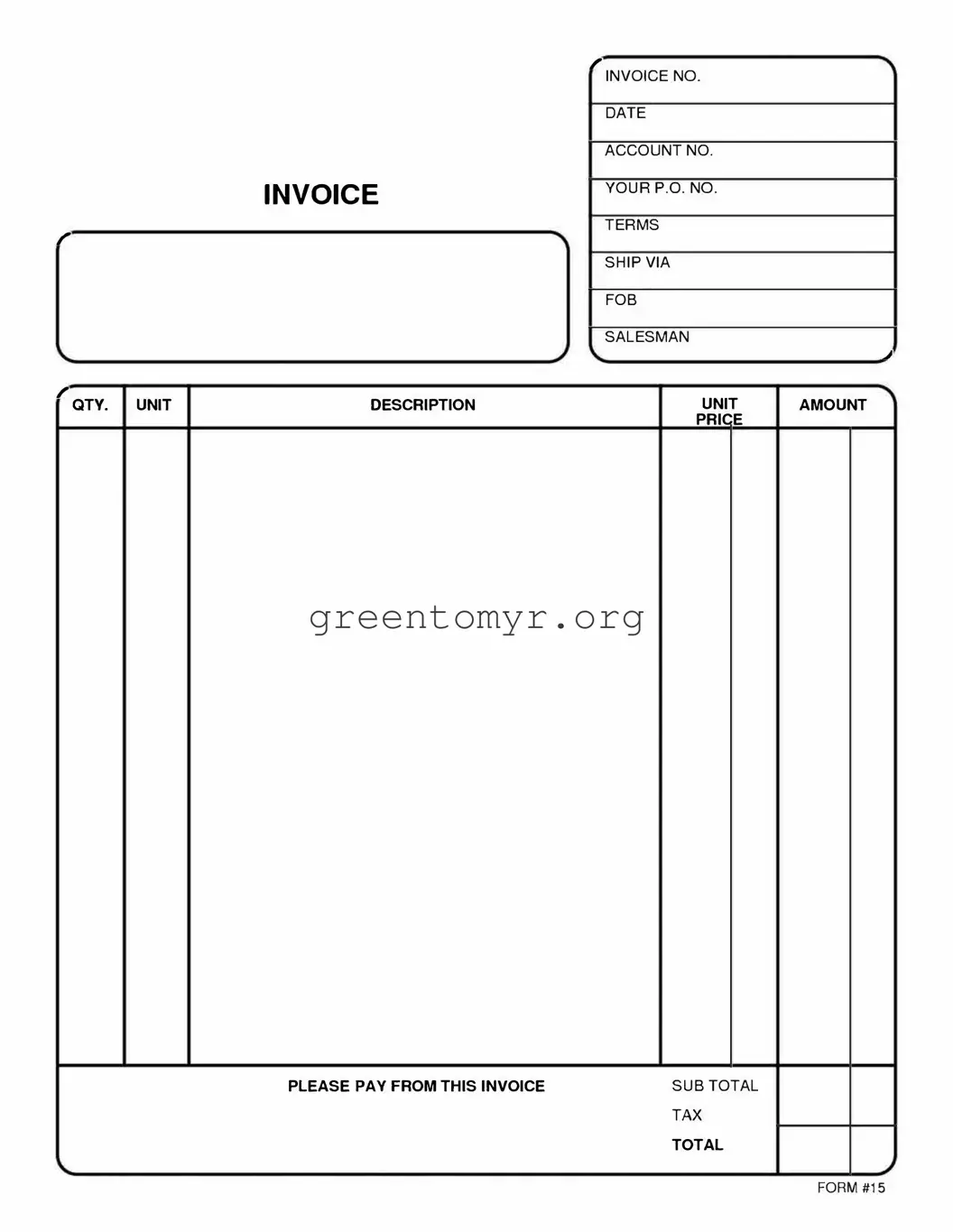

The Free And Invoice PDF form is a document designed to help businesses and individuals create and manage invoices efficiently. This user-friendly template allows you to input necessary information, including items sold, quantities, prices, and tax information. You can then save it as a PDF for easy sharing and printing.

You can access the Free And Invoice PDF form by visiting the designated website or platform that offers it. Typically, it can be downloaded directly to your device, often available at no cost. Look for a download option or button, and follow the on-screen instructions to get the form.

When completing the invoice, you will need to provide the following details:

-

Your name or business name and contact information

-

Client's name and contact information

-

Date of the invoice

-

Description of the products or services provided

-

Quantity and price for each item

-

Tax rate if applicable

-

Total amount due

-

Payment terms and conditions

Yes, you can customize the Free And Invoice PDF form. Most versions allow you to edit text fields and adjust layout elements to fit your branding needs. This way, you can add your logo, change colors, and modify font styles to create a professional look that reflects your business identity.

Absolutely. The Free And Invoice PDF form is designed for ease of use. With clear sections and prompts, even those with limited experience can fill it out without difficulty. The simple layout helps ensure that all necessary information is included and presented clearly.

If you encounter any issues while using the Free And Invoice PDF form, consider the following steps:

-

Check for updates or different versions of the form, which may resolve any bugs.

-

Consult the FAQ or help section provided on the website where you accessed the form.

-

Reach out to customer support or community forums for assistance.

-

Consider using alternative invoice templates if persistent problems occur.