|

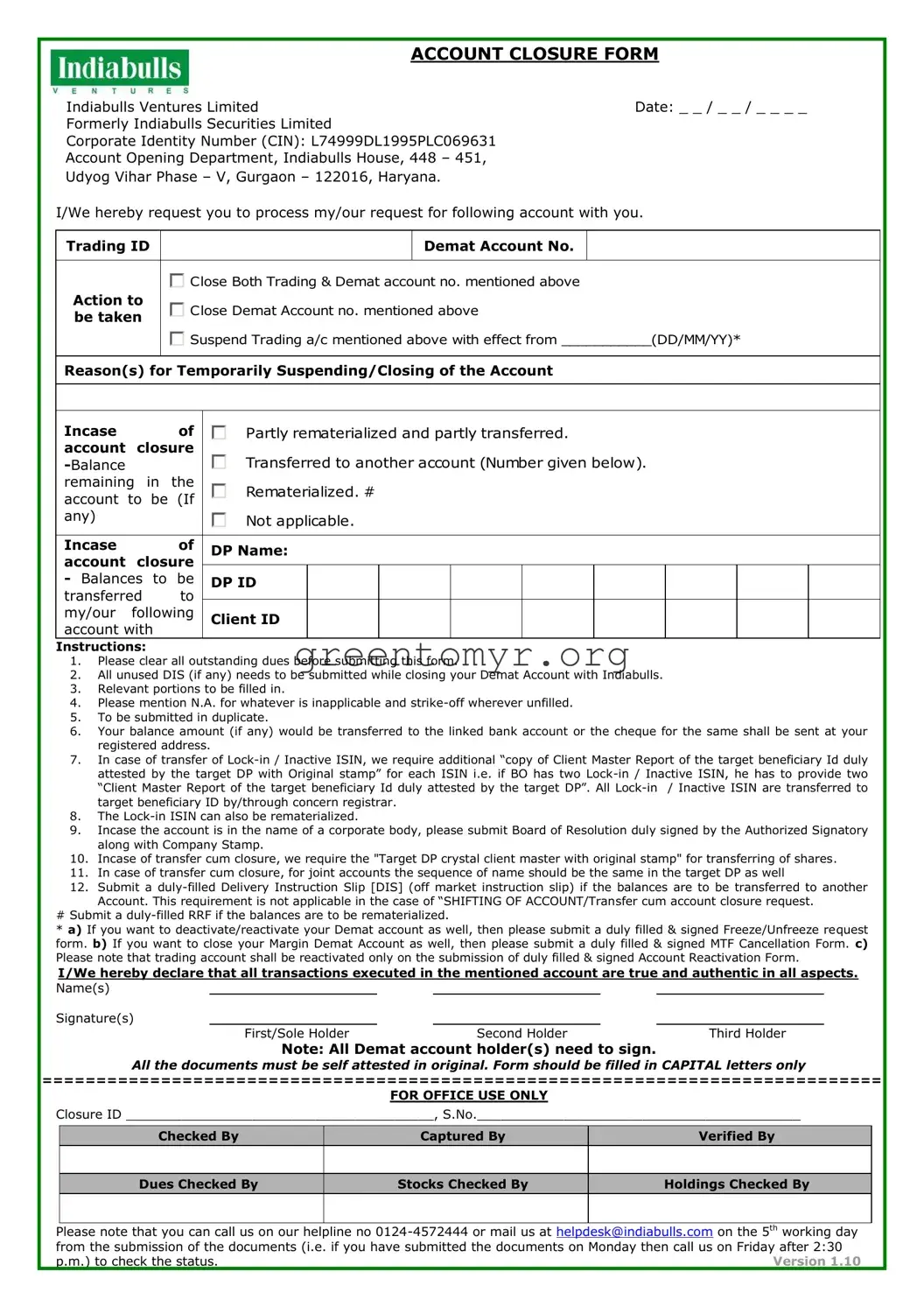

ACCOUNT CLOSURE FORM |

Indiabulls Ventures Limited |

Date: _ _ / _ _ / _ _ _ _ |

Formerly Indiabulls Securities Limited

Corporate Identity Number (CIN): L74999DL1995PLC069631

Account Opening Department, Indiabulls House, 448 – 451,

Udyog Vihar Phase – V, Gurgaon – 122016, Haryana.

