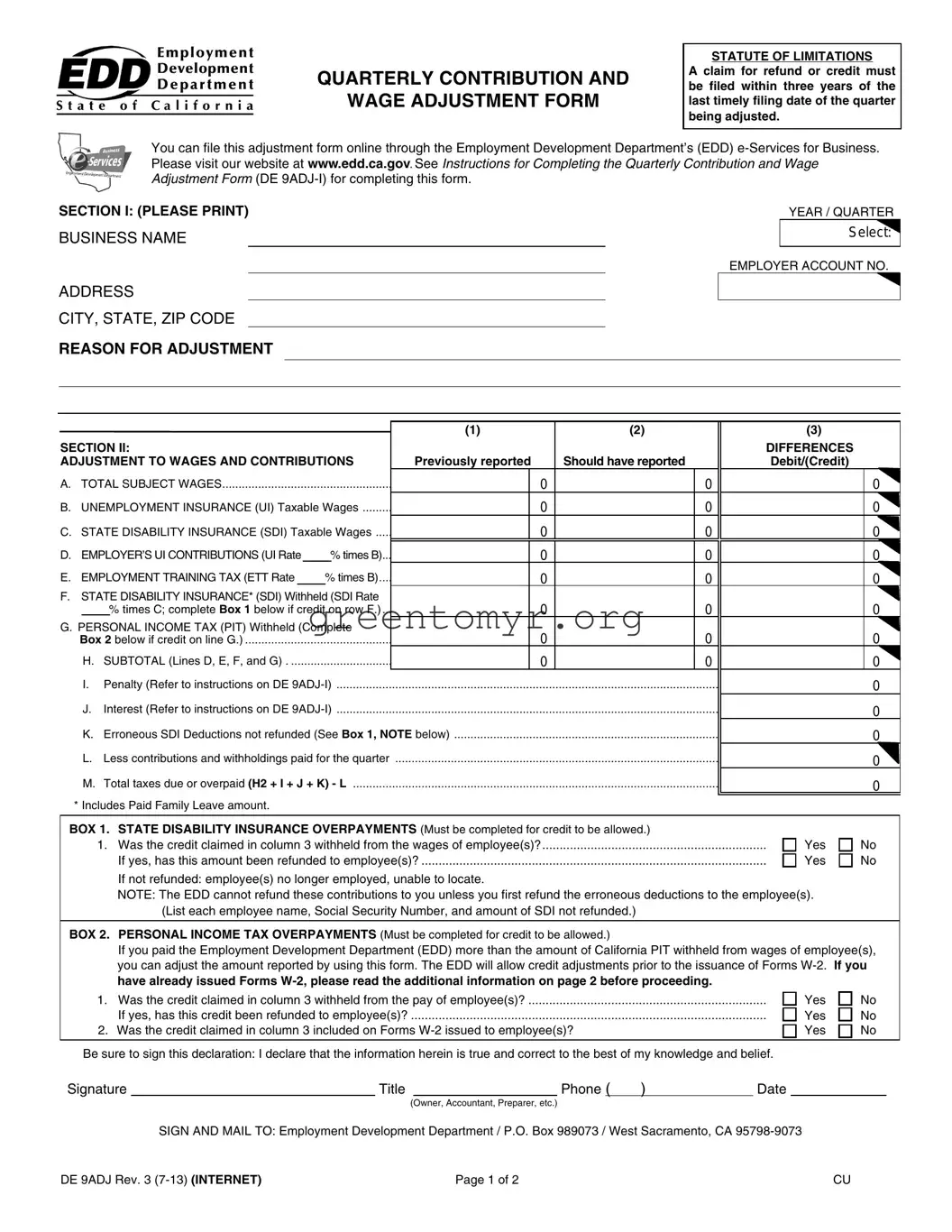

Misconception 1: The DE 9ADJ form can be submitted at any time without a deadline.

This is false. A claim for refund or credit must be filed within three years from the last timely filing date of the quarter being adjusted. It's crucial to pay attention to deadlines to ensure that adjustments are considered valid.

Misconception 2: You cannot file the DE 9ADJ form online.

Actually, you can submit this adjustment form online through the Employment Development Department’s (EDD) e-Services for Business. This option makes the process more convenient and efficient for employers.

Misconception 3: The form only requires basic information without the need for specific details.

In reality, the DE 9ADJ requires detailed information. Sections must be filled out precisely, including your business name, employer account number, and reason for adjustment. Accuracy is paramount.

Misconception 4: Employers can automatically receive a refund once the DE 9ADJ form is submitted.

While the form can initiate a refund process, refunds are contingent upon the successful completion of each requirement, including the refunding of erroneous deductions to employees when applicable. Ensure all steps are fulfilled.

Misconception 5: Adjustments on Social Security Numbers or names can be made with a single entry.

This is not the case. If you need to correct a Social Security Number or an employee's name, you must enter the information twice. Attention to detail is essential in these areas.

Misconception 6: There are no penalties for failing to report accurate wages.

It's important to know that there can be penalties for discrepancies. Always refer to the instructions on the DE 9ADJ for possible penalties and ensure that the information reported aligns with actual wages.

Misconception 7: You don't need to refund employees before claiming a credit for overpaid state disability insurance (SDI).

This is incorrect. The EDD will not refund these contributions unless you first refund the erroneous deductions directly to the employees. Proper steps must be taken.

Misconception 8: Corrections to previously reported miscellaneous deductions are not allowed.

In truth, you can adjust amounts for personal income tax overpayments using the DE 9ADJ as long as the proper information is provided and accurate records are maintained.

Misconception 9: The signing of the declaration is optional.

It's crucial to understand that signing the declaration is a mandatory step. By signing, you affirm that the information provided is true and correct to the best of your knowledge, which is significant for any possible audits.