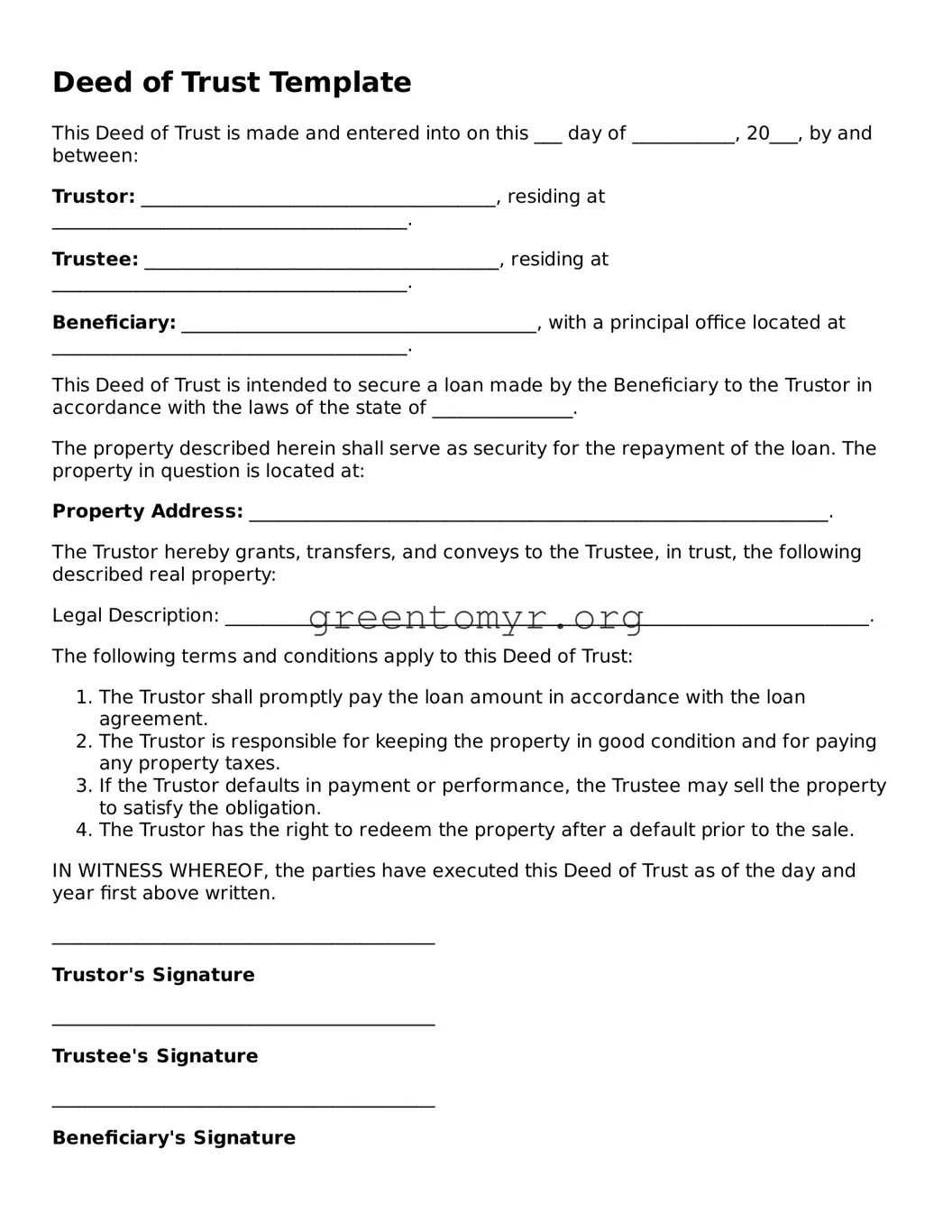

Deed of Trust Template

This Deed of Trust is made and entered into on this ___ day of ___________, 20___, by and between:

Trustor: ______________________________________, residing at ______________________________________.

Trustee: ______________________________________, residing at ______________________________________.

Beneficiary: ______________________________________, with a principal office located at ______________________________________.

This Deed of Trust is intended to secure a loan made by the Beneficiary to the Trustor in accordance with the laws of the state of _______________.

The property described herein shall serve as security for the repayment of the loan. The property in question is located at:

Property Address: ______________________________________________________________.

The Trustor hereby grants, transfers, and conveys to the Trustee, in trust, the following described real property:

Legal Description: _____________________________________________________________________.

The following terms and conditions apply to this Deed of Trust:

- The Trustor shall promptly pay the loan amount in accordance with the loan agreement.

- The Trustor is responsible for keeping the property in good condition and for paying any property taxes.

- If the Trustor defaults in payment or performance, the Trustee may sell the property to satisfy the obligation.

- The Trustor has the right to redeem the property after a default prior to the sale.

IN WITNESS WHEREOF, the parties have executed this Deed of Trust as of the day and year first above written.

_________________________________________

Trustor's Signature

_________________________________________

Trustee's Signature

_________________________________________

Beneficiary's Signature