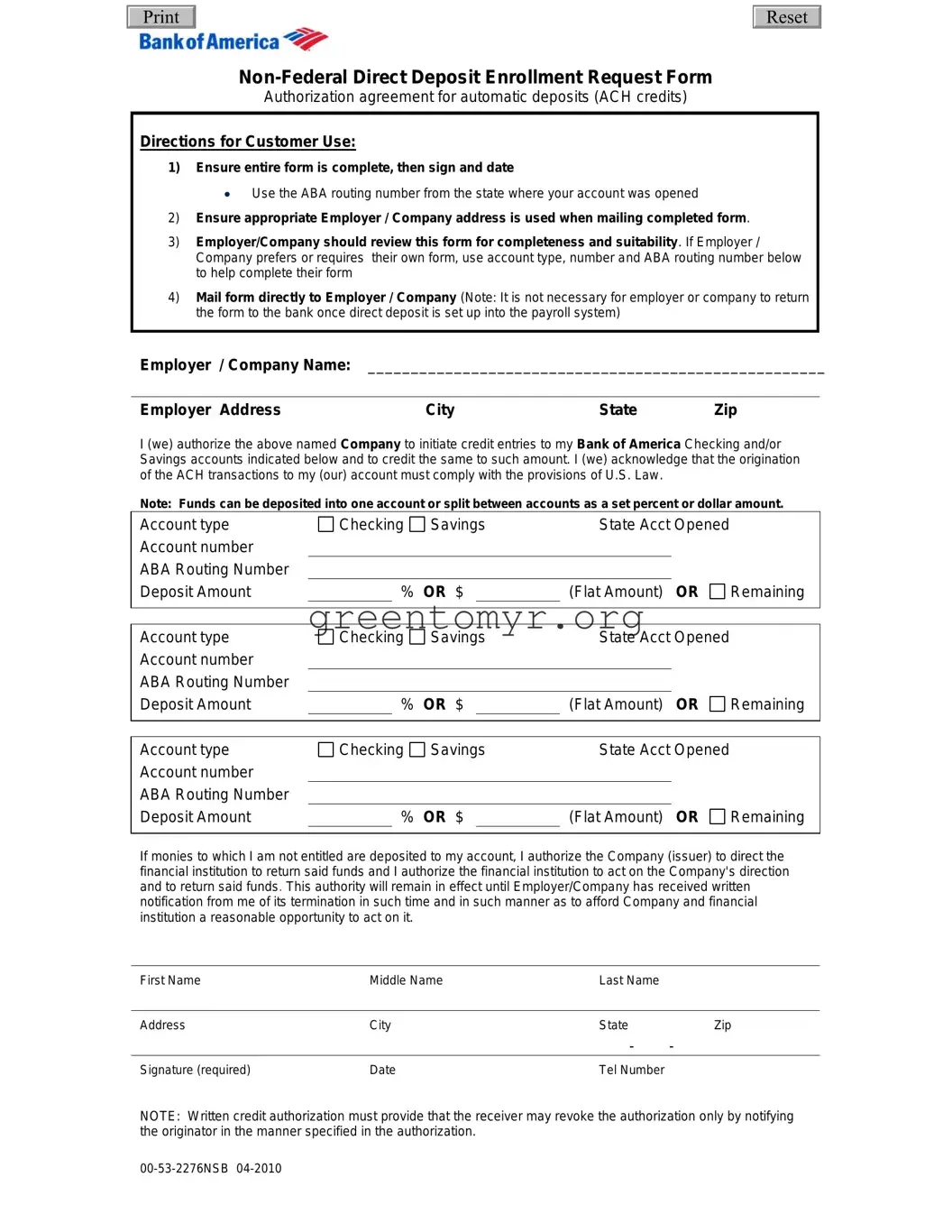

Filling out a Deposit Slip Bank America form seems straightforward, yet many people overlook crucial details. One common mistake involves leaving the form incomplete. It's essential to ensure that every section is filled out properly. This includes your personal information, account types, and any deposit amounts. Incomplete sections can lead to delays or, worse, a failure to process your direct deposit.

Another frequent error occurs when individuals use the wrong ABA routing number. It's vital to use the routing number associated with the state where you opened your account. Using an incorrect routing number can cause funds to be misdirected, leading to significant complications for both you and your employer.

A third mistake is not specifying the correct employer or company address. When mailing the completed form, it’s imperative to use the accurate address. A mistake here might result in the form not reaching its intended destination, setting back the entire process.

Many people also fail to sign and date the form. Without your signature and the date, the deposit request may not be valid. Ensure that both are clearly provided; otherwise, your request could be dismissed as incomplete.

Moreover, some individuals disregard the section regarding the deposit amounts. Whether choosing a flat amount or a percentage, it's essential to specify how you'd like your funds divided among accounts. Omitting this information can lead to confusion and possibly incorrect distributions of your funds.

Another common oversight is neglecting to review the entire form with the employer or company before sending it. They should check it for completeness and accuracy. If they prefer their own form, they can use the information from your completed form to fill it out correctly, making this collaboration crucial.

Finally, a lack of clear communication about the return of funds can create misunderstandings. If unauthorized funds are deposited into your account, know that you must act promptly. Ensure you’ve provided your employer or company with written notification about how to handle any such situations. Clear guidelines can prevent frustration and ensure a smoother experience.