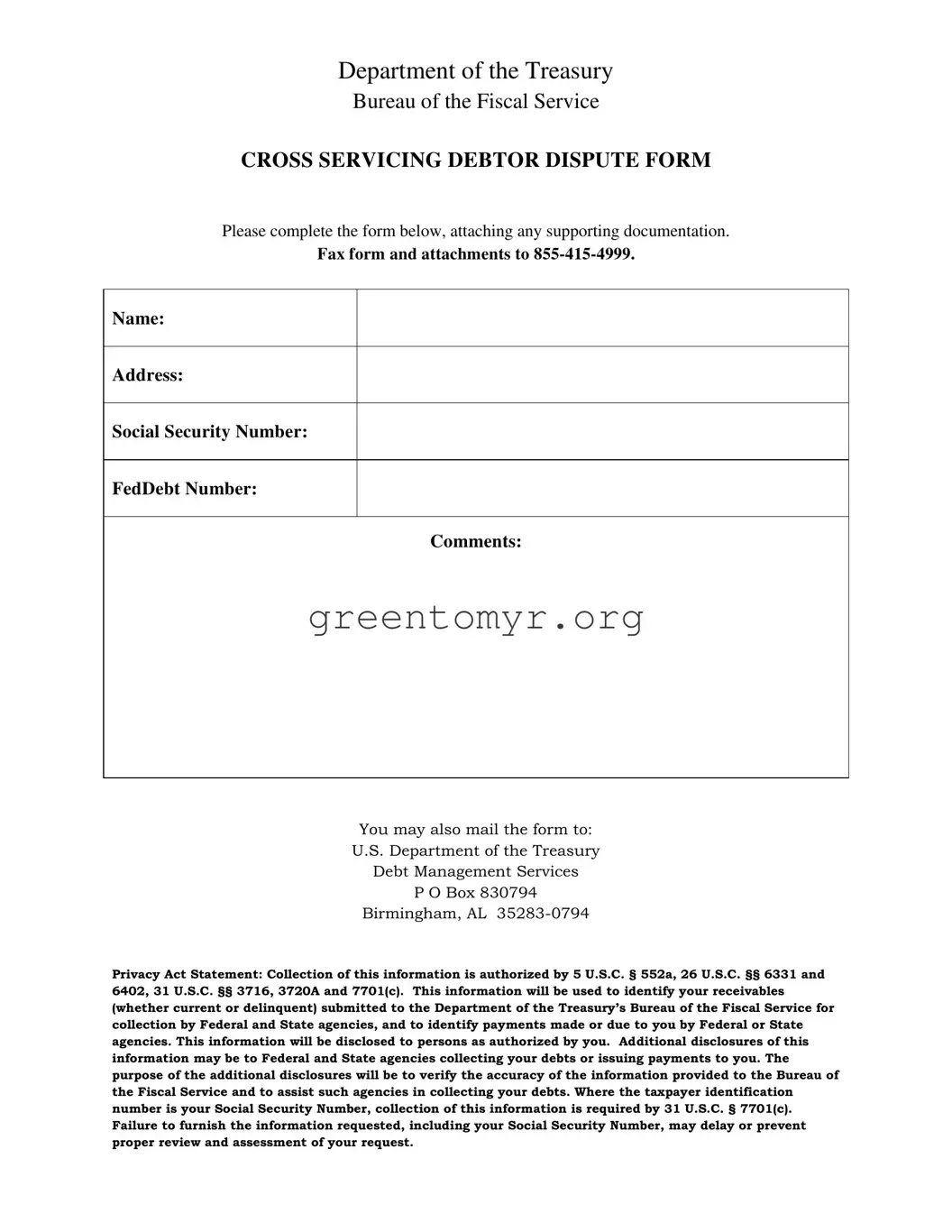

Department of the Treasury

Bureau of the Fiscal Service

CROSS SERVICING DEBTOR DISPUTE FORM

Please complete the form below, attaching any supporting documentation.

Fax form and attachments to 855-415-4999.

Name:

Address:

Social Security Number:

FedDebt Number:

Comments:

You may also mail the form to:

U.S. Department of the Treasury

Debt Management Services

P O Box 830794

Birmingham, AL 35283-0794

Privacy Act Statement: Collection of this information is authorized by 5 U.S.C. § 552a, 26 U.S.C. §§ 6331 and

6402, 31 U.S.C. §§ 3716, 3720A and 7701(c). This information will be used to identify your receivables (whether current or delinquent) submitted to the Department of the Treasury’s Bureau of the Fiscal Service for

collection by Federal and State agencies, and to identify payments made or due to you by Federal or State agencies. This information will be disclosed to persons as authorized by you. Additional disclosures of this information may be to Federal and State agencies collecting your debts or issuing payments to you. The purpose of the additional disclosures will be to verify the accuracy of the information provided to the Bureau of the Fiscal Service and to assist such agencies in collecting your debts. Where the taxpayer identification number is your Social Security Number, collection of this information is required by 31 U.S.C. § 7701(c). Failure to furnish the information requested, including your Social Security Number, may delay or prevent proper review and assessment of your request.