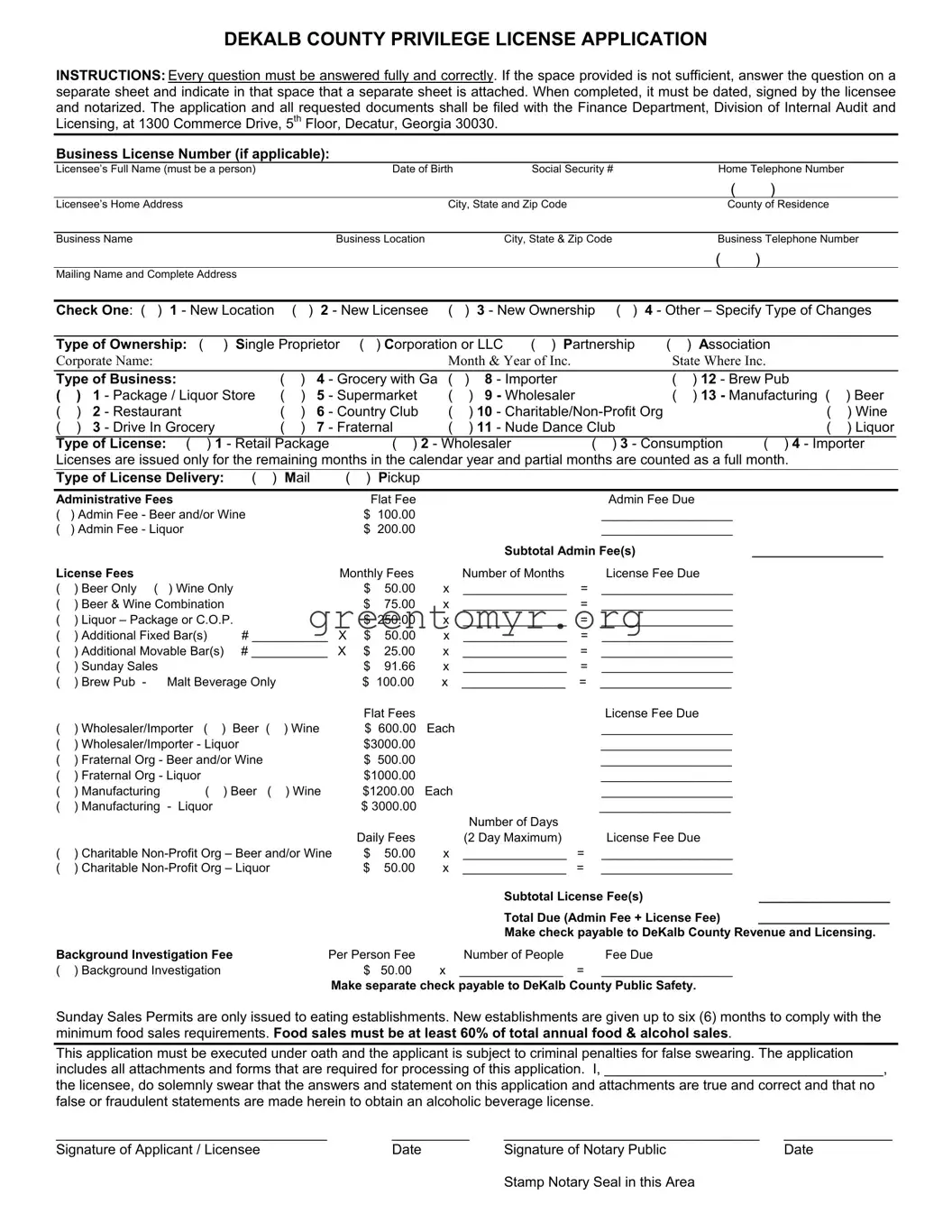

DEKALB COUNTY PRIVILEGE LICENSE APPLICATION

INSTRUCTIONS: Every question must be answered fully and correctly. If the space provided is not sufficient, answer the question on a separate sheet and indicate in that space that a separate sheet is attached. When completed, it must be dated, signed by the licensee and notarized. The application and all requested documents shall be filed with the Finance Department, Division of Internal Audit and Licensing, at 1300 Commerce Drive, 5th Floor, Decatur, Georgia 30030.

