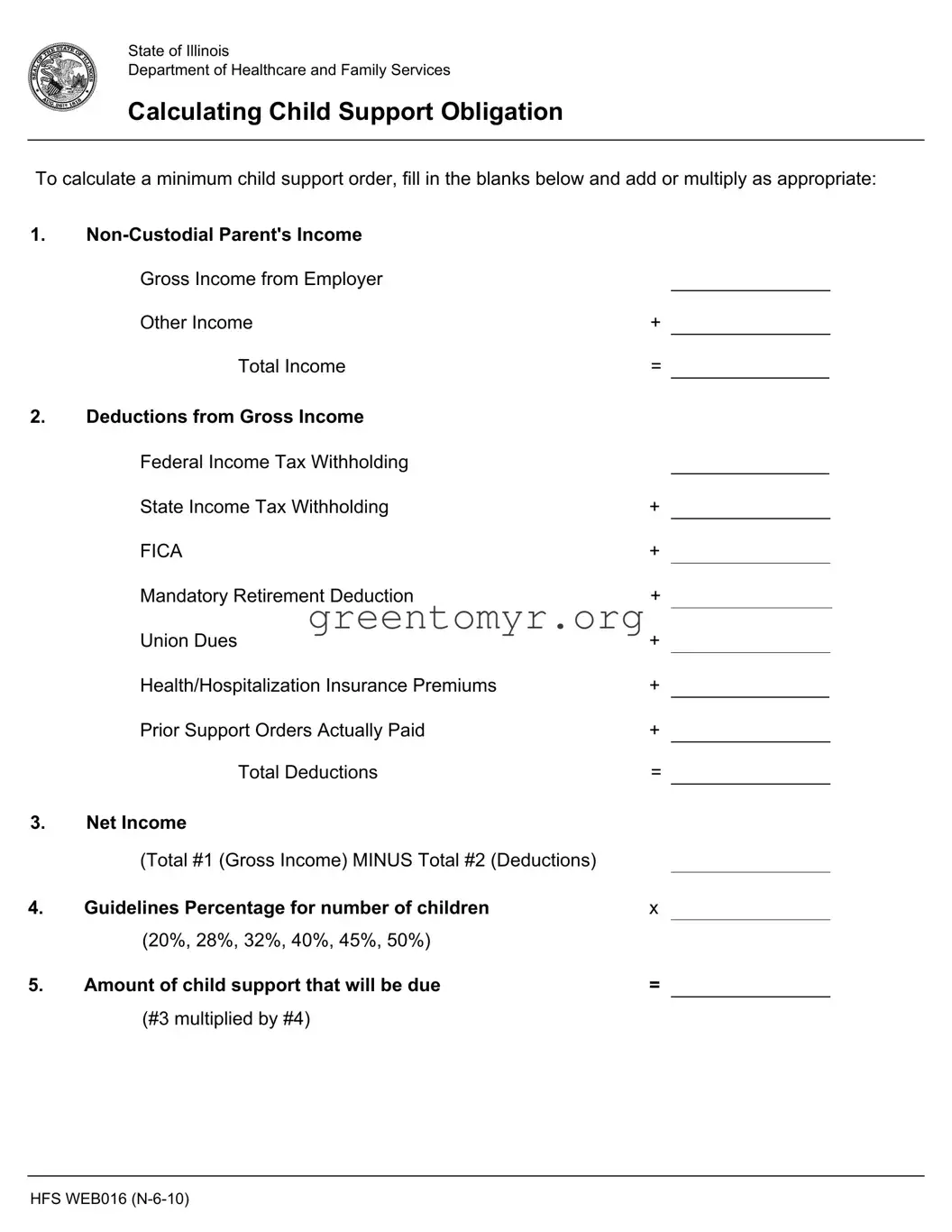

Filling out the Illinois Calculating Support form can feel daunting, and many make common errors that can have significant consequences. One of the most frequent mistakes occurs with the first section, where individuals must report the Non-Custodial Parent's income. In many cases, people either underestimate or overestimate their gross income from employers. This discrepancy can lead to an inaccurate calculation of child support obligations, resulting in either insufficient funds to support the child or excessive payments that strain finances.

Another common error is neglecting to include all sources of income. Besides their salary, non-custodial parents may have other income streams such as bonuses, freelance work, or rental income. Failure to report these can drastically skew the total income figure and ultimately affect the child support calculation.

The section on deductions from gross income often invites confusion. Many individuals erroneously leave out essential deductions. For instance, people may forget to account for federal and state income tax withholdings, FICA, or health insurance premiums. Each deduction is critical. Missing even one could inflate the net income figure, leading to miscalculations.

A significant pitfall is not subtracting total deductions from gross income correctly. This arithmetic step is crucial because it directly affects the calculation of net income. Errors in subtraction can result in a net income that is either overestimated or underestimated, thereby distorting the whole support obligation.

When calculating the guidelines percentage based on the number of children, misinterpretation of the rates can occur. Individuals may mistakenly apply the wrong percentage, which varies depending on how many children are involved. For example, some may use the percentage assigned for two children instead of three, thereby producing an erroneous number for required child support.

Further complicating matters, some individuals fail to double-check their final calculations. After filling out the form, they may arise at an amount of child support due that has not been thoroughly verified. This oversight can lead to unexpected and unintended financial burdens.

In addition to errors in calculations, clarity in presentation can become a stumbling block. If the form is filled out but difficult to read or follow due to messy handwriting or poor formatting, it may lead to questions or disputes during a support review process. Clarity should never be underestimated when it comes to legal forms.

Moreover, individuals might forget to keep a copy of the completed form for their records. Documentation is essential. Without a copy, individuals may face issues if there are any disagreements or clarifications needed in the future regarding child support obligations.

Lastly, some people fail to seek assistance. Laws can be complex, and navigating forms alone may not yield the best results. Consulting with family law attorneys or support services can provide invaluable insights and help prevent mistakes from the start. Overall, awareness of these common errors can lead to a more accurate and fair assessment of child support obligations.