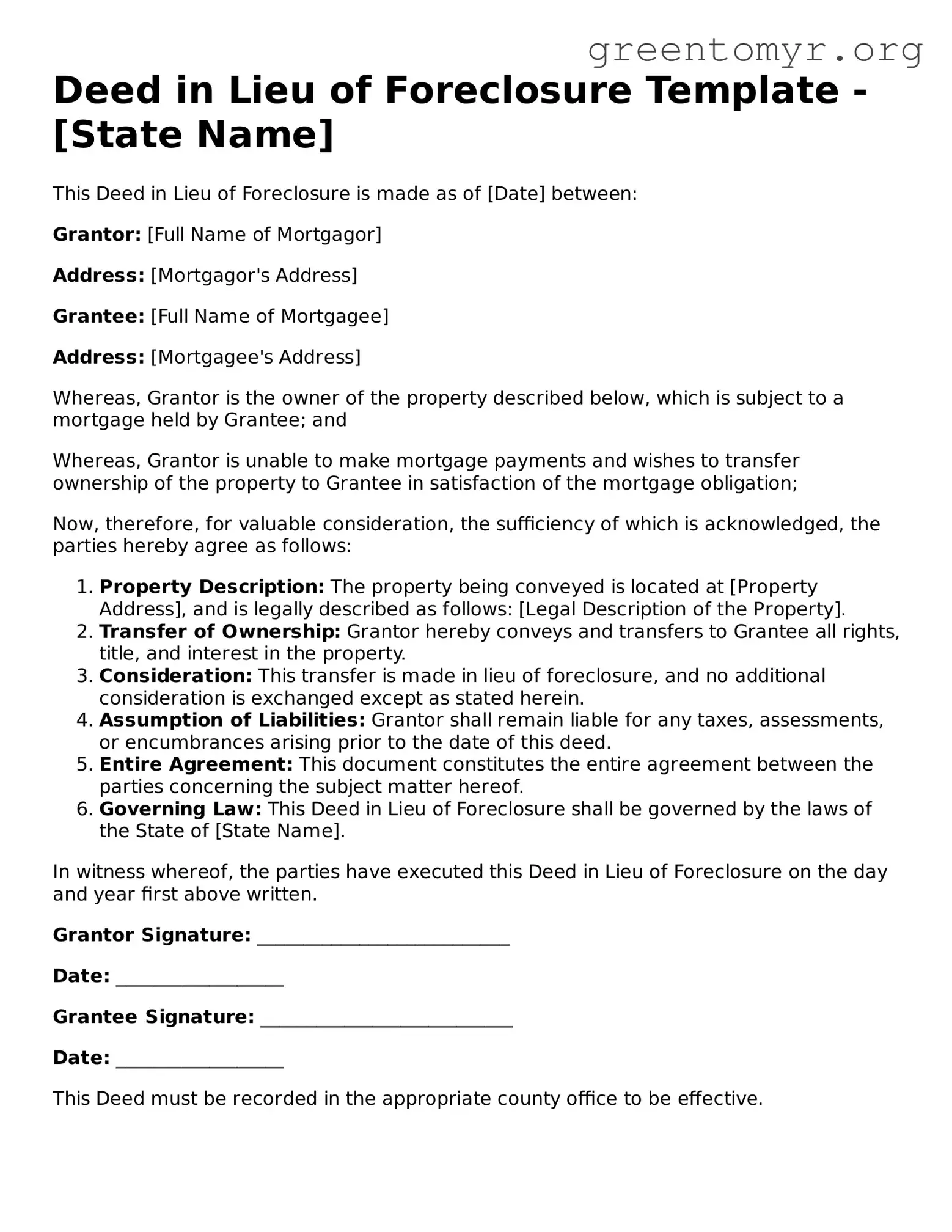

Deed in Lieu of Foreclosure Template - [State Name]

This Deed in Lieu of Foreclosure is made as of [Date] between:

Grantor: [Full Name of Mortgagor]

Address: [Mortgagor's Address]

Grantee: [Full Name of Mortgagee]

Address: [Mortgagee's Address]

Whereas, Grantor is the owner of the property described below, which is subject to a mortgage held by Grantee; and

Whereas, Grantor is unable to make mortgage payments and wishes to transfer ownership of the property to Grantee in satisfaction of the mortgage obligation;

Now, therefore, for valuable consideration, the sufficiency of which is acknowledged, the parties hereby agree as follows:

- Property Description: The property being conveyed is located at [Property Address], and is legally described as follows: [Legal Description of the Property].

- Transfer of Ownership: Grantor hereby conveys and transfers to Grantee all rights, title, and interest in the property.

- Consideration: This transfer is made in lieu of foreclosure, and no additional consideration is exchanged except as stated herein.

- Assumption of Liabilities: Grantor shall remain liable for any taxes, assessments, or encumbrances arising prior to the date of this deed.

- Entire Agreement: This document constitutes the entire agreement between the parties concerning the subject matter hereof.

- Governing Law: This Deed in Lieu of Foreclosure shall be governed by the laws of the State of [State Name].

In witness whereof, the parties have executed this Deed in Lieu of Foreclosure on the day and year first above written.

Grantor Signature: ___________________________

Date: __________________

Grantee Signature: ___________________________

Date: __________________

This Deed must be recorded in the appropriate county office to be effective.