I/We hereby request you to process my/our request for following account with you.

|

Trading ID |

|

Demat Account No. |

|

|

|

|

|

|

|

|

Close Both Trading & Demat account no. mentioned above |

|

Action to |

Close Demat Account no. mentioned above |

|

be taken |

|

|

|

|

|

|

Suspend Trading a/c mentioned above with effect from ___________(DD/MM/YY)* |

|

|

|

|

Reason(s) for Temporarily Suspending/Closing of the Account |

|

Incase |

|

|

of |

Partly rematerialized and partly transferred. |

|

account |

closure |

|

|

|

|

|

|

|

|

|

|

-Balance |

|

|

|

Transferred to another account (Number given below). |

|

remaining |

in |

the |

Rematerialized. # |

|

account |

to |

be |

(If |

|

|

|

|

|

|

|

|

|

|

|

any) |

|

|

|

Not applicable. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Incase |

|

|

of |

DP Name: |

|

account |

closure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Balances |

to |

be |

DP ID |

|

|

|

|

|

|

|

|

|

transferred |

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

my/our |

following |

Client ID |

|

|

|

|

|

|

|

|

|

account with |

|

|

|

|

|

|

|

|

|

|

|

Instructions: |

|

|

|

|

|

|

|

|

|

|

|

1.Please clear all outstanding dues before submitting this form.

2.All unused DIS (if any) needs to be submitted while closing your Demat Account with Indiabulls.

3.Relevant portions to be filled in.

4.Please mention N.A. for whatever is inapplicable and strike-off wherever unfilled.

5.To be submitted in duplicate.

6.Your balance amount (if any) would be transferred to the linked bank account or the cheque for the same shall be sent at your registered address.

7.In case of transfer of Lock-in / Inactive ISIN, we require additional “copy of Client Master Report of the target beneficiary Id duly attested by the target DP with Original stamp” for each ISIN i.e. if BO has two Lock-in / Inactive ISIN, he has to provide two “Client Master Report of the target beneficiary Id duly attested by the target DP”. All Lock-in / Inactive ISIN are transferred to target beneficiary ID by/through concern registrar.

8.The Lock-in ISIN can also be rematerialized.

9.Incase the account is in the name of a corporate body, please submit Board of Resolution duly signed by the Authorized Signatory along with Company Stamp.

10.Incase of transfer cum closure, we require the "Target DP crystal client master with original stamp" for transferring of shares.

11.In case of transfer cum closure, for joint accounts the sequence of name should be the same in the target DP as well

12.Submit a duly-filled Delivery Instruction Slip [DIS] (off market instruction slip) if the balances are to be transferred to another

Account. This requirement is not applicable in the case of “SHIFTING OF ACCOUNT/Transfer cum account closure request.

#Submit a duly-filled RRF if the balances are to be rematerialized.

*a) If you want to deactivate/reactivate your Demat account as well, then please submit a duly filled & signed Freeze/Unfreeze request form. b) If you want to close your Margin Demat Account as well, then please submit a duly filled & signed MTF Cancellation Form. c) Please note that trading account shall be reactivated only on the submission of duly filled & signed Account Reactivation Form.

I/We hereby declare that all transactions executed in the mentioned account are true and authentic in all aspects. Name(s)

Signature(s)

First/Sole Holder |

Second Holder |

Third Holder |

Note: All Demat account holder(s) need to sign.

All the documents must be self attested in original. Form should be filled in CAPITAL letters only

==============================================================================

FOR OFFICE USE ONLY

Closure ID _______________________________________, S.No._________________________________________