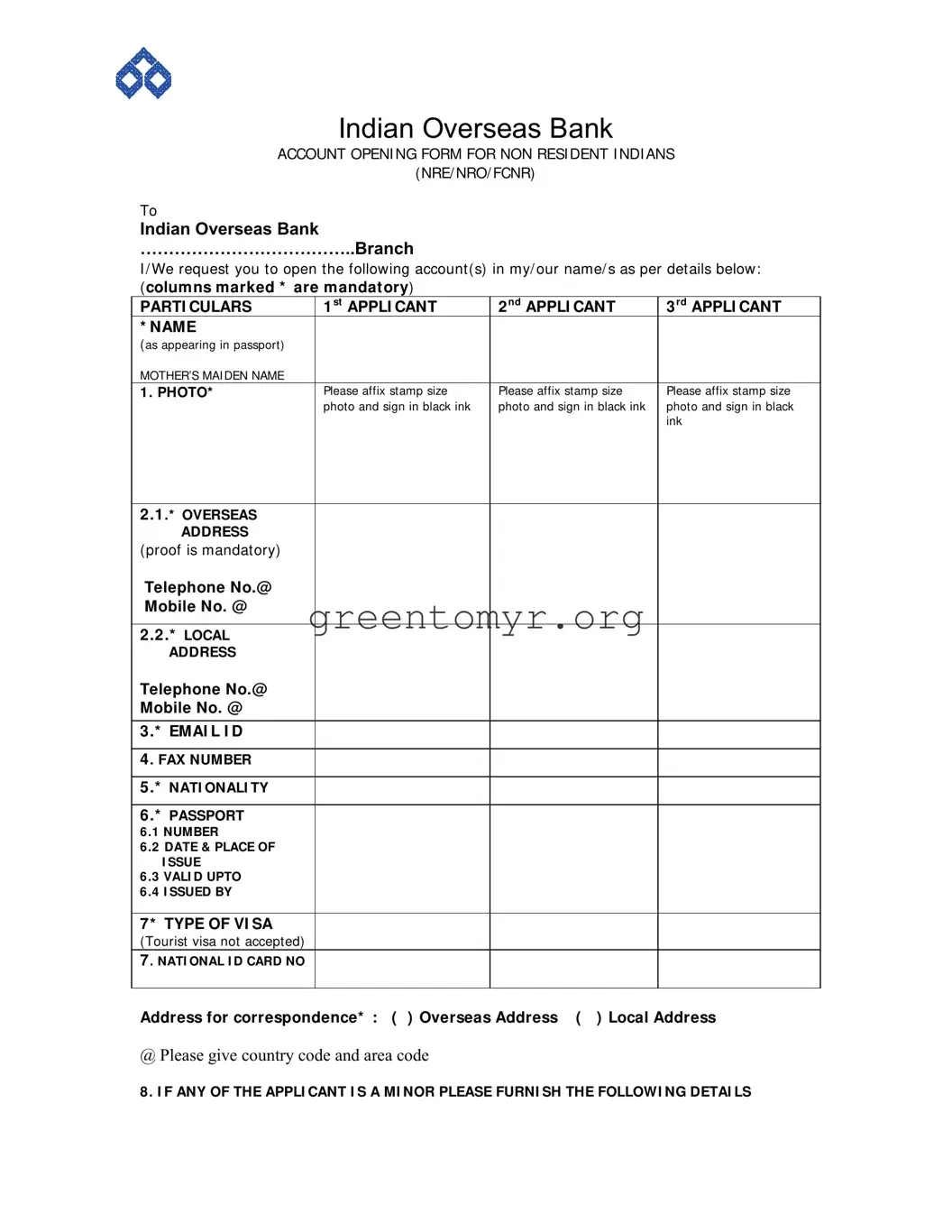

INDIAN OVERSEAS BANK

ACCOUNT OPENI NG FORM FOR NON RESI DENT I NDI ANS

(NRE/ NRO/ FCNR)

To

INDIAN OVERSEAS BANK

………………………………..BRANCH

I / We request you to open the following account(s) in my/ our name/ s as per details below: ( columns marked * are mandatory)

