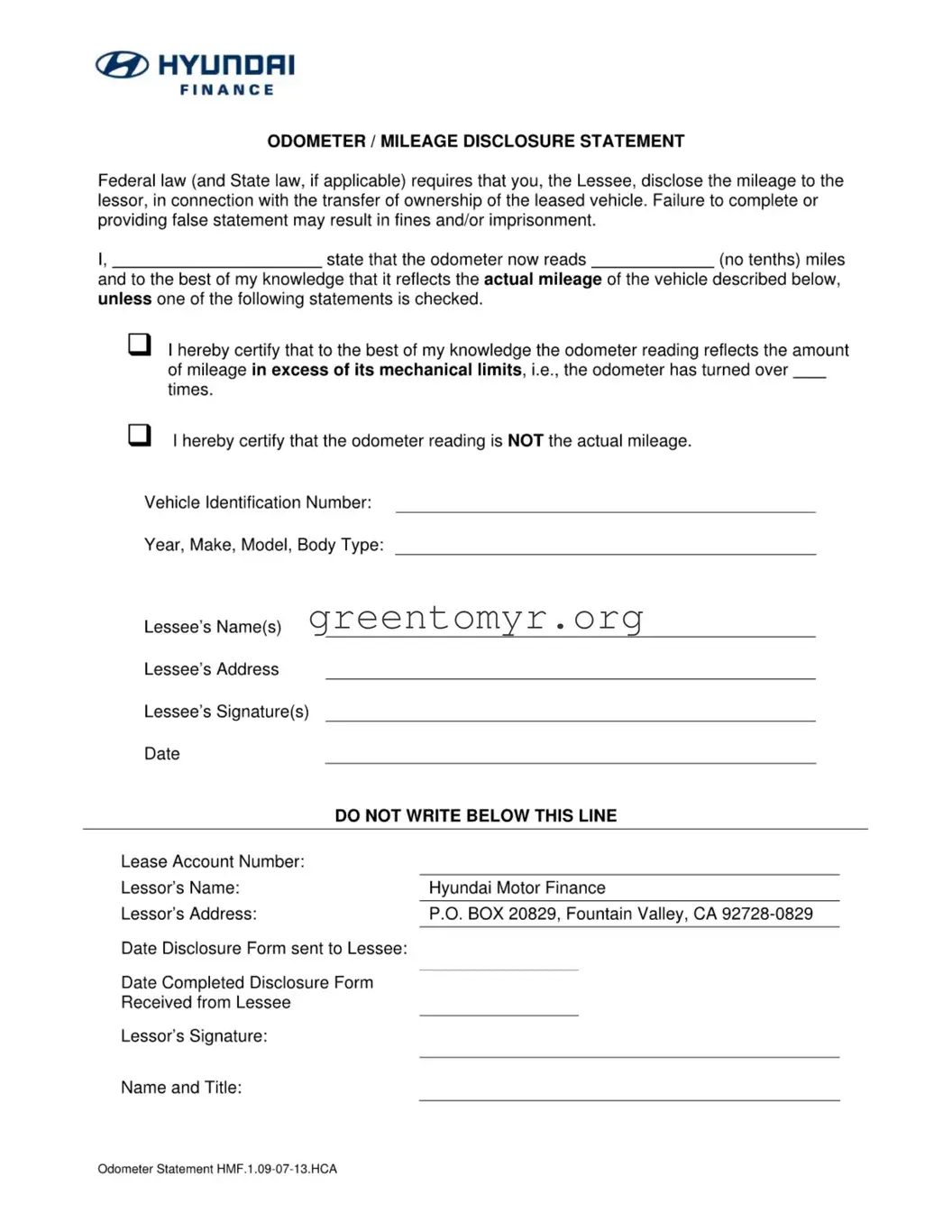

Completing the Hyundai Finance Odometer Statement form requires careful attention to detail. One common mistake is failing to provide an accurate odometer reading. This number should reflect the vehicle's current mileage, without any tenths. An inaccurate figure can lead to legal repercussions, including fines or imprisonment.

Another frequent error involves neglecting to check one of the required statements related to the odometer reading. If the mileage is not the actual amount or exceeds the mechanical limits, the appropriate box must be checked. Failing to do so can cause confusion and may ultimately result in complications during the transfer of ownership.

