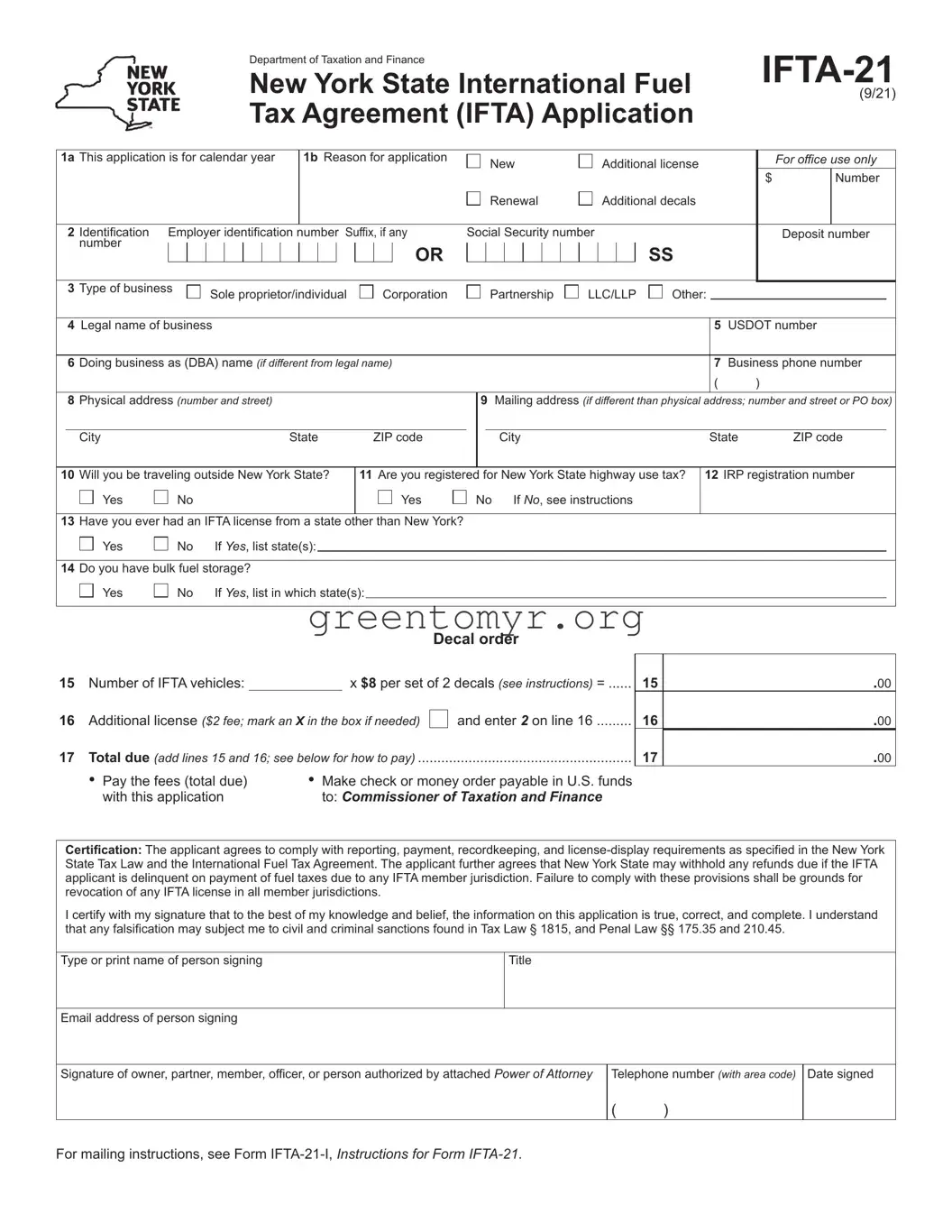

Filling out the IFTA 21 form can seem daunting, but common mistakes often create unnecessary delays. One significant error occurs when applicants fail to provide the correct employer identification number or Social Security number. Ensure these numbers are accurate, as they are essential for proper identification and can lead to processing delays if incorrect.

Another frequent mistake is the omission of the USDOT number. This number is crucial for tracking vehicles operating under the International Fuel Tax Agreement and its absence can hinder the licensing process. Always double-check that this number is included and correctly recorded.

Many people also neglect to specify their type of business. Whether you're a sole proprietor, corporation, or partnership, indicating your business structure is vital for compliance. This information helps the state categorize your application and address it appropriately.

Moreover, failing to confirm if you have bulk fuel storage can lead to complications later on. This detail is important and must be answered accurately to avoid problems with compliance. Always review your responses to ensure you have not left out any critical information.

One of the most frequently overlooked sections is the mailing address. If it differs from the physical address, it is essential to provide both accurately. Miscommunication can occur if the tax authorities do not have the correct mailing information, which can ultimately affect your correspondence.

Another mistake is not answering whether the applicant has previously held an IFTA license from another state. It is necessary to disclose this to avoid potential issues with discrepancies. Transparency in previous applications is key to a smooth process.

Additionally, it’s important to check your math when calculating the total fee due. Mistakes in this area can result in delays, as the tax authority will require you to rectify any discrepancies before processing your application. Ensure you add all fees properly and verify your calculations.

Finally, one common oversight involves the signature. Some applicants forget to have an authorized person sign the application. It is crucial that the individual who submits the form holds the appropriate authority within the business. Without a proper signature, your application may be delayed or rejected, causing frustration and unnecessary wait times.

Overall, careful attention to detail can significantly ease the process of completing the IFTA 21 form. By avoiding these common mistakes, applicants can expedite their application and ensure compliance with the International Fuel Tax Agreement.