PARTI CULARS |

1 st APPLI CANT |

2 nd APPLI CANT |

3 rd APPLI CANT |

* NAME |

|

|

|

( as appearing in passport) |

|

|

|

MOTHER’S MAI DEN NAME |

|

|

|

1 . PHOTO* |

Please affix stamp size |

Please affix stamp size |

Please affix stamp size |

|

|

photo and sign in black ink |

photo and sign in black ink |

photo and sign in black |

|

|

|

|

ink |

|

|

|

|

|

2 |

.1 .* OVERSEAS |

|

|

|

|

ADDRESS |

|

|

|

(proof is mandatory) |

|

|

|

Telephone No.@ |

|

|

|

Mobile No. @ |

|

|

|

|

|

|

|

|

2 |

.2 .* LOCAL |

|

|

|

|

ADDRESS |

|

|

|

Telephone No.@ |

|

|

|

Mobile No. @ |

|

|

|

|

|

|

|

|

3 |

.* EMAI L I D |

|

|

|

|

|

|

|

|

4 |

. FAX NUMBER |

|

|

|

|

|

|

|

|

5 |

.* NATI ONALI TY |

|

|

|

|

|

|

|

|

6 |

.* PASSPORT |

|

|

|

6 .1 NUMBER |

|

|

|

6 .2 DATE & PLACE OF |

|

|

|

|

I SSUE |

|

|

|

6 .3 VALI D UPTO |

|

|

|

6 .4 I SSUED BY |

|

|

|

|

|

|

|

7* TYPE OF VI SA |

|

|

|

(Tourist visa not accepted) |

|

|

|

7 |

. NATI ONAL I D CARD NO |

|

|

|

|

|

|

|

|

Address for correspondence* : ( ) Overseas Address ( ) Local Address

@ Please give country code and area code

8 . I F ANY OF THE APPLI CANT I S A MI NOR PLEASE FURNI SH THE FOLLOWI NG DETAI LS

Name : |

Date of Birth : |

|

|

Name & Address of Parent/ Guardian : |

|

|

|

|

Relationship w ith the Minor : |

|

|

|

|

9 . TYPE OF ACCOUNTS * ( Please tick whichever is applicable) |

|

|

Nature of Deposit |

|

|

Currency & |

Period (for Term |

|

|

Type(Savings/ |

Amount |

Deposits only) |

|

|

Current/Term) |

|

|

Non Resident (External) Account |

|

|

|

|

|

|

|

|

|

Non Resident (Ordinary) Account |

|

|

|

|

|

|

|

|

|

Foreign Currency (Non Resident) Account |

|

|

|

|

|

|

|

|

|

I/We agree that if the premature withdrawal is permitted at my/our request, the payment of interest will be as per the guidelines pertaining to such payment.

I/We authorise the bank to automatically renew the deposit on the due date for an identical period, unless any instruction to the contrary from me/us, is received by the bank before maturity. I/We further understand that the interest applicable on renewals will be at applicable rates on the dates of maturity and that the renewal(s) will be noted on the deposit receipt on my/our presenting the same on maturity date or later for renewal/payment.

(Full details and interest rates of the schemes are available in our web site www.iob.in)

10 . ACCOUNT TO BE OPERATED BY* ( Please t ick whichever is applicable)

11 . I NTEREST PAYMENT* ( Please advise for disposal of interest payments |

|

for NRE/NRO - monthly/quarterly/half yearly/maturity |

|

for FCNR |

- maturity interest) |

|

Please credit ( ) SB ( ) Current Acct |

No. |

with |

branch |

In the name of ……………………………………………………………………………..

12 . OTHER FACI LI TI ES REQUI RED ( Available only for Single and E or S accounts)

a) |

e-see Banking (internet banking) |

( ) Yes ( ) No |

b) |

ATM/International Debit Card |

( ) Yes ( ) No |

(Please mail the PIN mailer and ATM card to my overseas address in separate envelopes)

c) SMS confirmation( ) Yes ( ) No (Please provide mobile number) I/We agree to abide by the terms and conditions as applicable and acknowledge it is my/our responsibility to obtain and read the same

13 . OTHER I NSTRUCTI ONS ( Kindly extend the facilities subject to conditions governing the same) ( ) Deposit receipt to be kept in safe custody/to be mailed to my local/overseas address/others (specify)

