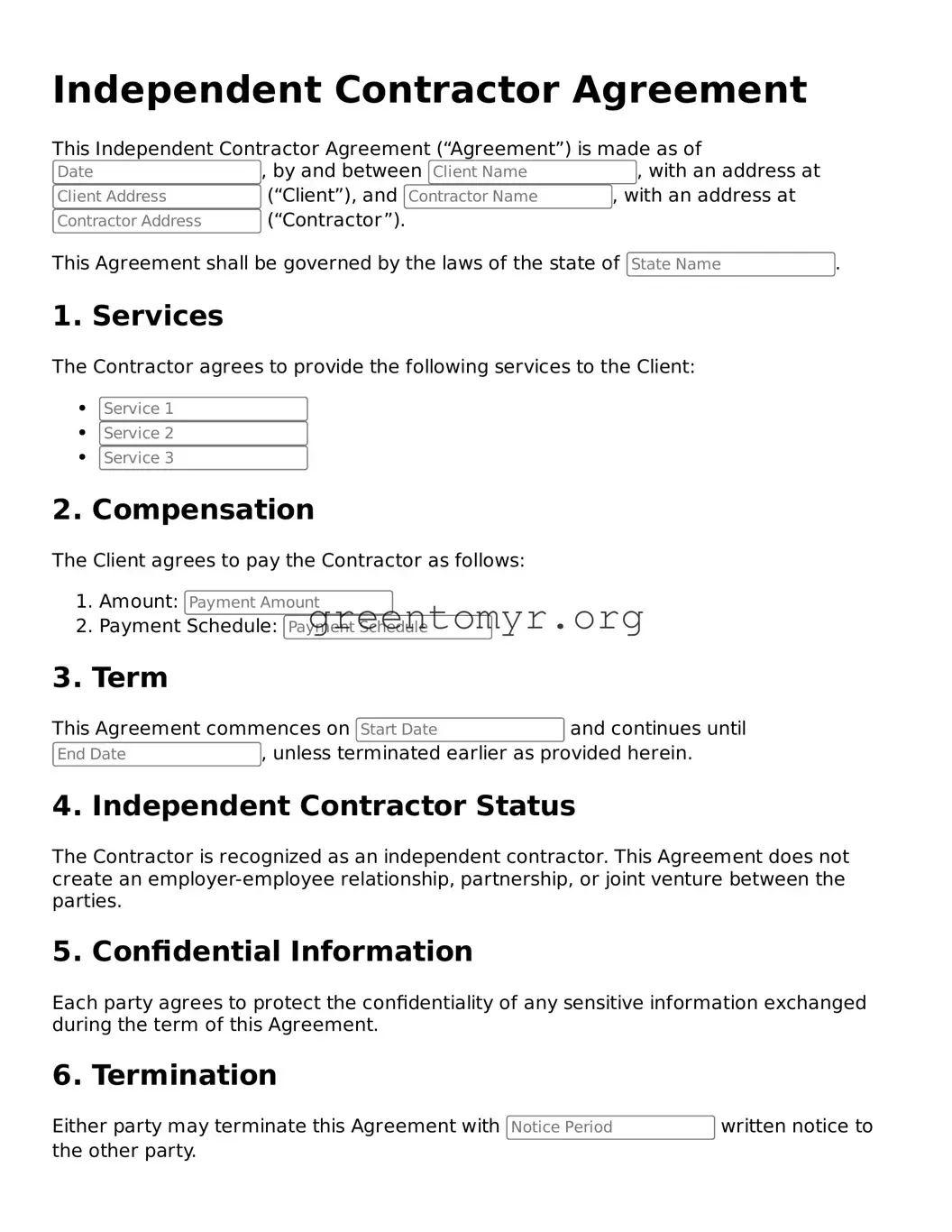

Valid Independent Contractor Agreement Form

The Independent Contractor Agreement form is a legal document that outlines the terms of a working relationship between a business and a contractor. This agreement protects both parties by clearly defining their rights and responsibilities. To ensure clarity and compliance, it is essential to fill out the form accurately; you can start the process by clicking the button below.