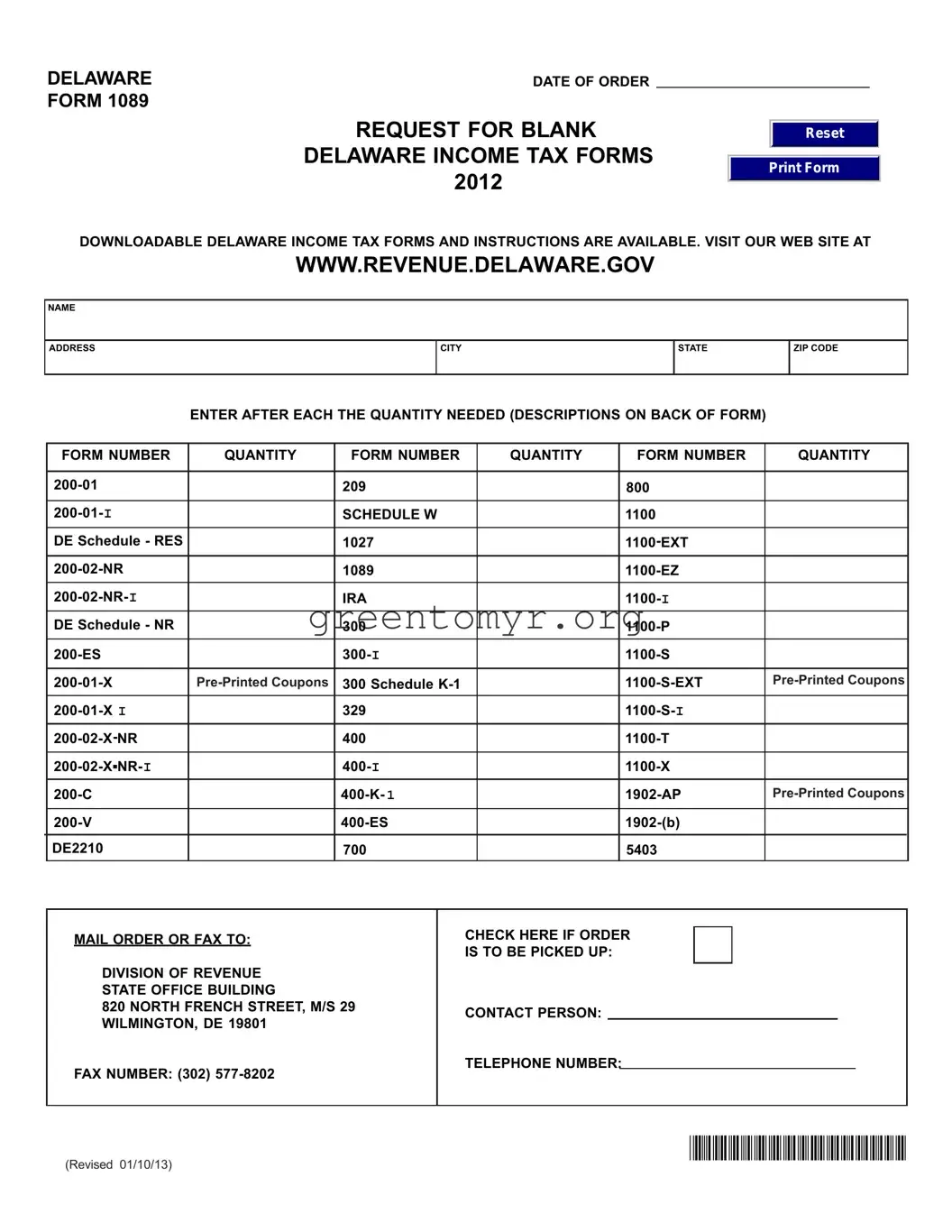

When filling out the Delaware 1089 form, people often overlook important details. One common mistake is not entering accurate contact information. If the name, address, or phone number contains errors, it can lead to delays or issues in processing requests for blank tax forms.

Another frequent error is neglecting to specify the quantity needed for each form. It’s essential to carefully list how many of each form you require. Failing to do this can result in an insufficient supply of forms, causing future complications.

People also sometimes select the wrong form number. Each form has specific purposes, and confusion between them can be costly. Make sure to double-check that the form numbers match your needs to avoid filing the incorrect tax return.

Additionally, some individuals mistakenly do not review the back of the form for additional instructions. There may be critical details about how to fill out the form or information that clarifies what is needed.

Another common oversight is failing to check the box intended for in-person pickup, if applicable. This helps streamline the process for those who prefer to collect the forms directly. Marking this box, when relevant, ensures that your request is handled as desired.

People frequently forget to include a contact person’s name when submitting the order. Including this information can help the Division of Revenue reach someone quickly if any questions arise. This small step can facilitate smoother communication.

Some individuals do not provide a fax number or leave the telephone number field blank. Providing a way for the tax office to contact you is vital. Having your contact information ensures that they can address any issues swiftly.

Lastly, many fail to sign the form or date it. This is an essential step that verifies the request. Without a signature or date, the order might not be processed, putting a delay on acquiring the necessary tax forms.