( ) Maturity notice to be sent to local/overseas address by post/may be advised through email/need not be

sent/others (specify)

() Deposit to be renewed on maturity with interest/principal only/may be credited to SB/Current account/proceeds may be sent by draft to overseas/local address

14 . DECLARATI ON

I/We hereby declare that I am/we are non resident Indian(s) person(s) of Indian origin. I/We understand that the above account will be opened on the basis of statement/declaration made by me/us and I/we also agree that if any of the statements / declarations made herein is found to be not correct in material particulars, you are not bound to pay any interest on the deposit made by me/us. I/We agree that no claim will be made by me/us for any interest on the deposit(s) for any period after the date(s) of maturity of the deposit(s). I/we agree to abide by the provisions, terms and conditions governing the deposit(s) opened by me/us. I/We also undertake to intimate the Bank about my/our return to India for permanent residence immediately on arrival.

I/We agree that the Bank may at its absolute discretion, discontinue any of the services completely or partially without any notice to me/us. I/We agree that the Bank may debit my account for service charges as applicable from time to time. I/We understand that the operations in our account are subject to the provisions of FEMA and other RBI/GOI notifications from time to time.

15 . Applicable to Non Resident ( Ordinary) Accounts

I/We are aware that Tax will be deducted at source on the interest paid/accrued as per income tax laws in force.

16 . Collection of I nstruments paid into the account

From time to time I/We may deposit into the account, instruments for collection. I/We authorise the bank to collect and credit the proceeds of the same subject to conditions for such collections including arranging a correspondent of its choice in case of foreign currency cheques. In case any overdraft is created by return of such instruments for whatsoever reason, I/We are liable to the bank for such overdrafts. The Bank will not be responsible for any loss, damage, miscarriage of cheques, any delay in collection, transmission and otherwise of any remittance howsoever caused.

17 . Mandate for operations ( optional)

I/We are desirous of authorising a person in India to operate our account for local payments by ( ) mandate letter ( ) power of attorney.

18 . NOMI NATI ON ( I f nomination not required please give a separate letter to that effect)

I/We nominate the following person to receive the amount deposit in the unfortunate event of my/our death

Name |

Address |

Relationship with depositor |

Age (yrs) |

|

|

|

|

As the nominee is a minor, I/We appoint Mr./Mrs. ……………………………………….. to receive the

amount of deposit on behalf of the nominee

Signature of 1st Applicant |

Signature of 2nd Applicant |

Signature of 3rd Applicant |

Name and signature of witness (in case nominee is a minor) :

Note: Signature to be attested by the Bank/Indian Embassy/High Commission/Consulate/Notary Public/Account holder of the bank