Business License Number (if applicable):

Licensee’s Full Name (must be a person)Date of BirthSocial Security #Home Telephone Number

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Licensee’s Home Address |

|

|

|

|

City, State and Zip Code |

|

County of Residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Name |

|

|

|

Business Location |

|

|

|

|

City, State & Zip Code |

|

Business Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

Mailing Name and Complete Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check One: ( ) 1 - New Location |

( |

|

) 2 - New Licensee |

( |

) |

3 - New Ownership ( ) 4 - Other – Specify Type of Changes |

|

|

|

|

|

Type of Ownership: ( ) Single Proprietor ( ) Corporation or LLC |

( ) Partnership |

( |

) Association |

|

Corporate Name: |

|

|

|

|

Month & Year of Inc. |

State Where Inc. |

|

Type of Business: |

( |

) |

4 |

- Grocery with Ga |

( |

) |

8 |

- Importer |

( |

) 12 - Brew Pub |

|

( |

) |

1 |

- Package / Liquor Store |

( |

) |

5 |

- Supermarket |

( |

) |

9 |

- Wholesaler |

( |

) 13 - Manufacturing ( |

) Beer |

( |

) |

2 |

- Restaurant |

( |

) |

6 |

- Country Club |

( |

) |

10 |

- Charitable/Non-Profit Org |

|

|

( |

) Wine |

( |

) |

3 |

- Drive In Grocery |

( |

) |

7 |

- Fraternal |

( |

) |

11 |

- Nude Dance Club |

|

|

( |

) Liquor |

|

Type of License: |

( |

) 1 - Retail Package |

|

|

( ) 2 - Wholesaler |

|

( ) 3 - Consumption |

( ) 4 - Importer |

|

|

Licenses are issued only for the remaining months in the calendar year and partial months are counted as a full month. |

|

|

Type of License Delivery: |

( |

) |

Mail |

( |

) |

Pickup |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative Fees |

|

|

|

|

|

|

Flat Fee |

|

|

|

Admin Fee Due |

|

|

|

( ) Admin Fee - Beer and/or Wine |

|

|

|

$ 100.00 |

|

|

|

___________________ |

|

|

|

( |

) Admin Fee - Liquor |

|

|

|

|

|

|

$ 200.00 |

|

|

|

___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Admin Fee(s) |

___________________ |

|

|

License Fees |

|

|

|

|

|

|

Monthly Fees |

|

Number of Months |

|

License Fee Due |

|

|

|

( |

) Beer Only ( |

) Wine Only |

|

|

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

|

( ) Beer & Wine Combination |

|

|

|

|

$ |

75.00 |

x |

_______________ |

= |

___________________ |

|

|

|

( ) Liquor – Package or C.O.P. |

|

|

|

$ 250.00 |

x |

_______________ |

= |

___________________ |

|

|

|

( |

) Additional Fixed Bar(s) |

|

# ___________ |

X |

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

|

( |

) Additional Movable Bar(s) |

# ___________ |

X |

$ |

25.00 |

x |

_______________ |

= |

___________________ |

|

|

|

( |

) Sunday Sales |

|

|

|

|

|

|

|

$ |

91.66 |

x |

_______________ |

= |

___________________ |

|

|

|

( |

) Brew Pub - |

Malt Beverage Only |

|

|

$ 100.00 |

x |

_______________ |

= |

___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

Flat Fees |

|

|

|

License Fee Due |

|

|

|

( |

) Wholesaler/Importer |

( |

) |

Beer |

( |

) Wine |

|

$ |

600.00 |

Each |

|

|

___________________ |

|

|

|

( |

) Wholesaler/Importer - Liquor |

|

|

|

$3000.00 |

|

|

|

___________________ |

|

|

|

( ) Fraternal Org - Beer and/or Wine |

|

|

|

$ 500.00 |

|

|

|

___________________ |

|

|

|

( |

) Fraternal Org - Liquor |

|

|

|

|

|

|

$1000.00 |

|

|

|

___________________ |

|

|

|

( |

) Manufacturing |

|

( |

) Beer |

( |

) Wine |

|

$1200.00 |

Each |

|

|

___________________ |

|

|

|

( |

) Manufacturing - Liquor |

|

|

|

|

|

$ 3000.00 |

|

|

|

___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Days |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daily Fees |

