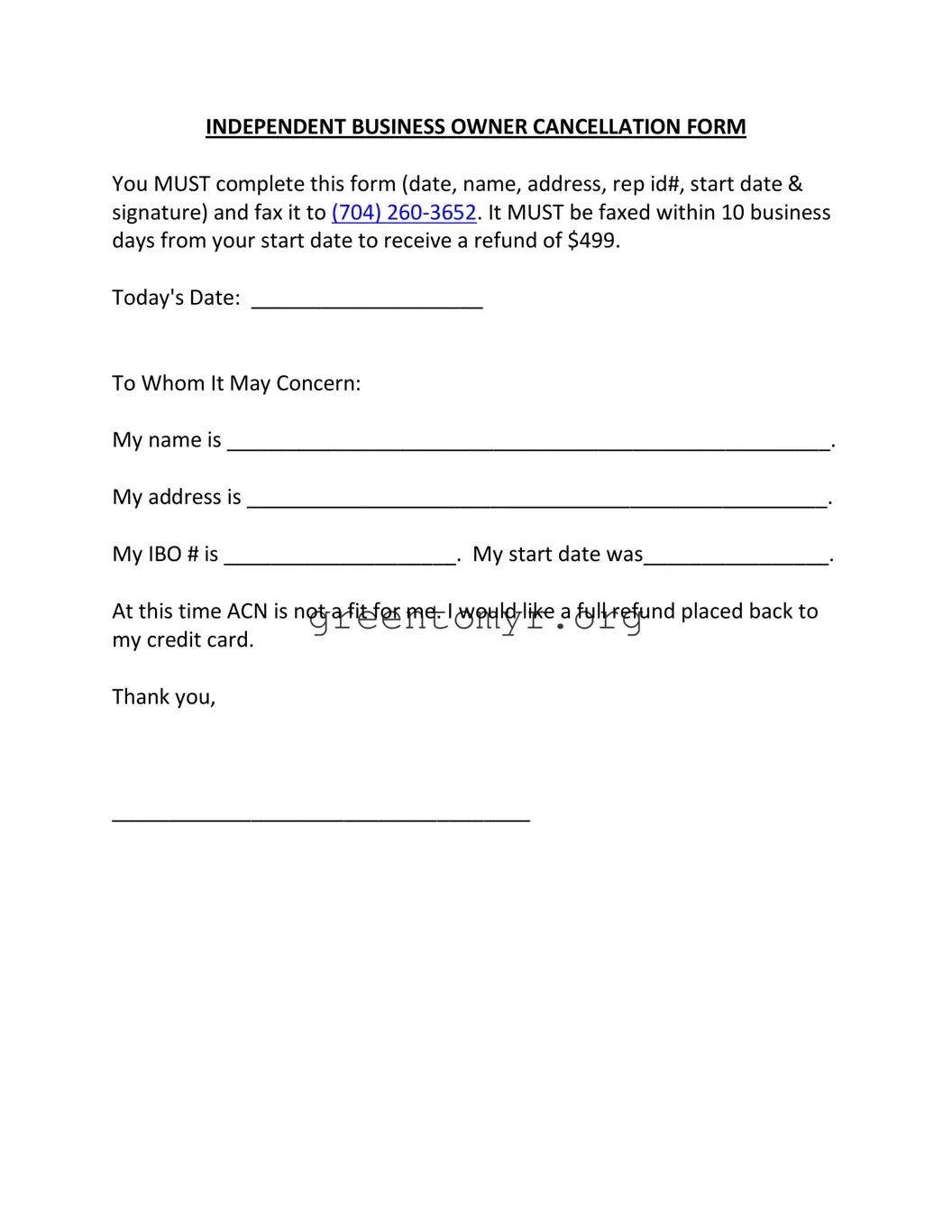

Fill in a Valid Independent Business Cancellation Template

The Independent Business Cancellation Form is a document that allows business owners to officially request the cancellation of their agreement with ACN. Completing this form is essential for those seeking a refund, as it must be submitted with accurate information and within a specified timeframe. To initiate your cancellation and receive your refund, please fill out the form by clicking the button below.