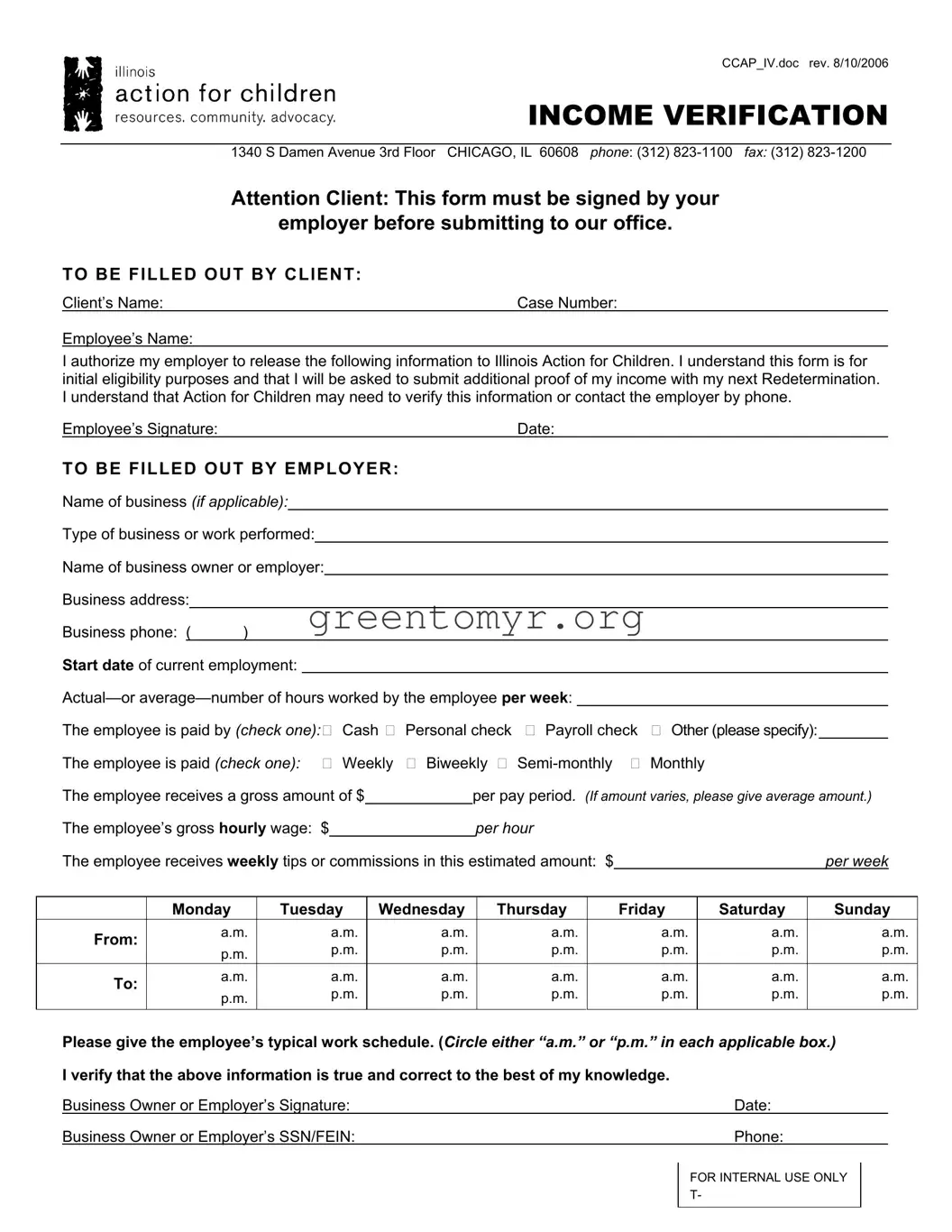

The Illinois Income Verification form is primarily used to verify an employee's income for eligibility in various assistance programs. It ensures that the information provided accurately reflects the employee’s financial status, helping organizations like Illinois Action for Children determine eligibility for child care assistance and related services.

Both the client and the employer need to fill out different sections of the Illinois Income Verification form. The client, typically an employee, must authorize the release of their income information. Meanwhile, the employer provides specific details regarding the employee's work hours, wages, and payment method.

After the form has been completed and signed by both the employer and the employee, it should be submitted to Illinois Action for Children. This can be done via fax or mail to the contact information specified on the form. Ensure all required sections are filled out to avoid delays in processing.

What should I do if my income varies from pay period to pay period?

If your income fluctuates, it’s important to provide an average amount on the form. The employer will have space to specify the typical gross pay and any variability in income, helping the evaluators understand your financial situation more comprehensively.

Why is an employer's signature required?

The employer's signature is crucial as it certifies the truthfulness of the information provided. It assures the reviewing agency that the details shared about wages, hours worked, and employment status are accurate and verified, making the process transparent and reliable.

What happens after I submit the income verification?

Once the form is submitted, Illinois Action for Children will process the information. They may reach out to the employer directly to confirm the details provided. Additionally, you will typically be asked to submit further proof of income during your next redetermination process.

While the form submission deadline can vary based on specific programs or circumstances, it is advisable to submit the form as soon as possible to avoid any disruptions in assistance. Check with Illinois Action for Children if you have uncertainties about specific timelines.

If you encounter any issues or have questions while completing the Illinois Income Verification form, do not hesitate to reach out to the agency listed on the form. They can provide clarification and assistance, ensuring that you complete the form correctly.