|

(2 Day Maximum) |

|

License Fee Due |

|

|

|

( ) Charitable Non-Profit Org – Beer and/or Wine |

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

|

( ) Charitable Non-Profit Org – Liquor |

|

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal License Fee(s) |

___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due (Admin Fee + License Fee) |

___________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make check payable to DeKalb County Revenue and Licensing. |

|

|

Background Investigation Fee |

|

Per Person Fee |

|

Number of People |

|

Fee Due |

|

|

|

( |

) Background Investigation |

|

|

|

|

|

$ |

50.00 |

x |

_______________ |

= |

___________________ |

|

|

Make separate check payable to DeKalb County Public Safety.

Sunday Sales Permits are only issued to eating establishments. New establishments are given up to six (6) months to comply with the minimum food sales requirements. Food sales must be at least 60% of total annual food & alcohol sales.

This application must be executed under oath and the applicant is subject to criminal penalties for false swearing. The application includes all attachments and forms that are required for processing of this application. I, ____________________________________,

the licensee, do solemnly swear that the answers and statement on this application and attachments are true and correct and that no false or fraudulent statements are made herein to obtain an alcoholic beverage license.

___________________________________ |

__________ |

_________________________________ |

______________ |

Signature of Applicant / Licensee |

Date |

Signature of Notary Public |

Date |

|

|

Stamp Notary Seal in this Area |

|

Application – Page 2

1.Will you have entertainment? ________ If yes, describe in detail ____________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

2.Does the licensee, partner, corporation or owner have any ownership interest in any other licensed alcoholic beverage business in the State of Georgia? If yes, give name of that person, name of business and complete address of business. ________________

________________________________________________________________________________________________________

3.List the full name, address and other pertinent information for each person having any ownership interest in this business, corporate officers or partners:

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

|

|

|

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

|

|

|

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

|

|

|

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

|

|

|

Name: |

Social Security #: |

Date Of Birth: |

Home Address: |

City: |

State: |

|

|

|

Zip Code: |

Dollar Investment in Business: |

Percent of Interest: |

|

|

|

4.List name and address of the owners of the building and land and the name and address of the lessor or sub-lessor:

NameStreet Address City – State – Zip Amount of Rent Due Owner Building __________________________________________________________________________________________

Owner of Land __________________________________________________________________________________________

Lessor ___________________________________________________________________________________________

Sub-Lessor ___________________________________________________________________________________________

5.How much money is being invested in the business? Total amount of money paid _________________________

6.How much of the money being invested is borrowed and from whom? Show total amount borrowed ______________________

Name of Bank, Business or Person Street AddressCity-State-Zip Code

________________________________________________________________________________________________________

________________________________________________________________________________________________________

7.Name and home address of the manager of this business:

________________________________________________________________________________________________________

8.Have you attached a copy of the floor plans of this business showing inside layout of the store, including entrance(s) and exit(s). Nightclubs and restaurants needs to show kitchen, bathrooms, dining areas, entertainment area and any offices. Yes _________

9.If this is a corporation, Limited Liability Company or a partnership, please attach copies of the state Certificate of Incorporation along with copies of your corporate, LLC or partnership papers showing the officers.

10.Have you attached two (2) registered agent forms with pictures of the agent? ______________

11.Have you received a copy of the DeKalb County Alcoholic Beverage Ordinance? ___________ No application can be processed until you acknowledge receipt of the County Ordinance (rules and regulations).

____________________________________ |

________________________________________ |

_____________________ |

Print name of applicant / licensee |

Signature of applicant / licensee |

Date |