Note: It is the seller’s responsibility to verify that the purchaser’s Illinois account ID or Illinois resale number is valid and active. You can confirm this by visiting our web site at tax.illinois.gov and using the Verify a Registered Business tool.

General information

When is a Certificate of Resale required?

Generally, a Certificate of Resale is required for proof that no tax is due on any sale that is made tax-free as a sale for resale. The purchaser, at the seller’s request, must provide the information that is needed to complete this certificate.

Who keeps the Certificate of Resale?

The seller must keep the certificate. We may request it as proof that no tax was due on the sale of the specified property.

Do not mail the certificate to us.

Can other forms be used?

Yes. You can use other forms or statements in place of this certificate but whatever you use as proof that a sale was made for resale must contain

the seller’s name and address;

the purchaser’s name and address;

a description of the property being purchased;

a statement that the property is being purchased for resale;

the purchaser’s signature and date of signing; and

either an Illinois account ID number, an Illinois resale number, or a certification of resale to an out-of-state purchaser.

Note: A purchase order signed by the purchaser may be used as a Certificate of Resale if it contains all of the above required information.

CRT-61 (R-12/10) IL-492-3850

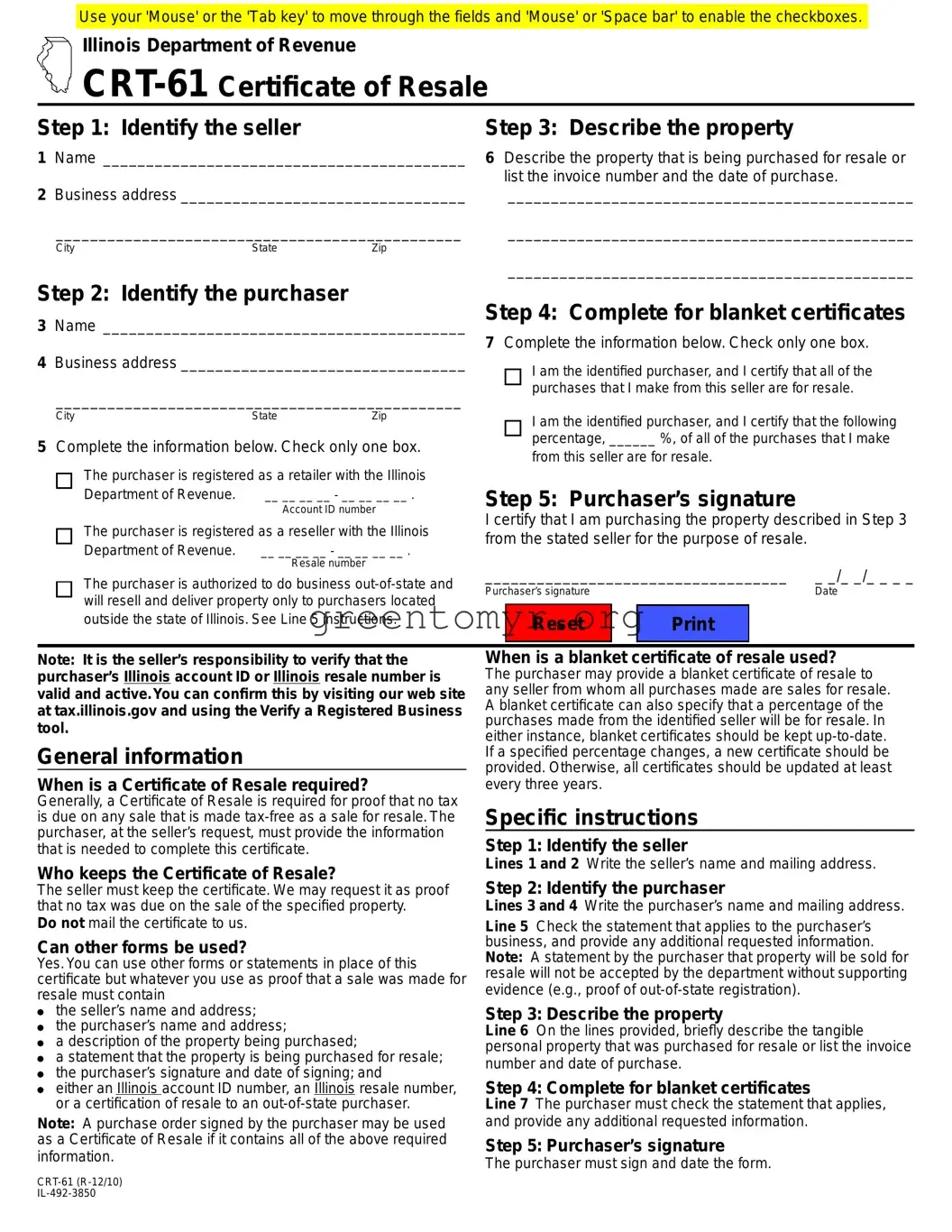

The purchaser is authorized to do business out-of-state and will resell and deliver property only to purchasers located outside the state of Illinois. See Line 5 instructions.

City

Step 2: Identify the purchaser

State

Zip

Step 1: Identify the seller

1 Name __________________________________________

2 Business address _________________________________

_______________________________________________

City

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

CRT-61 Certificate of Resale

Step 3: Describe the property

6 Describe the property that is being purchased for resale or list the invoice number and the date of purchase.

_______________________________________________

_______________________________________________

_______________________________________________

Step 4: Complete for blanket certificates

3 Name __________________________________________

7 Complete the information below. Check only one box.

|

4 Business address _________________________________ |