The Lessee's information must be filled out completely. Some individuals mistakenly overlook this vital requirement. Missing names, addresses, or signatures can render the form invalid. Accurate identification ensures that all parties involved are properly documented, which is critical in any transaction.

A third issue arises when individuals do not include the Vehicle Identification Number (VIN). This unique identifier is essential for confirming the specific vehicle involved in the transaction. Omitting the VIN can lead to delays or disputes about the vehicle's ownership.

People often forget to date the form before submitting it. A missing date can complicate the timeline of the transaction and might lead to misunderstandings about when the vehicle was returned. It's a small detail, but it can have significant implications.

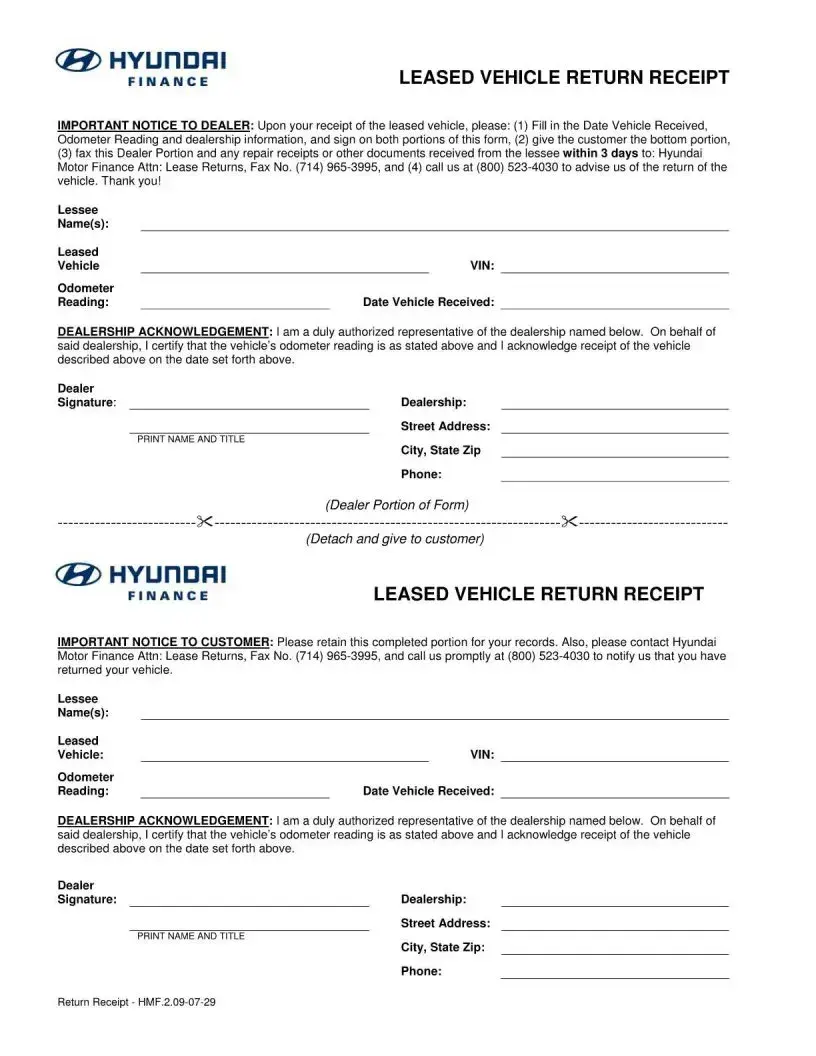

Some users may confuse different sections of the form. For instance, the dealership's acknowledgment must be properly completed by a dealership representative. Errors happen when this section is filled out by someone who is not authorized, which can invalidate the entire process.

In addition, certain individuals might fail to provide their contact information. This oversight can create challenges if the lessor needs to reach out for clarification or additional information after the form has been submitted. Clear communication channels are essential for resolving any potential issues.

Finally, failing to keep a copy of the completed form can be a significant mistake. Retaining a record is important for personal reference and can serve as proof of compliance in case any disputes arise in the future. As with any legal document, maintaining thorough documentation is crucial.