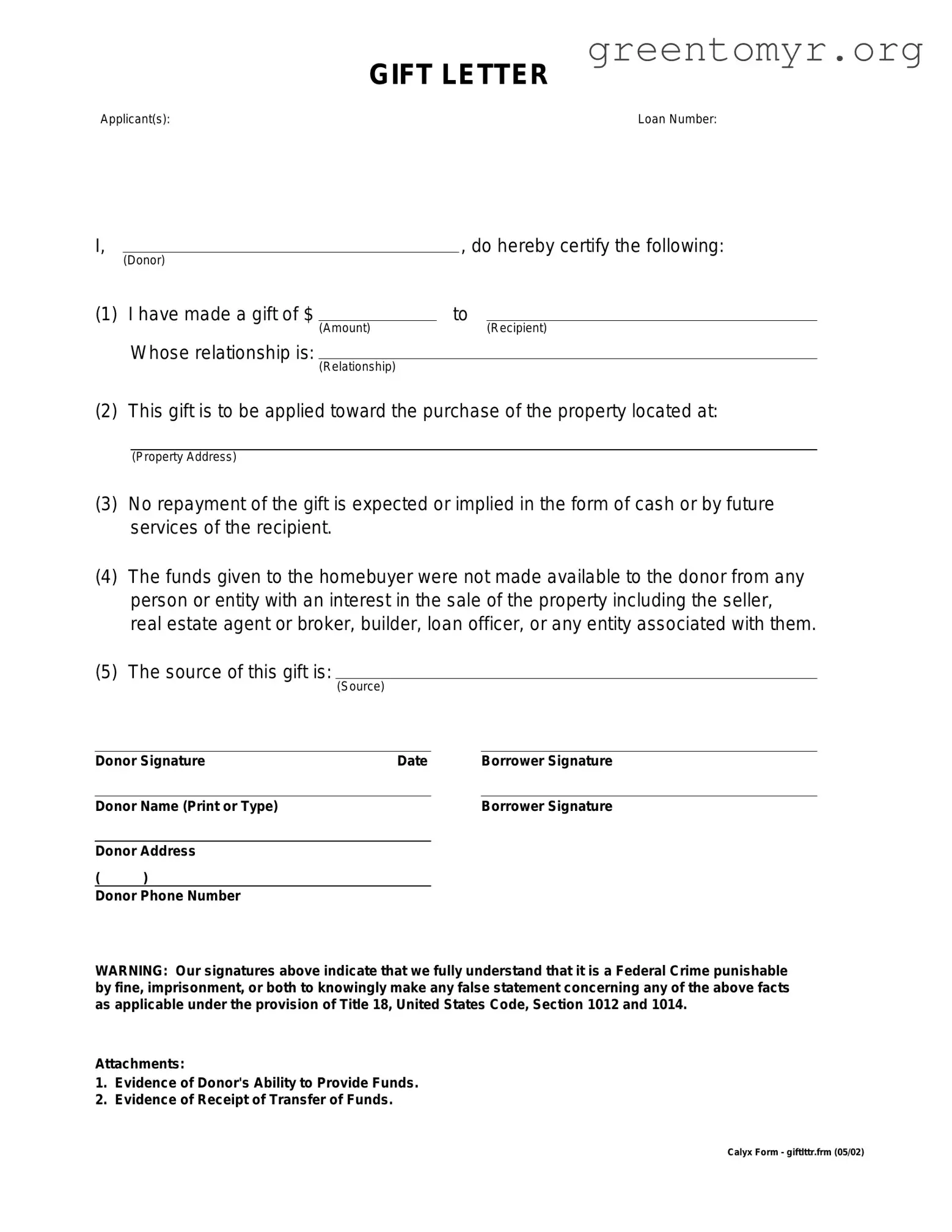

Filling out a Gift Letter form may seem straightforward, but mistakes can lead to delays or complications in the process. One common error is failing to include the correct names of the giver and the recipient. It is essential to ensure that both parties are accurately identified, as any discrepancies could raise questions about the legitimacy of the gift.

Another frequent mistake is neglecting to provide the correct date of the gift. This information is crucial, as it indicates when the transaction took place. A missing or incorrect date can create confusion, especially if the gift amount raises suspicions of being a loan instead of a genuine gift. Ensuring that the date is clear and precise is vital for transparency.

People often overlook the importance of specifying the amount of the gift. Incomplete or vague descriptions can lead to misunderstandings. By clearly stating the exact dollar amount being gifted, both the giver and the recipient can avoid potential issues later on. This clarity demonstrates transparency and intent, reinforcing the nature of the gift.

Some individuals make the mistake of not signing the document. A signature serves as a formal acknowledgment of the gift. If the giver forgets to sign, the recipient may face difficulties in proving that the funds were indeed a gift, rather than a loan. This omission can result in unnecessary complications and a potential questioning of the gift's legitimacy.

Another area of concern is the failure to provide context for the gift. While it's common to assume that the purpose is understood, including a brief explanation can be beneficial. This helps clarify the intention behind the gift and reinforces its validity, particularly for larger amounts. Not providing this context may raise red flags for financial institutions.

Inaccurate information about the relationship between the donor and the recipient is also problematic. The form typically requires a description of the nature of the relationship, such as family or friend. Failing to accurately describe this relationship can lead to complications, as financial institutions may require proof of a legitimate personal connection to validate the gift.

Lastly, individuals often forget to check for completeness before submitting the Gift Letter. Taking a moment to review the form for any missed sections or errors can save time and frustration. Providing a complete and accurate gift letter helps ensure that the transaction proceeds smoothly and without unnecessary delays.