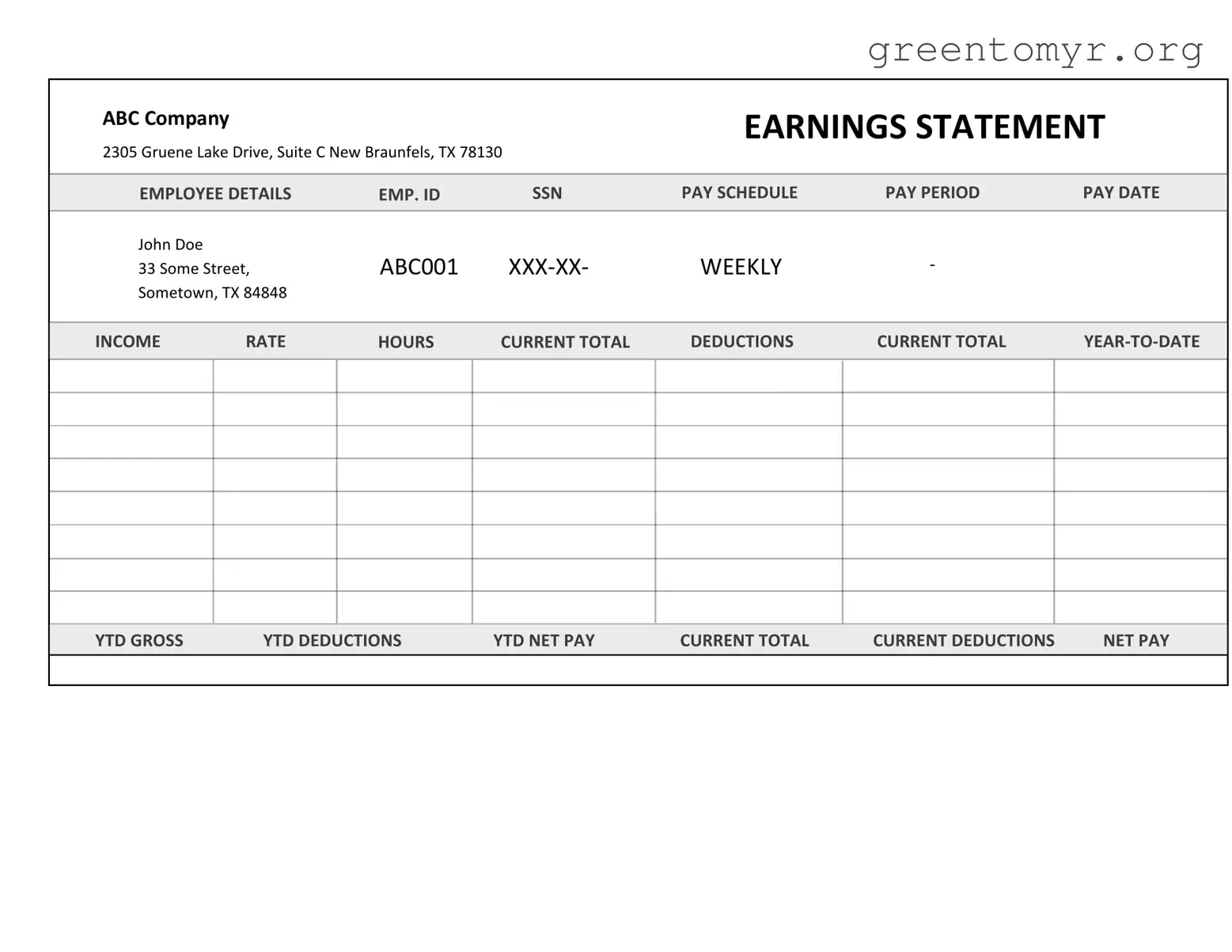

Filling out the Independent Contractor Pay Stub form can often be a straightforward process, yet many individuals still encounter errors. One common mistake arises from inaccurate personal information. Contractors frequently input incorrect addresses, Social Security numbers, or contractor IDs. Such mistakes can lead not only to delays in payment but also create complications with tax reporting.

Another area where errors often occur is in the calculation of hours worked. Contractors may forget to total their hours or miscalculate the number of hours worked during the pay period. This oversight can result in underpayment or overpayment, both of which can cause issues in maintaining clear financial records.

Misclassifying earnings is another frequent misstep. Independent contractors sometimes confuse their earnings with expenses or fail to categorize bonuses and commissions accurately. This misclassification can impact both the net income reported and the overall accuracy of the Pay Stub.

When it comes to deductions, many individuals neglect to document them properly. Whether it’s insurance, retirement contributions, or taxes, failing to clearly outline these deductions can lead to misunderstandings or disputes. Such discrepancies not only affect the take-home pay but may also create issues during tax season.

Employees unfamiliar with the form might overlook the inclusion of company information. The absence of important details such as the business name, address, or contact information can lead to confusion. This can be especially problematic if the contractor needs the Pay Stub for verification purposes or for applying for loans.

Attention to detail is critical, yet individuals often forget to review the form thoroughly before submission. Simple typographical errors, such as incorrect dates or inputting zeros instead of ones, can compromise the integrity of the Pay Stub and, in turn, the contractor’s financial reputation.

Not keeping a copy of the completed Pay Stub represents another significant error. After submission, it’s essential to maintain a personal record for future reference. This documentation can prove invaluable, especially in case of discrepancies or questions regarding payments.

Moreover, some contractors overlook the requirement for signatures. A neglected signature can render the Pay Stub incomplete, causing confusion or delays in processing. Ensuring that all necessary signatures are present is an important step in finalizing the document.

Lastly, failing to stay updated with any changes in tax regulations or company policies can lead to outdated information being provided on the Pay Stub. Given that tax laws may evolve, it is imperative for contractors to familiarize themselves with the current requirements to avoid any legal complications or tax liabilities.