Donating to Goodwill is a generous act that benefits both the community and the donor. However, when filling out the donation receipt form, many individuals make common mistakes that can lead to challenges later on. Understanding these pitfalls can help ensure a smooth donation process.

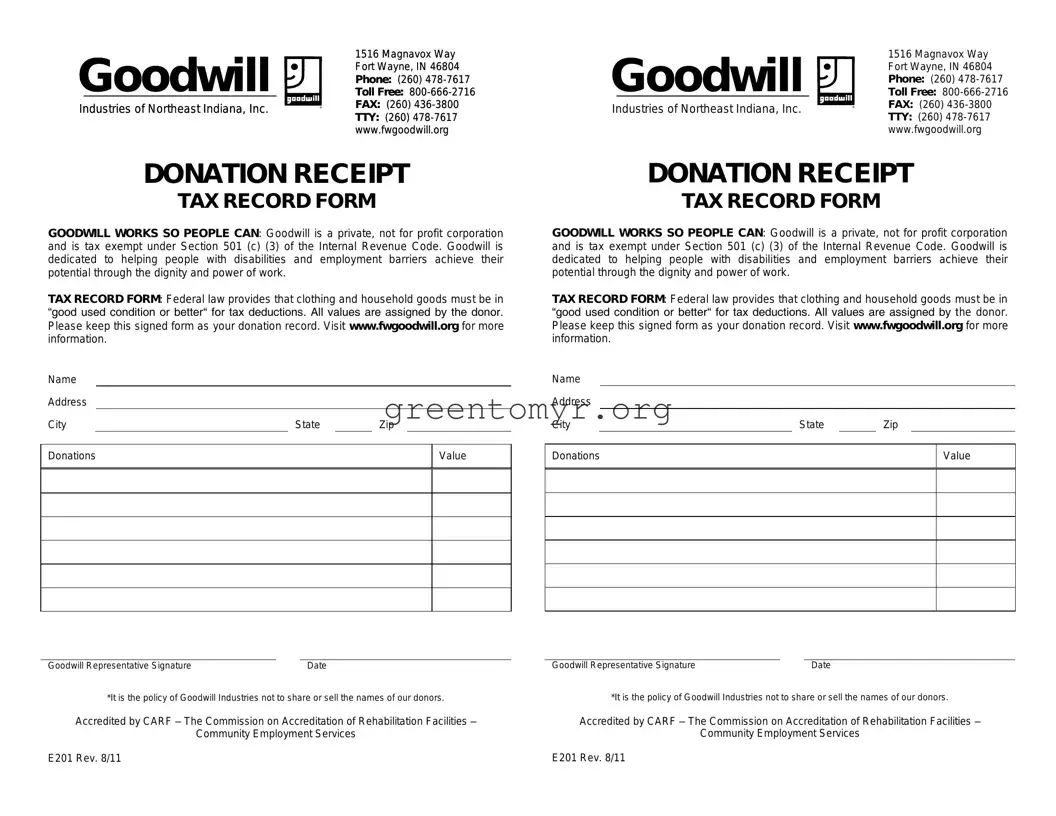

One prevalent mistake is not recording the valuation of items. It’s essential to estimate the fair market value of the items being donated. Failure to do so could result in difficulties when tax time arrives. Having accurate values helps in case of an audit and ensures that you receive the credit you deserve.

Another issue is forgetting to keep a copy of the receipt. Receipts serve as proof of your donation for tax deductions. Without this documentation, you may miss out on potential tax benefits. It’s wise to make a copy of the receipt immediately after it is filled out.

Many donors also overlook the specific details of the items donated. General descriptions can raise questions and may not support claims for higher valuations. Documenting specific items ensures clarity and strengthens your case if needed later.

Some individuals fail to sign the receipt after filling it out. A signature verifies your donation and acknowledges receipt from Goodwill. Without it, the receipt may not be considered valid for tax purposes.

Another common oversight is not mentioning additional notes or conditions related to the donation. If there are stipulations, such as whether the items are damaged or if they have certain restrictions, documenting that on the receipt can avoid misunderstandings in the future.

People may also mistakenly use the donation receipt for multiple donations. Each time you donate items, a new receipt should be completed to ensure accurate record-keeping. This prevents confusion and ensures that all donations are correctly accounted for.

Lastly, some donors forget to review the completed receipt thoroughly before leaving. Verifying all information prevents errors that can be challenging to correct later on. Take a moment to ensure everything is accurate and complete.

By being mindful of these common mistakes, donors can safeguard their contributions and ensure they fully benefit from their generous acts. Taking the time to accurately complete the Goodwill donation receipt form pays off in the long run.