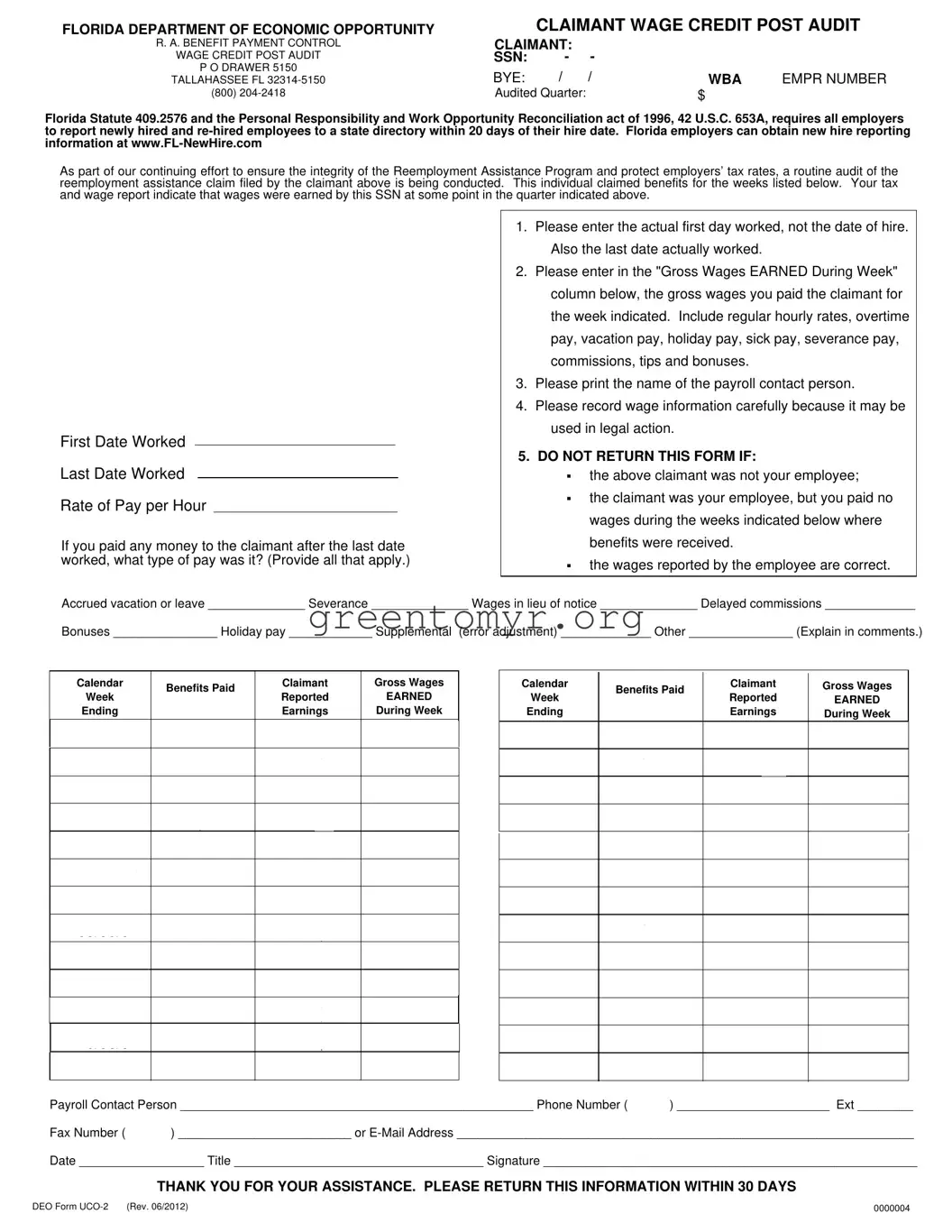

Filling out the DEO UCO 2 form can seem straightforward, but many individuals make critical errors that can lead to delays or complications. One common mistake is failing to enter the actual first day worked instead of the hire date. This information is essential for the accurate processing of the claim, and inconsistencies can slow the overall process.

Another frequent error is neglecting to provide complete wage information for each week. It's vital to include all forms of payment—such as overtime, bonuses, and commissions—in the "Gross Wages EARNED During Week" column. Omitting any payments can alter the claim's validity and impact potential legal outcomes.

Individuals also often forget to print the name of the payroll contact person. This small detail ensures that the DEO can reach a responsible party quickly, streamlining communication and avoiding unnecessary back and forth. Having a designated contact person helps facilitate a smoother process.

Additionally, inaccuracies can arise if the wage information is not recorded carefully. When mistakes are made in reporting, it can lead to misunderstandings that might result in legal complications. Accuracy and attention to detail are paramount in this process.

Another misstep occurs when claimants assume that the form does not need to be returned if there are no wages reported for certain weeks. It’s crucial to return the form regardless, as it keeps the DEO informed about the claimant's employment status and compliance with regulations.

Some filers may also overlook the requirement to submit this information within 30 days. Failing to meet this deadline can complicate the situation further and potentially jeopardize claims or benefits. Timeliness is essential to maintain compliance with the DEO's regulations.

Furthermore, neglecting to include an accurate phone number or email address for the payroll contact can lead to delays in communication. The DEO relies on these contact methods to follow up on any discrepancies. Providing clear and accurate contact information helps eliminate confusion.

Finally, individuals sometimes fail to sign and date the form. A missing signature could lead to the form being deemed incomplete or invalid. It is a simple yet critical step that cannot be overlooked when submitting the DEO UCO 2 form.