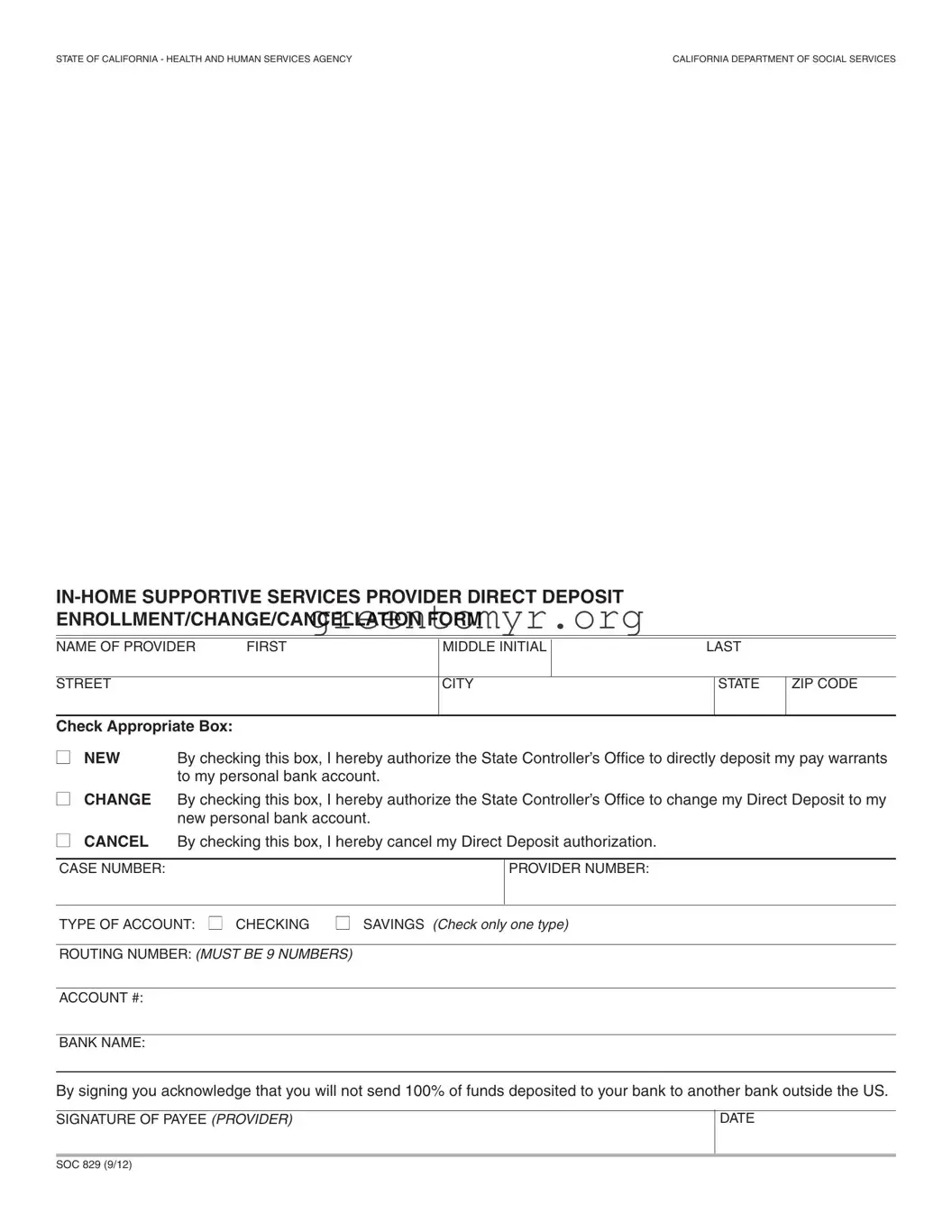

IN-HOME SUPPORTIVE SERVICES

PROVIDER DIRECT DEPOSIT ENROLLMENT INSTRUCTIONS

You are not eligible for Direct Deposit if you are planning to send 100% of funds deposited to your bank to another bank outside the US.

You will need the following information to complete the Direct Deposit Enrollment Form:

1.The name of your Bank.

2.The Bank Routing Number

3.Your Checking or Savings Account Number. If you need help identifying this information please ask your Bank for assistance.

CHECK APPROPRIATE BOX

Please check the box to tell us what you want to do. Check the Box: NEW to enroll in direct deposit; CHANGE to change your bank account; and CANCEL to cancel direct deposit.

Check the box to tell us whether you want your paycheck deposited in your Checking or Savings account.

IDENTIFICATION INFORMATION

Provide your Case and Provider number. You will find the case and provider numbers on your IHSS Statement of Earnings (pay stub).

BANKING INFORMATION

Provide the information requested on the form. You may find the bank information you will need to complete the enrollment form on your personal checks or your bank may assist you. Below is an example of a check and where to find the necessary information.

Check Example:

Your Name |

|

Check NO. 4444 |

Pay to the Order of _________________________________ |

I112145678 I: |

5765432109812 |

4444 |

|

|

|

{ |

{ |

{ |

Routing No. |

Your Acct. No. |

Ck. No. |

If you prefer to have your money deposited into your savings account, please contact your bank for assistance.

PROVIDE ALL REQUESTED INFORMATION

All information requested on the form must be provided. Incomplete forms will be returned. To enroll in Direct Deposit you must complete all fields on an Enrollment/Change/Cancellation form. Your signature authorizing Direct Deposit must be an ORIGINAL SIGNATURE, photocopies will not be accepted.

IF YOU WORK FOR MULTIPLE RECIPIENTS

You must complete a separate Provider Enrollment/Change/Cancellation form for EACH Recipient with whom you are employed. When you begin work for a new recipient you will need to complete a new form.

CHANGING OR CANCELLING YOUR DIRECT DEPOSIT

Your Direct Deposit will continue to be deposited into the bank account you have chosen until you request a change. If you wish to change or cancel your Direct Deposit authorization for any recipient for whom you work, you must submit an Enrollment/Change/Cancellation form with a check next to the box for Change or Cancel. You may access our website at www.dss.cahwnet.gov to download additional forms or contact the Direct Deposit Help desk toll free at (866) 376-7066.

Please send your COMPLETED Enrollment/Change/Cancellation Form to:

PROVIDER ENROLLMENT PROCESSING CENTER

P.O. BOX 1120

ROSEVILLE, CA 95678