What is a General Power of Attorney?

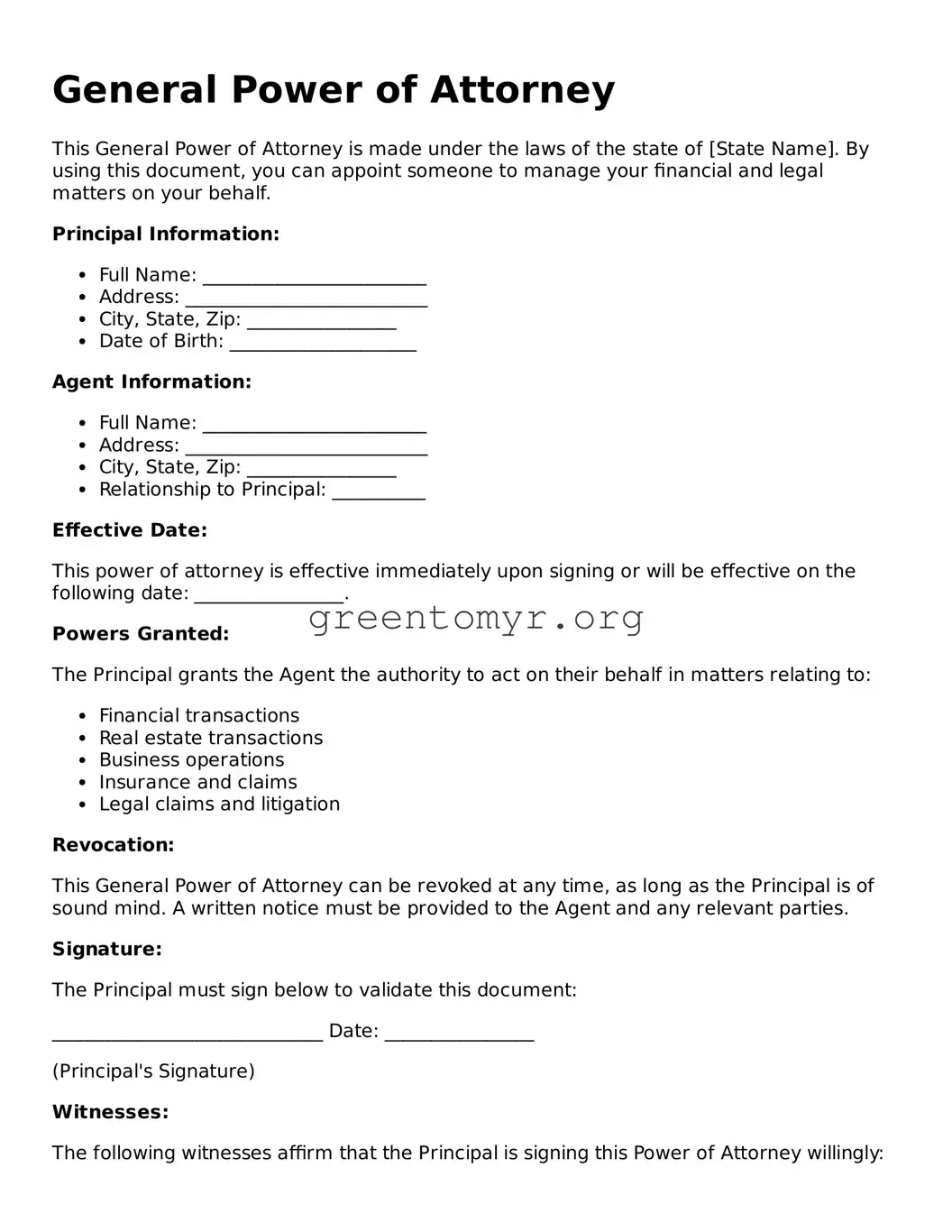

A General Power of Attorney is a legal document that allows one person, known as the "principal," to appoint another person, known as the "agent," to make decisions and act on their behalf. This can include managing finances, making medical decisions, and handling other personal affairs.

Who can be an agent in a General Power of Attorney?

Any adult can serve as an agent. This includes family members, friends, or professionals such as attorneys or financial advisors. The principal should choose someone they trust, as the agent will have significant authority.

When does a General Power of Attorney go into effect?

A General Power of Attorney can go into effect immediately upon signing or at a future date specified in the document. If it’s set to become effective at a future date, the principal should clearly state when this will occur.

Can I limit the powers granted in a General Power of Attorney?

Yes, you can limit the powers. The document can specify what decisions the agent is authorized to make or what actions they can take. It’s important to be as clear and detailed as possible to avoid any confusion.

How long is a General Power of Attorney valid?

A General Power of Attorney remains valid until the principal revokes it, the principal passes away, or the document includes a specified expiration date. Revocation must be done in writing and communicated to the agent and any relevant institutions.

Do I need a lawyer to create a General Power of Attorney?

A lawyer is not required to create a General Power of Attorney, but it can be helpful to seek legal advice, especially if you have specific concerns or complex financial situations. Simple templates are widely available online.

What happens if the agent can no longer serve?

If the agent can no longer serve due to incapacity or resignation, the General Power of Attorney may become ineffective. The principal can name an alternate agent in the document or may need to create a new power of attorney if no successor is designated.

Can I revoke a General Power of Attorney?

Yes, a principal has the right to revoke a General Power of Attorney at any time, as long as they are mentally competent. To do this, they must create a written revocation notice and provide it to the agent and any institutions relying on the original document.

Is a General Power of Attorney effective for medical decisions?

A General Power of Attorney can cover medical decisions if specific language is included. However, if you want someone to make only healthcare decisions, a separate Health Care Power of Attorney might be more appropriate.

What if the principal becomes incapacitated?

If the principal becomes incapacitated, a General Power of Attorney that does not include "durable" language may no longer be effective. A durable power of attorney remains in effect even if the principal can no longer make decisions due to incapacity. It's essential to specify this if that is the intent.