I am the identified purchaser, and I certify that all of the |

|

|

|

|

|

_______________________________________________ |

purchases that I make from this seller are for resale. |

|

|

|

|

|

State |

Zip |

I am the identified purchaser, and I certify that the following |

|

|

|

|

|

5 Complete the information below. Check only one box. |

percentage, ______ %, of all of the purchases that I make |

|

from this seller are for resale. |

|

|

|

|

|

|

|

The purchaser is registered as a retailer with the Illinois |

|

|

|

Department of Revenue. |

__ __ __ __ - __ __ __ __ . |

Step 5: Purchaser’s signature |

|

|

|

|

Account ID number |

|

|

|

|

I certify that I am purchasing the property described in Step 3 |

|

The purchaser is registered as a reseller with the Illinois |

|

from the stated seller for the purpose of resale. |

|

|

Department of Revenue. |

__ __ __ __ - __ __ __ __ . |

|

|

|

|

|

|

|

Resale number |

___________________________________ |

_ _/_ _/_ _ _ _ |

|

|

|

|

|

|

|

|

Purchaser’s signature |

Date |

When is a blanket certificate of resale used?

The purchaser may provide a blanket certificate of resale to any seller from whom all purchases made are sales for resale. A blanket certificate can also specify that a percentage of the purchases made from the identified seller will be for resale. In either instance, blanket certificates should be kept up-to-date. If a specified percentage changes, a new certificate should be provided. Otherwise, all certificates should be updated at least every three years.

Specific instructions

Step 1: Identify the seller

Lines 1 and 2 Write the seller’s name and mailing address.

Step 2: Identify the purchaser

Lines 3 and 4 Write the purchaser’s name and mailing address.

Line 5 Check the statement that applies to the purchaser’s business, and provide any additional requested information. Note: A statement by the purchaser that property will be sold for resale will not be accepted by the department without supporting evidence (e.g., proof of out-of-state registration).

Step 3: Describe the property

Line 6 On the lines provided, briefly describe the tangible personal property that was purchased for resale or list the invoice number and date of purchase.

Step 4: Complete for blanket certificates

Line 7 The purchaser must check the statement that applies, and provide any additional requested information.

Step 5: Purchaser’s signature

The purchaser must sign and date the form.