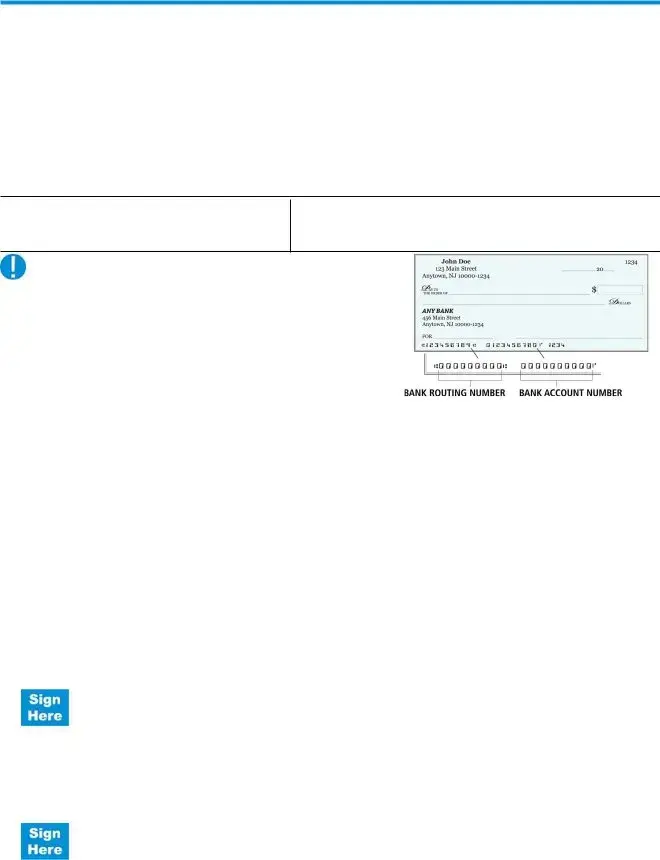

The Deposit Metlife Check form serves as a vital tool for individuals looking to streamline their insurance claims or annuities process with Metlife. When filling out this form, recipients must ensure that all required information is accurately provided to facilitate prompt processing of their checks. Key components of the form include personal identification details, check information, and specific instructions on how to submit it effectively. Individuals must also pay attention to any additional documentation that may be required alongside the form, as incomplete submissions can lead to delays. Understanding the function and importance of each section can significantly help in avoiding potential issues. The form is designed to be user-friendly, yet it's essential to approach it with careful consideration to ensure that all necessary steps are followed. With correct information and adherence to the instructions, the process of depositing a Metlife check can be accomplished smoothly.