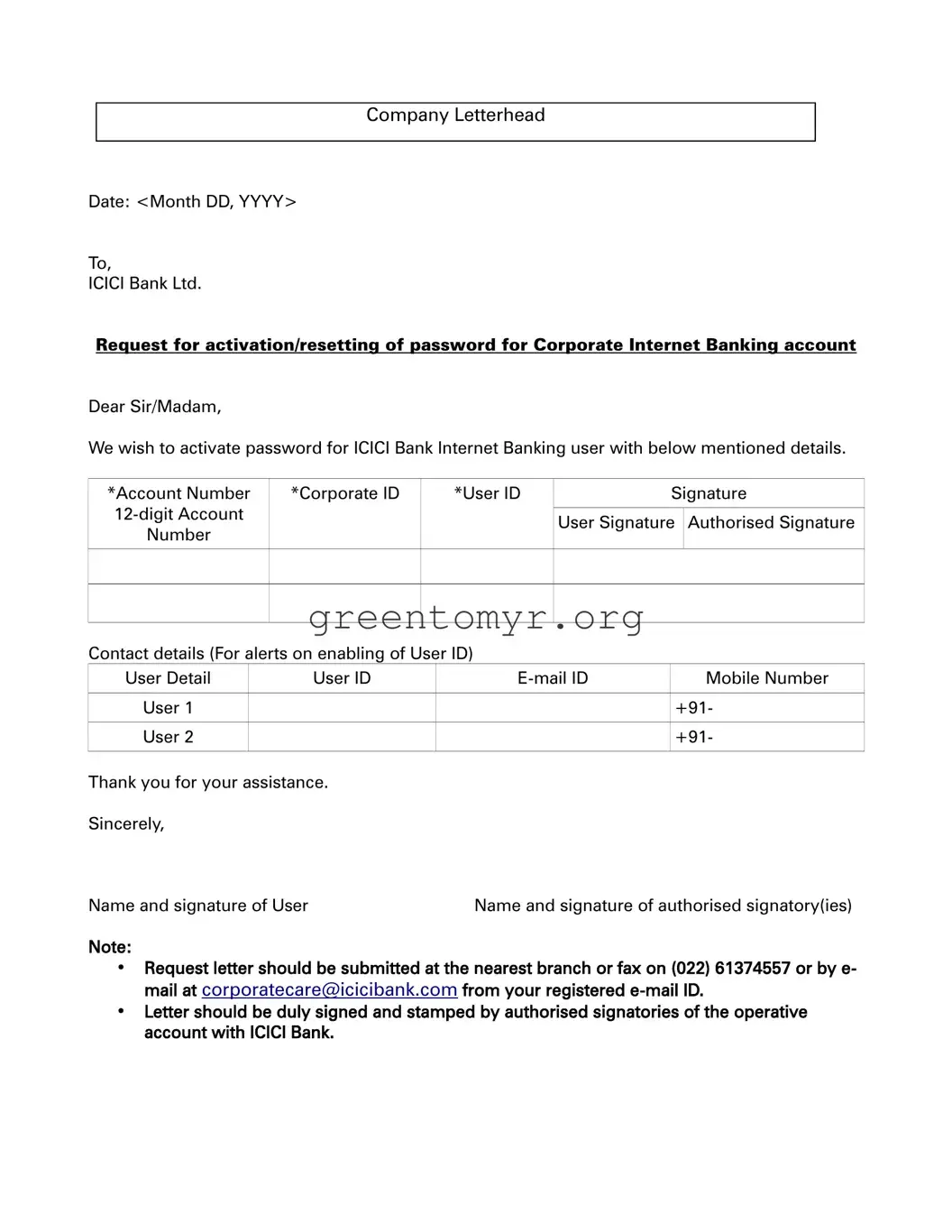

The ICICI Bank Letterhead Format form is used to request the activation or resetting of a password for a Corporate Internet Banking account. This form ensures that necessary details are provided and helps facilitate the process efficiently.

To complete the form, you need to include the following details:

-

Account Number

-

Corporate ID

-

User ID

-

Contact details for alerts (email and mobile numbers)

Additionally, signatures from the user and authorized signatories are required.

You can submit the completed form by either of the following methods:

-

Deliver the form in person at the nearest ICICI Bank branch.

-

Send it via fax to (022) 61374557.

-

Email the form to [email protected] from your registered email ID.

The form must be signed by both the user requesting the activation/resetting of the password and the authorized signatories of the operative account. This ensures account security and compliance with banking regulations.

In the contact details section, include:

-

The User ID

-

The email ID

-

The mobile number for notifications

Make sure this information is accurate to receive alerts regarding the process.

While the letterhead must include your company's name and relevant details, there is no strict format prescribed. However, it should look professional and contain the date and address to ICICI Bank Ltd.

If you make an error, it is advisable to start over with a new form to ensure clarity and accuracy. Errors in sensitive information like account numbers or user IDs can cause delays in processing your request.

Once you submit the form, ICICI Bank will process your request. You will receive confirmation alerts based on the contact details provided. Processing times may vary based on the bank's operational procedures.

Can I track the status of my request?

Yes, you can track the status of your request by reaching out to ICICI Bank's customer service. They will provide updates based on the details of your request and the associated account information.

Why is it necessary to send the request from a registered email ID?

Sending the request from a registered email ID adds a layer of security. It ensures that the request originates from an authorized source, protecting your account from unauthorized changes.