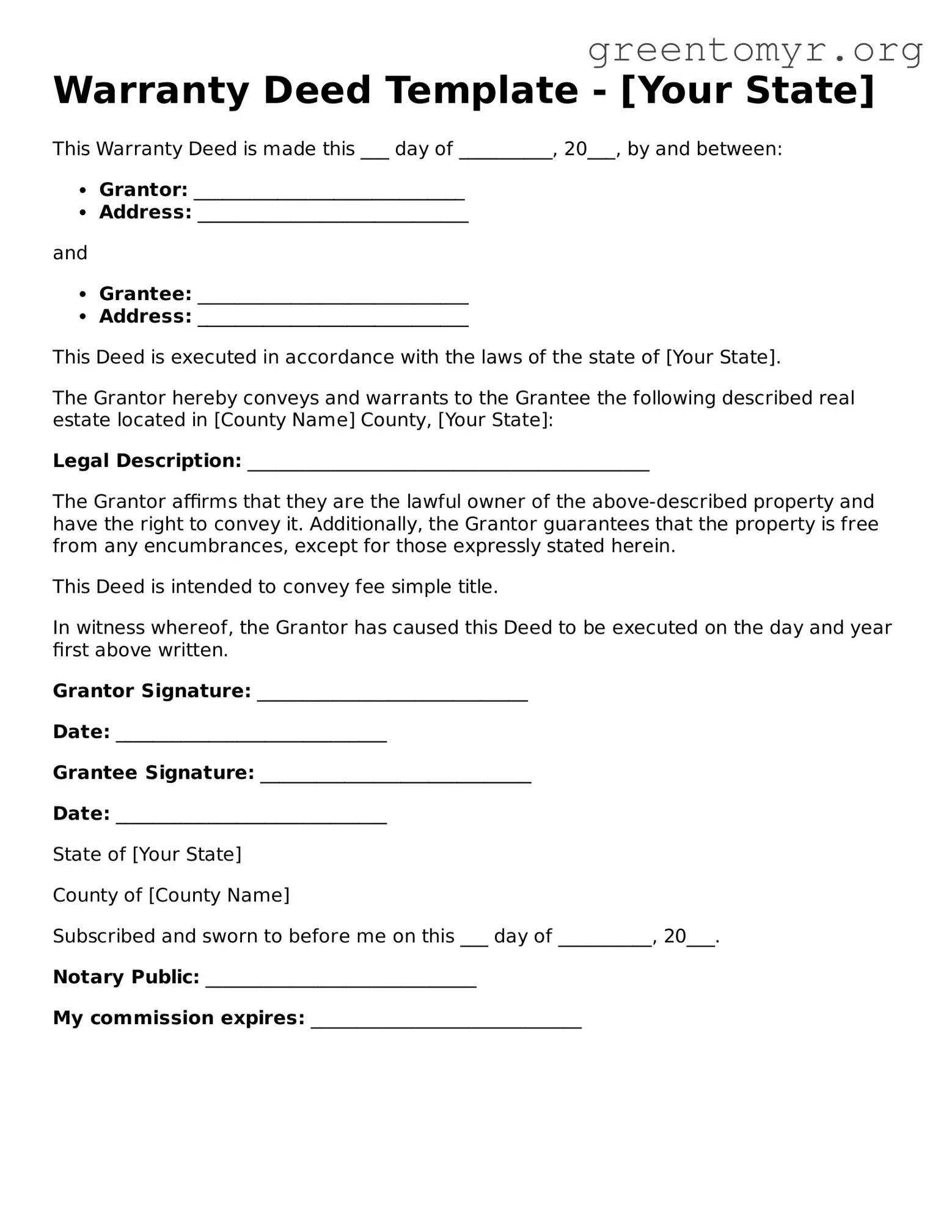

Warranty Deed Template - [Your State]

This Warranty Deed is made this ___ day of __________, 20___, by and between:

- Grantor: _____________________________

- Address: _____________________________

and

- Grantee: _____________________________

- Address: _____________________________

This Deed is executed in accordance with the laws of the state of [Your State].

The Grantor hereby conveys and warrants to the Grantee the following described real estate located in [County Name] County, [Your State]:

Legal Description: ___________________________________________

The Grantor affirms that they are the lawful owner of the above-described property and have the right to convey it. Additionally, the Grantor guarantees that the property is free from any encumbrances, except for those expressly stated herein.

This Deed is intended to convey fee simple title.

In witness whereof, the Grantor has caused this Deed to be executed on the day and year first above written.

Grantor Signature: _____________________________

Date: _____________________________

Grantee Signature: _____________________________

Date: _____________________________

State of [Your State]

County of [County Name]

Subscribed and sworn to before me on this ___ day of __________, 20___.

Notary Public: _____________________________

My commission expires: _____________________________