inquiries. Always verify that this information aligns with your payroll records.

Including your account number on the form and ensuring it is correct is essential. This identifier helps the EDD match your payment with your business. A missing or incorrect account number can delay processing and lead to administrative headaches. Make it a habit to double-check this detail.

Many filers also forget to include their signature. The preparer's signature is a required field on the DE 88 form. Without it, the form may be deemed incomplete, causing delays in processing your deposit. Make sure to sign before submitting.

Some people pay little attention to the contact information. Failing to include a valid telephone number makes it difficult for the EDD to communicate with you if there are any issues with your form. Always provide a current number where you can be reached.

Lastly, a common mistake is not cutting along the dashed lines before submitting the form. Adhering to the instructions for submission can ensure the form is processed smoothly. This oversight can lead to complications, so take the time to follow the guidelines provided.

By being mindful of these common pitfalls, you can enhance your chances of filing the DE 88 form correctly and avoid unnecessary complications with your payroll tax deposits.