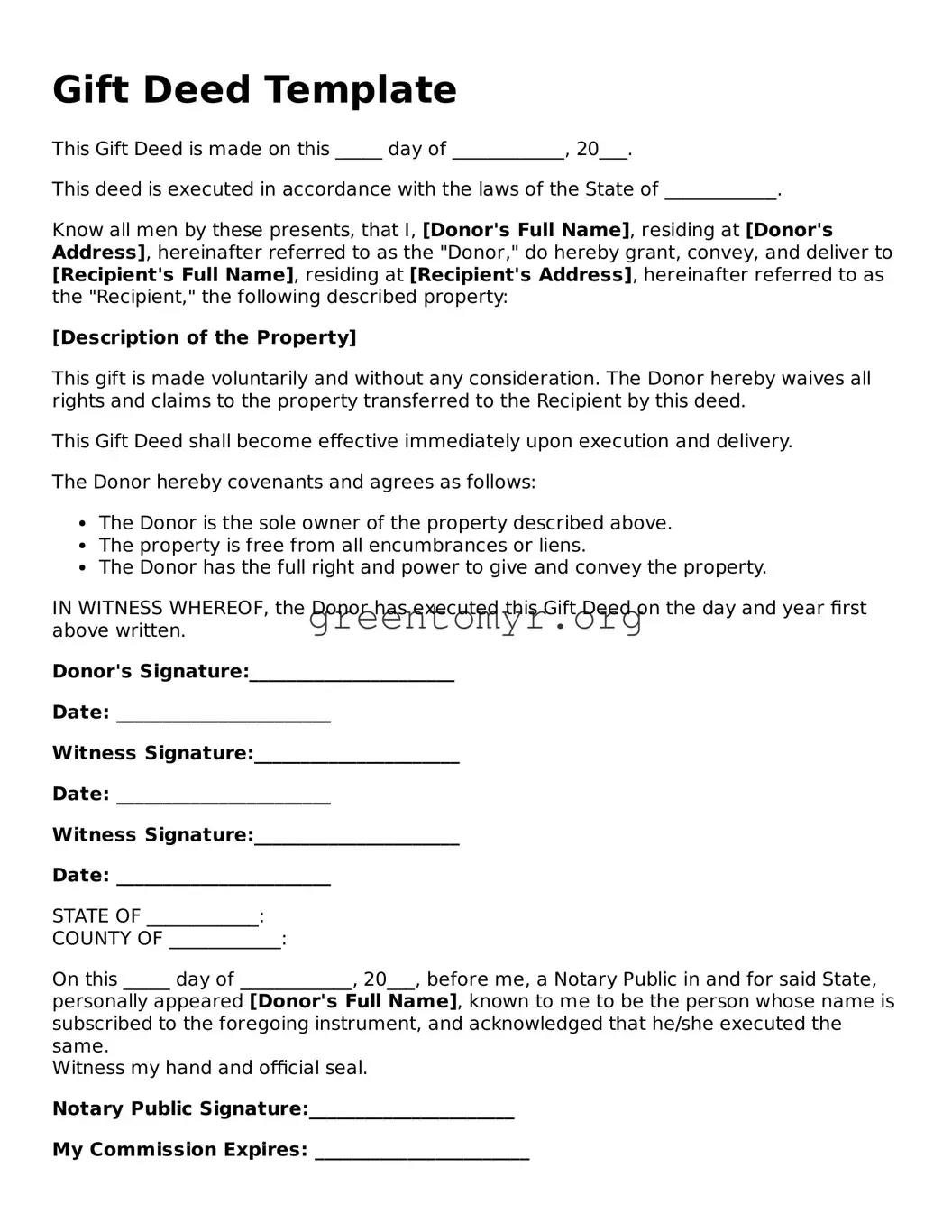

Gift Deed Template

This Gift Deed is made on this _____ day of ____________, 20___.

This deed is executed in accordance with the laws of the State of ____________.

Know all men by these presents, that I, [Donor's Full Name], residing at [Donor's Address], hereinafter referred to as the "Donor," do hereby grant, convey, and deliver to [Recipient's Full Name], residing at [Recipient's Address], hereinafter referred to as the "Recipient," the following described property:

[Description of the Property]

This gift is made voluntarily and without any consideration. The Donor hereby waives all rights and claims to the property transferred to the Recipient by this deed.

This Gift Deed shall become effective immediately upon execution and delivery.

The Donor hereby covenants and agrees as follows:

- The Donor is the sole owner of the property described above.

- The property is free from all encumbrances or liens.

- The Donor has the full right and power to give and convey the property.

IN WITNESS WHEREOF, the Donor has executed this Gift Deed on the day and year first above written.

Donor's Signature:______________________

Date: _______________________

Witness Signature:______________________

Date: _______________________

Witness Signature:______________________

Date: _______________________

STATE OF ____________:

COUNTY OF ____________:

On this _____ day of ____________, 20___, before me, a Notary Public in and for said State, personally appeared [Donor's Full Name], known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged that he/she executed the same.

Witness my hand and official seal.

Notary Public Signature:______________________

My Commission Expires: _______________________