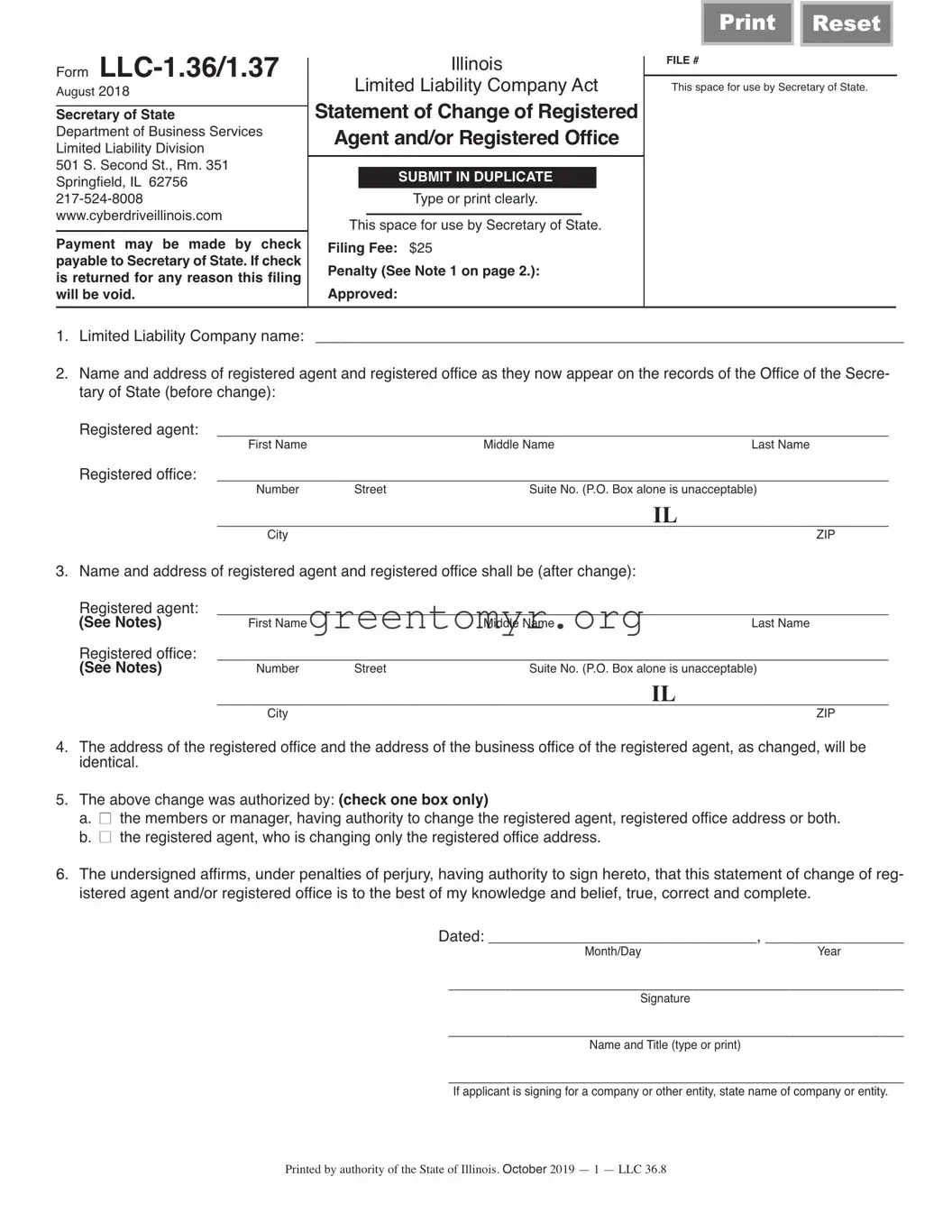

Filling out the Illinois Statement of Change form is crucial for any limited liability company (LLC) making changes to its registered agent or office address. Yet, many individuals make common mistakes that can delay processing or cause the filing to be rejected outright. Understanding these pitfalls will save you time and ensure compliance.

One frequent mistake is failing to type or print clearly. The instructions emphasize the need for clear writing, yet some people submit forms that are difficult to read. Illegible writing may lead to errors in processing, and as a result, your changes may not be recognized. Always use a neat, readable format.

Another common error is not providing the correct address for the registered office. Individuals might mistakenly list a PO Box when it clearly states that a PO Box alone is unacceptable. The registered office must include a physical address that complies with Illinois regulations.

Missing or incorrect signatures is also a significant issue. Some people forget to sign the form or fail to include the name and title in the designated area. Remember, your signature affirms that the information provided is accurate. Double-check that every section requiring a signature is complete before submission.

The form requires specifying whether the change was authorized by the members or the registered agent. People sometimes forget to check one of the boxes in section 5, which can lead to confusion or delay. Ensure you clearly mark which party authorized the change to expedite processing.

Submitting payment incorrectly is another hurdle. The filing fee is $25, and if payment is made by check, it must be payable to the Secretary of State. A wrong check or insufficient funds will void the filing. Confirm your payment details before sending in the form.

Some individuals overlook the important note regarding penalties. If a company fails to maintain a registered agent, a penalty of $100 applies. Ignoring this can lead to unexpected fees and complications, so ensure your registered agent is appropriately in place before submitting any changes.

Another mistake is failing to use abbreviations correctly in the registered office address. The form is limited to 30 characters, including spaces. Consulting USPS guidelines for address formatting can help avoid length issues and ensure that your address fits.

Lastly, people may not check the accuracy of all information before submission. Incorrect data can lead to processing delays and potential rejections. Take your time to review every detail thoroughly to ensure everything matches official records.

By being aware of these common mistakes, you can improve your chances of a smooth filing experience. Always double-check your work and ensure that all necessary information is correct and complete.