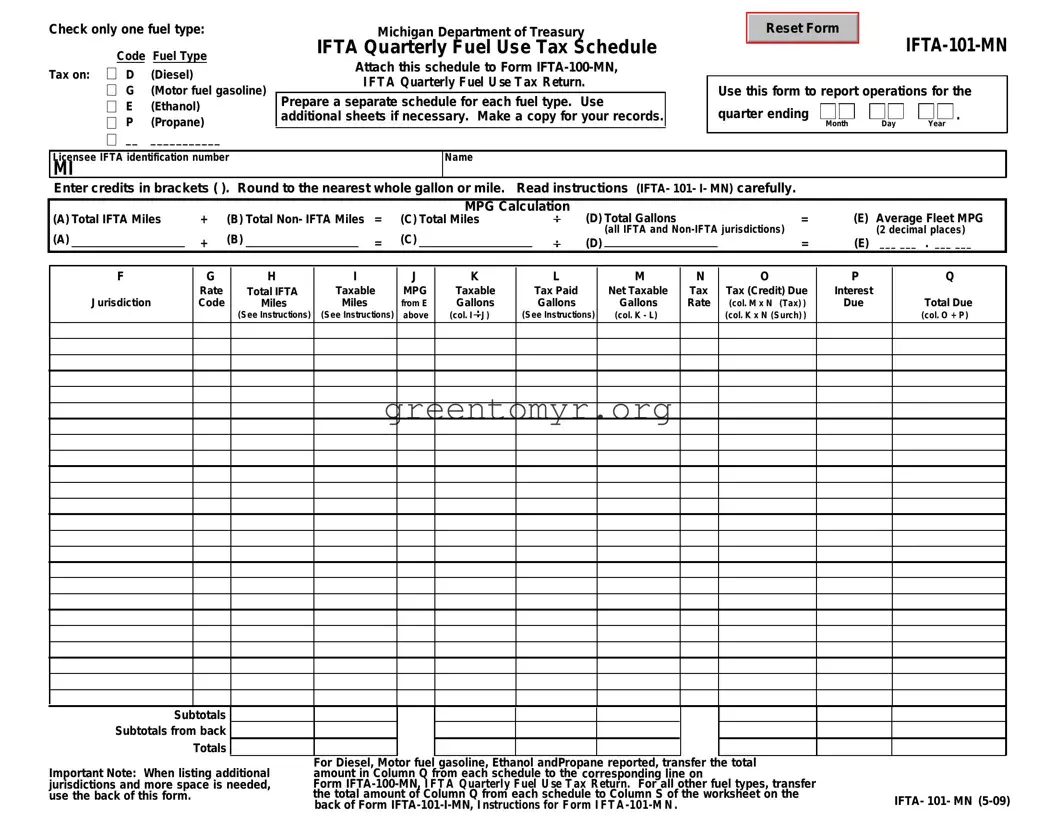

The IFTA 101Mn Form, known as the IFTA Quarterly Fuel Use Tax Schedule, is used to report fuel usage for International Fuel Tax Agreement (IFTA) jurisdictions. It allows motor carriers to document their fuel consumption and the miles traveled in various jurisdictions for the relevant quarter. This form must be completed and submitted alongside Form IFTA-100-MN, the IFTA Quarterly Fuel Use Tax Return.

To complete the IFTA 101Mn Form, follow these steps:

-

Select the type of fuel being reported by checking the appropriate box.

-

Enter your licensee IFTA identification number and legal name as it appears on your IFTA license.

-

Provide the quarter ending date.

-

Calculate the total IFTA miles, non-IFTA miles, total miles, and total gallons, rounding as necessary.

-

Document the average fleet MPG and fill in the required information for each jurisdiction where you operated.

Each section includes specific calculations and entries based on the fuel type and the jurisdiction. Refer to the accompanying instructions for detailed guidance.

You can report the following fuel types on the IFTA 101Mn Form:

-

Diesel

-

Motor fuel gasoline

-

Ethanol

-

Propane

For each fuel type, a separate IFTA 101Mn form should be completed. If you are reporting a fuel type not listed, indicate this by checking the box next to the blank line and entering the fuel type code and name.

What should I do if I need more space to list jurisdictions?

If additional space is required to list jurisdictions, you may use the back of the IFTA 101Mn Form. Ensure that you transfer the totals from the back to the appropriate lines on the front of the form. This maintains accuracy for your reporting.

How do I calculate the Average Fleet MPG?

The Average Fleet MPG (miles per gallon) is calculated by dividing the total miles traveled (IFTA and non-IFTA) by the total gallons of fuel used. This figure should be rounded to two decimal places. For example, if your total miles are 10,000 and total gallons are 1,000, your calculation would be:

Average Fleet MPG = Total Miles / Total Gallons = 10,000 / 1,000 = 10.00 MPG.

If you file the IFTA 101Mn Form late, interest will apply to any tax due. The interest is computed at 1% per month or part of a month, up to a maximum of 12% per year. To avoid additional charges, file your return before the due date, which is the last day of the month following the quarter ending.

Your completed IFTA 101Mn Form should be attached to the IFTA 100-MN form and submitted to:

MICHIGAN DEPARTMENT OF TREASURY

SPECIAL TAXES DIVISION

P.O. BOX 30474

LANSING, MI 48909-7974

For further assistance, the Michigan Department of Treasury offers a manual with more detailed information about IFTA credentials, record keeping, and tax reporting. This manual is accessible on their website. You can also contact the Motor Carrier section directly at (517) 636-4580 for further inquiries. For TDD assistance, dial (517) 636-4999. Their office hours are Monday through Friday, from 8:00 a.m. to 5:00 p.m.