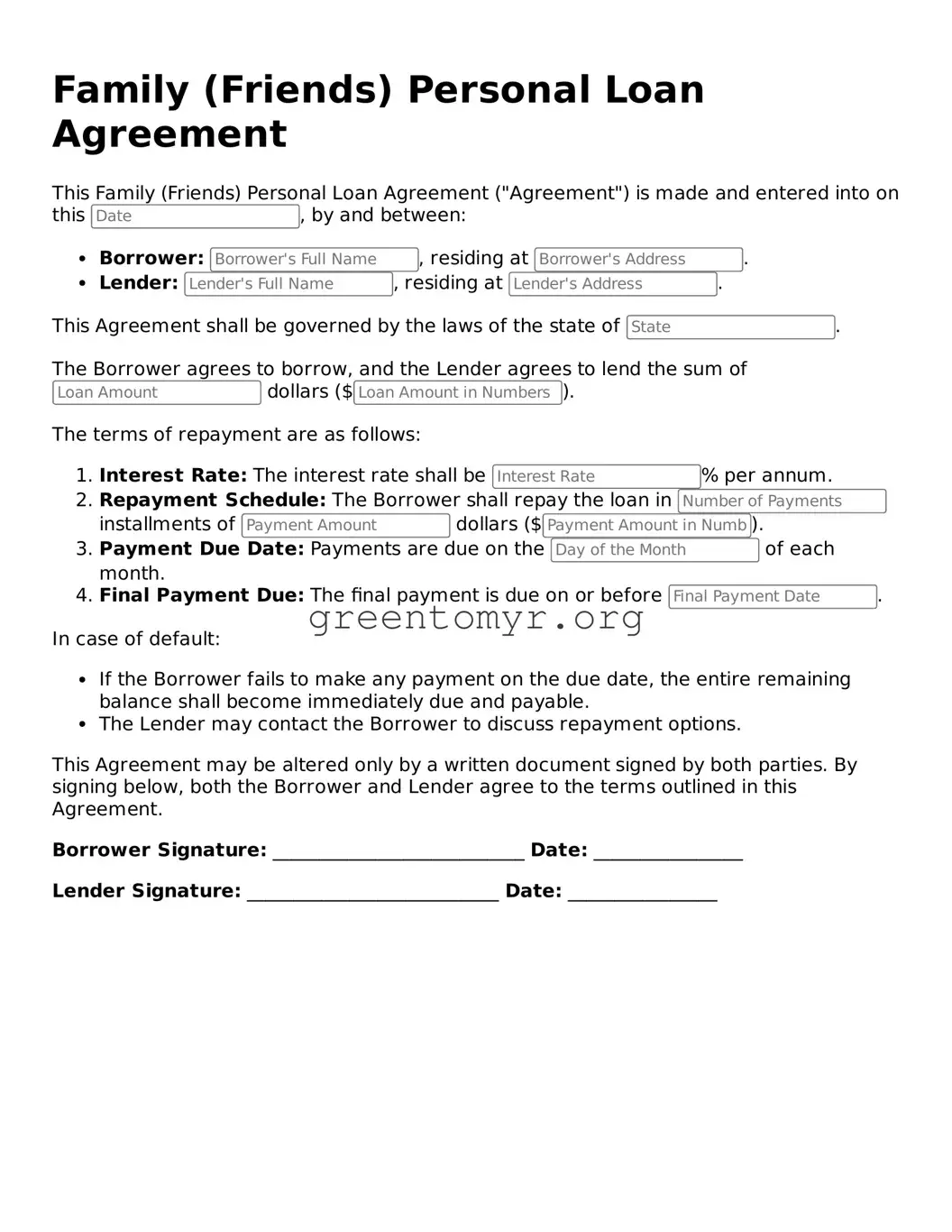

Valid Family (Friends) Personal Loan Agreement Form

The Family (Friends) Personal Loan Agreement form is a crucial document that outlines the terms of a loan between friends or family members. This agreement helps ensure that both parties understand their responsibilities, repayment terms, and any interest that may apply. To establish clear expectations and maintain healthy relationships, consider filling out the form by clicking the button below.