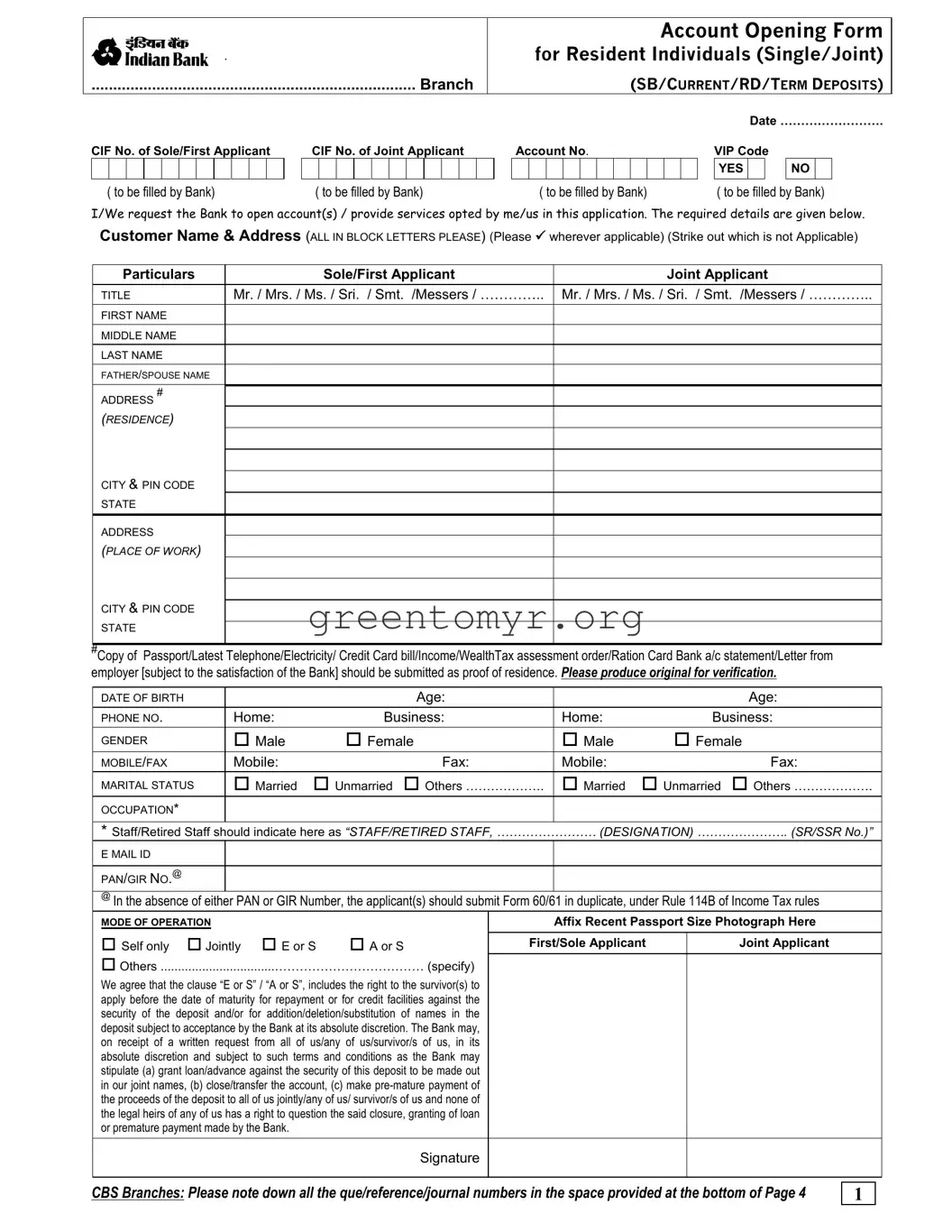

PRODUCTS/SERVICES - Please ( ) (Available at select Centres/Branches – Terms & Conditions can be obtained from Branch Manager)

Internet Banking ATM Card Telebanking |

Mobile Banking |

Debit/Maestro Card IndBank Billpay |

Any Branch Banking through Multicity Cheque |

Others (Specify) .....………… |

Senior Citizens (completed 60 years of age): Please provide copy of Secondary School Leaving Certificate/LIC Policy/Voter’s Identity Card/Pension Payment Order/Birth Certificate issued by the competent authority/Passport/Any other relevant document providing proof for age.

Declaration for Minor (In case * first/ * joint applicant is a Minor)

|

|

|

|

I declare that the minor |

(name) is my |

(relation) and I am his/her *natural and lawful guardian / * |

guardian appointed in terms of Court’s order dated |

(copy attached). I shall represent the said minor in all future transactions of any |

description in respect to the above deposit account until the said minor attains majority. I certify that the minor was born on |

(date). I |

shall indemnify the Bank against the claim of above minor for any withdrawal/transaction made by me in his/her account. |

|

Name of Guardian |

Signature |

|

Operating Instructions for Joint SB/Current Accounts: We request and authorise you , until any one of us shall give you notice in writing to

the contrary, to honour all cheques or other orders drawn or Bills of Exchange accepted or notes made on our behalf signed by 1) ....................

........................................................ 2) |

of us jointly and/or severally and to debit such |

cheques to our account with you, whether such account be |

for the time being in credit or overdrawn. We also request you to accept the |

endorsement by 1) |

2) |

.................................................................................... of us jointly and/or |

severally on cheques, orders, bills or notes payable to us. We shall be jointly and severally liable to you for any monies owing to you from time to time in case the account is overdrawn and debit balance is caused including your commission, interest at the appropriate rate and other incidental charges. In the event of death, insolvency or withdrawal of any of us, the survivor/s of us shall have full control of any monies then and thereafter standing to our credit in our account with you, and in that event the survivor/s will have full powers to operate the account and/ or to close the account.

Interest on FD: Please credit the interest payable every month/quarterly/half-yearly/annually to my/our SB/Current account No. .........................

RIP/Cash Certificate Deposit: I/We understand that the interest earned every quarter will be reinvested in the RIP/Cash Certificate a/c until maturity date as provided in the scheme.

|

|

|

SWAP: I/We authorise you to transfer amounts in excess of Rs |

in my/our SB/Current account No |

on any day into a fixed deposit of |

days tenor in units of Rs…………. I/We further authorise that inadequacy of funds in my/our |

SB/current account referred above is met any time by prematurely breaking the fixed deposit in units of Rs.1000 and transferring the required amount into the said SB/current account.

Recurring Deposit: Please debit my/our SB/Current account No. |

............................... with Rs |

every month on …………………(date) |

and credit to my RD / Variable RD account No |

towards the periodical installments upto ……………………. (date) |

Variable Deposit: I/We hereby declare that the core deposit for my/our variable deposit account is Rs |

and I/We hereby agree that |

the maximum amount of instalment paid in my/our account shall not exceed 10 times of core deposit or Rs.10,000 whichever is less. Due Date Notice: Please *send / *do not send due date notice to my/our above address. (* strikeout which is not applicable)

Auto Renewal for Term Deposits: Unless the Bank receives a demand for payment or instructions to the contrary from me/us on or before the date of maturity, please renew/continue to renew the deposit *including/ *excluding interest at the Bank’s discretion for similar period, subject to a maximum of one year, under the same scheme, at the then prevailing rate of interest, without insisting on production of the deposit receipt.

Tax Deduction at Source: Form No.15G/15H for exemption from TDS is enclosed.(for applicant seeking exemption from TDS)

In the event of my/our seeking pre-closure of term deposit/RD, I/We agree that the Bank shall apply the rules for pre-closure of

term deposits/RD prevailing on the date of my/our request for such pre-closure

2