|

|

|

Stamp and signature of attesting person |

We attach the following attested document (indicate by ticking) |

( ) Passport Copy (mandatory) ( ) Visa ( ) Work Permit |

( ) National ID card ( ) Others (specify) |

FOR BRANCH USE : Indian Overseas Bank |

|

Branch |

|

|

|

|

|

Letter of thanks sent |

to |

Account opened on |

|

Authorised by |

Customer/Introducer on |

|

by |

|

Name: |

|

|

Name: |

|

Signature : |

|

|

Signature : |

|

Date: |

|

|

Date : |

|

|

|

|

|

|

|

|

|

|

|

|

KYC : CROP |

INDIAN OVERSEAS BANK ………………………………………………. BRANCH |

|

|

|

|

|

|

|

|

KNOW YOUR CUSTOMER – CUSTOMER RECORD OF PROFILE |

|

{TO BE FILLED IN BY THE APPLICANT/S IN COMPLIANCE OF KYC REQUIREMENT} |

|

|

Particulars |

|

|

1st Applicant |

2nd Applicant |

|

3rd Applicant |

|

1. Name |

|

|

|

|

|

|

|

|

|

|

2. Nationality |

|

|

|

|

|

|

|

|

|

3. Father/spouse name |

|

|

|

|

|

|

|

|

|

4. Date of birth |

|

|

|

|

|

|

|

|

|

5. Whether PEP # (see below) |

|

|

|

|

|

|

|

|

6. Marital Status |

|

|

|

|

|

|

|

|

|

7. If married no of children |

|

|

|

|

|

|

|

|

|

8. Educational qualification |

|

|

|

|

|

|

|

|

|

8.1 |

Non graduate |

|

|

|

|

|

|

|

|

|

8.2 |

Graduate 8.3 Post |

|

|

|

|

|

|

|

|

|

Graduate |

8.4 Professional |

|

|

|

|

|

|

|

|

|

9. Occupation (refer table |

|

|

|

|

|

|

|

|

|

below and furnish serial |

|

|

|

|

|

|

|

|

|

numbers as appropriate |

|

|

|

|

|

|

|

|

|

10. |

Annual Income |

|

|

|

|

|

|

|

|

|

11. |

Source of funds |

|

|

|

|

|

|

|

|

|

12. |

Vehicle owned |

|

|

|

|

|

|

|

|

|

12.1 Car |

12.2 Two wheeler |

|

|

|

|

|

|

|

|

12.3 Others 12.4 None |

|

|

|

|

|

|

|

|

|

13. |

Residence |

|

|

|

|

|

|

|

|

|

13.1 Own |

13.2 Rented |

|

|

|

|

|

|

|

|

|

14. |

Details of credit cards held |

|

|

|

|

|

|

|

|

15. |

Details of deposit/loan |

|

|

|

|

|

|

|

|

|

accounts/credit facilities at |

|

|

|

|

|

|

|

|

|

other branches of IOB/other |

|

|

|

|

|

|

|

|

|

banks |

|

|

|

|

|

|

|

|

|

|

16. |

Details of foreign countries |

|

|

|

|

|

|

|

|

visited during the last 3 years |

|

|

|

|

|

|

|

|

|

17. |

Any other information |

|

|

|

|

|

|

|

|

|

which you would like to |

|

|

|

|

|

|

|

|

|

record with the bank |

|

|

|

|

|

|

|

|

|

18. |

I/We declare that the above |

|

|

|

|

|

|

|

|

particulars furnished by me are |

|

|

|

|

|

|

|

|

correct |

|

|

|

Signature |

Signature |

|

Signature |

|

|

9.a Service |

|

|

9.b Professional |

9.c Others |

|

|

|

8.a.1 Government |

|

|

8.b.1. Lawyer |

|

8.c.1. Pensioner |

|

|

|

8.a.2 Public Sector Undertaking |

8.b.2. Doctor |

|

8.c.2. Retired Non pensioner |

|

8.3.3. Private Sector |

|

|

8.b.3. Chartered/Cost Accountant |

8.c.3. Home maker |

|

(Furnish |

designation |

and |

8.b.4. Engineer |

|

8.c.4. Student |

|

|

|

employer name) |

|

|

8.b.5 Information Technology |

8.c.5. Farmer/Trader |

|

|

|

|

|

|

8.b.6. Others (specify) |

|

8.c.6. Vendor/Business |

|

|

|

|

|

|

|

|

8.c.7. Others (specify) |

|

|

|

FOR USE AT BRANCH: 1. Identify and verify genuineness of address as per instructions in force. |

|

2. Remarks: |

|

|

|

|

|

|

|

|

|

Date: |

|

|

|

Branch Seal |

Name and signature of Authorised Officer |

|

#Politically Exposed Person (PEP) include individuals entrusted with prominent public functions in a foreign country, their family members and close associates

MANDATE FORM

To

The Branch Manager

Indian Overseas Bank

Branch

Place

Date

Dear Sir

Referring to the NRE/NRO SB account number and various term deposits/FCNR deposits going to be deposited with you in my/our name(s), I/We request and authorise you to honour all cheques drawn on the said account as well as for operating the term deposits both existing and future for local payments by……………………………………

whose signature(s) are hereunder written, notwithstanding such cheques may create or increase an overdraft to any extent and we authorise the said person on our behalf to make, draw, accept, endorse and negotiate cheques, hundies, bills and other negotiable instruments.

This authority shall continue in force until we have expressly revoked it by a notice in writing to be delivered to you.

Dated this |

day of two thousand |

Yours faithfully,

(Account Holder(s)) |

|

Specimen signature of |

authorized to sign as |

above mentioned |

|

………………………………………. |

|

………………………………………. |

|

confirmed |

|