Steps for filling out Deposit Slips

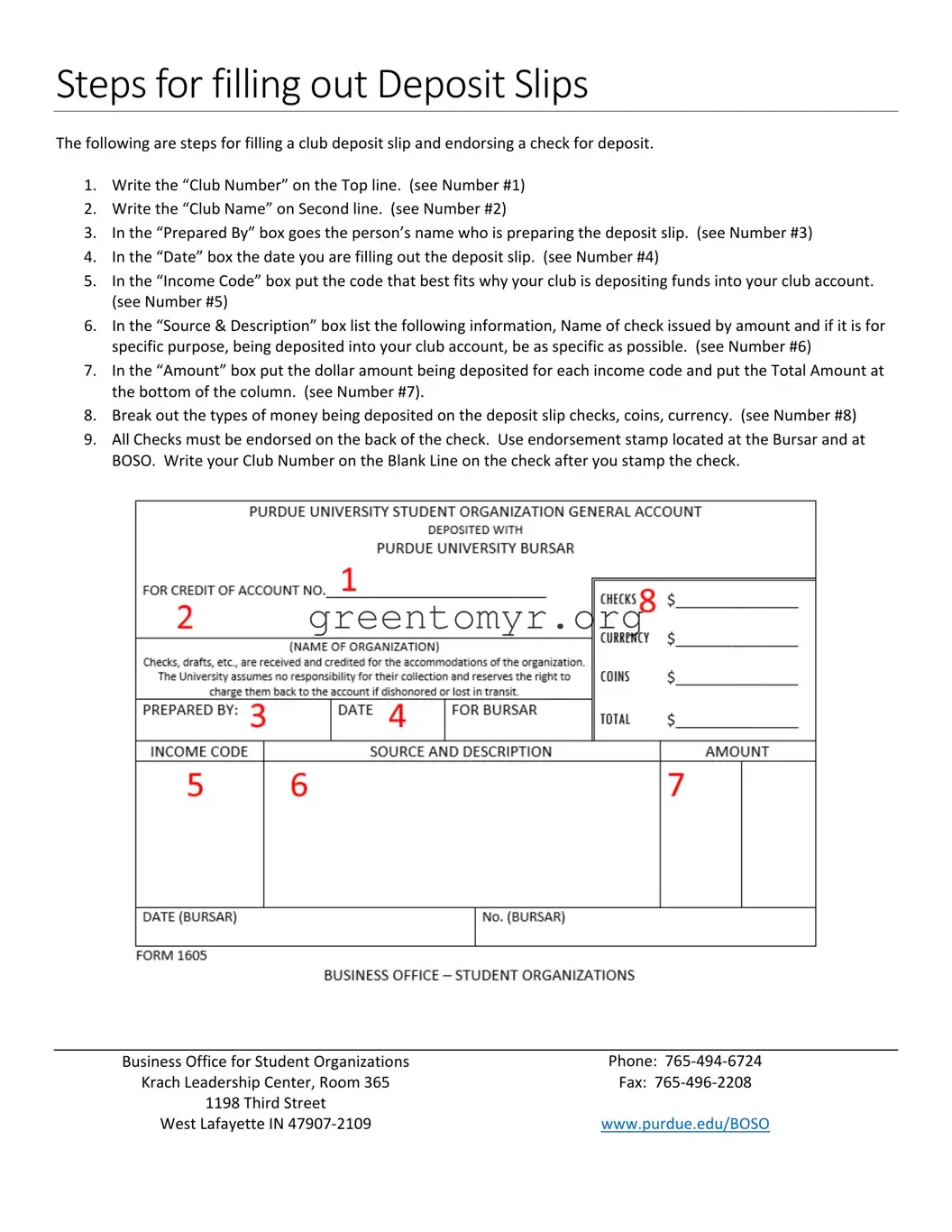

The following are steps for filling a club deposit slip and endorsing a check for deposit.

1.Write the “Club Number” on the Top line. (see Number #1)

2.Write the “Club Name” on Second line. (see Number #2)

3.In the “Prepared By” box goes the person’s name who is preparing the deposit slip. (see Number #3)

4.In the “Date” box the date you are filling out the deposit slip. (see Number #4)

5.In the “Income Code” box put the code that best fits why your club is depositing funds into your club account. (see Number #5)

6.In the “Source & Description” box list the following information, Name of check issued by amount and if it is for specific purpose, being deposited into your club account, be as specific as possible. (see Number #6)

7.In the “Amount” box put the dollar amount being deposited for each income code and put the Total Amount at the bottom of the column. (see Number #7).

8.Break out the types of money being deposited on the deposit slip checks, coins, currency. (see Number #8)

9.All Checks must be endorsed on the back of the check. Use endorsement stamp located at the Bursar and at BOSO. Write your Club Number on the Blank Line on the check after you stamp the check.

Business Office for Student Organizations |

Phone: 765‐494‐6724 |

Krach Leadership Center, Room 365 |

Fax: 765‐496‐2208 |

1198 Third Street |

www.purdue.edu/BOSO |

West Lafayette IN 47907‐2109 |