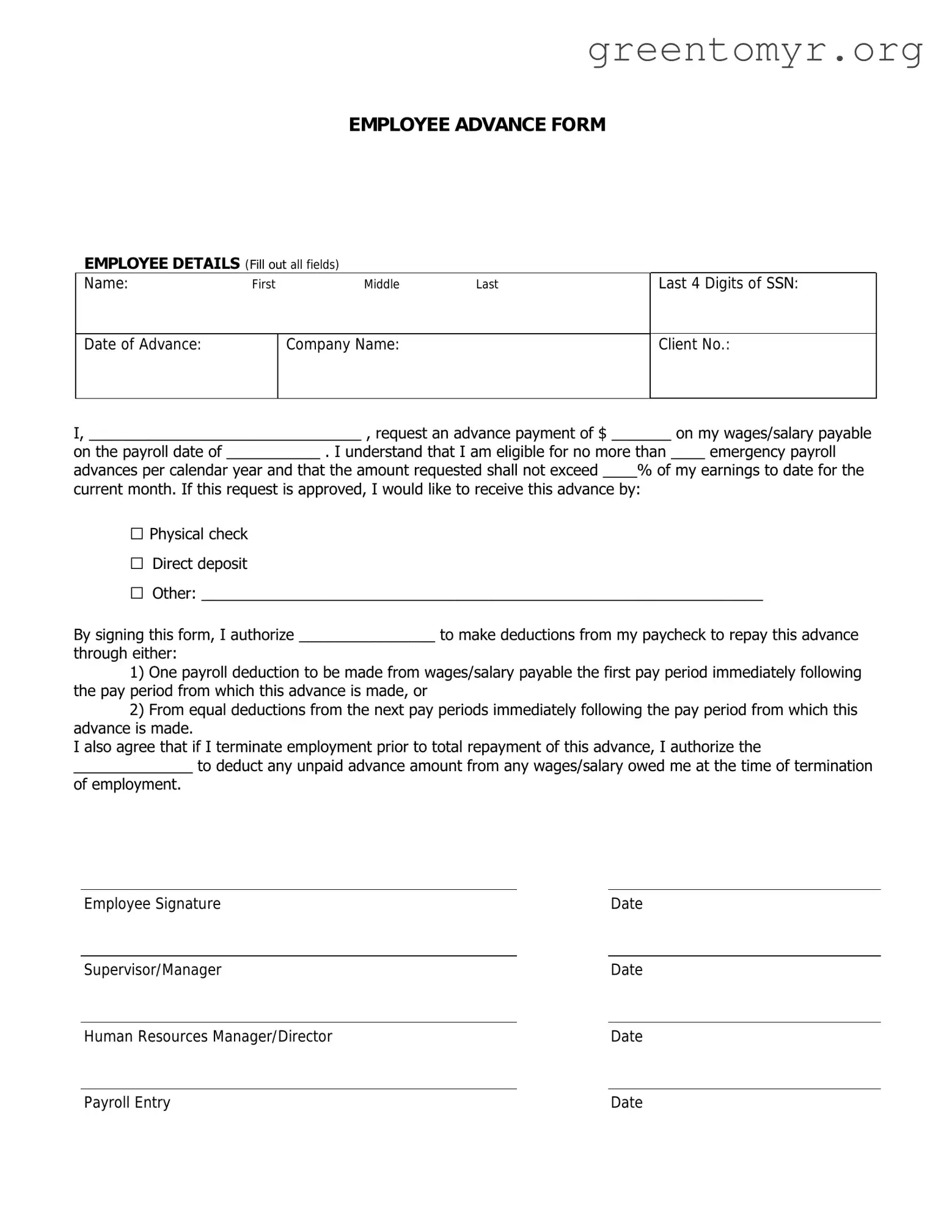

The Employee Advance form is a document that employees use to request funds from their employer before their scheduled pay date. This advance is typically intended for unexpected expenses or emergencies.

Generally, all full-time employees may be eligible to submit an advance request. However, some companies may have specific policies regarding eligibility based on tenure or performance. It is advisable to check your company’s guidelines.

To complete the form, follow these steps:

-

Fill in your personal details, including your name, employee ID, and department.

-

Specify the amount you wish to request.

-

Provide a brief explanation of why you are requesting the advance.

-

Sign and date the form.

Make sure all information is accurate before submission. Incomplete forms may delay the processing of your request.

Is there a limit to how much I can request?

Most companies set a limit on the amount that can be requested as an advance. This could be a percentage of your salary or a fixed dollar amount. Check your HR policy for specific limits.

How is my request for an advance reviewed?

Your immediate supervisor or the HR department usually reviews all requests. They will assess the validity of your request based on company policies and your circumstances.

Will the advance be deducted from my next paycheck?

Yes, typically, the amount you receive as an advance will be deducted from your next paycheck. Some companies may offer a repayment schedule if the amount is significant.

How long does it take to get approval for an Employee Advance?

The approval time may vary. Typically, you can expect a response within a few business days after submission. If there are any issues or additional information is needed, the process may take longer.

What happens if my advance request is denied?

If your request is denied, you should receive an explanation from your supervisor or HR department. You may have the option to appeal the decision or submit a new request, perhaps with additional documentation.

Can I request an advance for personal loans or non-emergency expenses?

Most companies prefer that advances be used for genuine emergencies or unexpected expenses. Requests for personal loans or non-urgent expenses may be scrutinized more closely and could be denied based on company policy.

Once completed, you should submit the form to your supervisor or the HR department, depending on your organization’s specific procedures. Ensure that you keep a copy of the submitted form for your records.