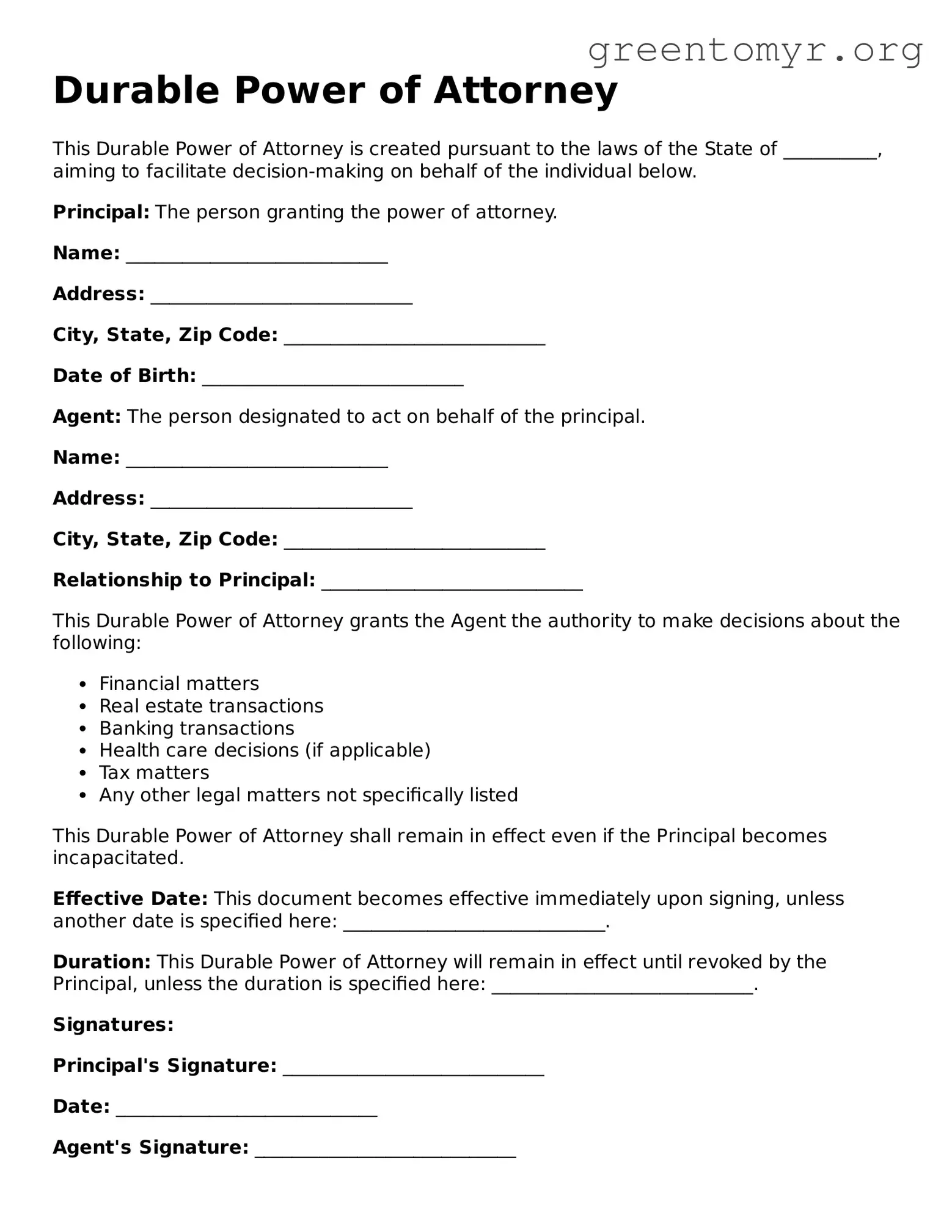

Durable Power of Attorney

This Durable Power of Attorney is created pursuant to the laws of the State of __________, aiming to facilitate decision-making on behalf of the individual below.

Principal: The person granting the power of attorney.

Name: ____________________________

Address: ____________________________

City, State, Zip Code: ____________________________

Date of Birth: ____________________________

Agent: The person designated to act on behalf of the principal.

Name: ____________________________

Address: ____________________________

City, State, Zip Code: ____________________________

Relationship to Principal: ____________________________

This Durable Power of Attorney grants the Agent the authority to make decisions about the following:

- Financial matters

- Real estate transactions

- Banking transactions

- Health care decisions (if applicable)

- Tax matters

- Any other legal matters not specifically listed

This Durable Power of Attorney shall remain in effect even if the Principal becomes incapacitated.

Effective Date: This document becomes effective immediately upon signing, unless another date is specified here: ____________________________.

Duration: This Durable Power of Attorney will remain in effect until revoked by the Principal, unless the duration is specified here: ____________________________.

Signatures:

Principal's Signature: ____________________________

Date: ____________________________

Agent's Signature: ____________________________

Date: ____________________________

Witness Statement: I, the undersigned witness, confirm that the Principal signed this Durable Power of Attorney in my presence.

Witness Name: ____________________________

Witness Signature: ____________________________

Date: ____________________________

In accordance with the laws of the State of __________, this Durable Power of Attorney serves to protect the interests of the Principal and streamline the decision-making process.