Completing the ING Beneficiary form can be straightforward, but there are common mistakes that may lead to delays or complications in processing. Understanding these errors is crucial for ensuring that the beneficiary designations are correctly established.

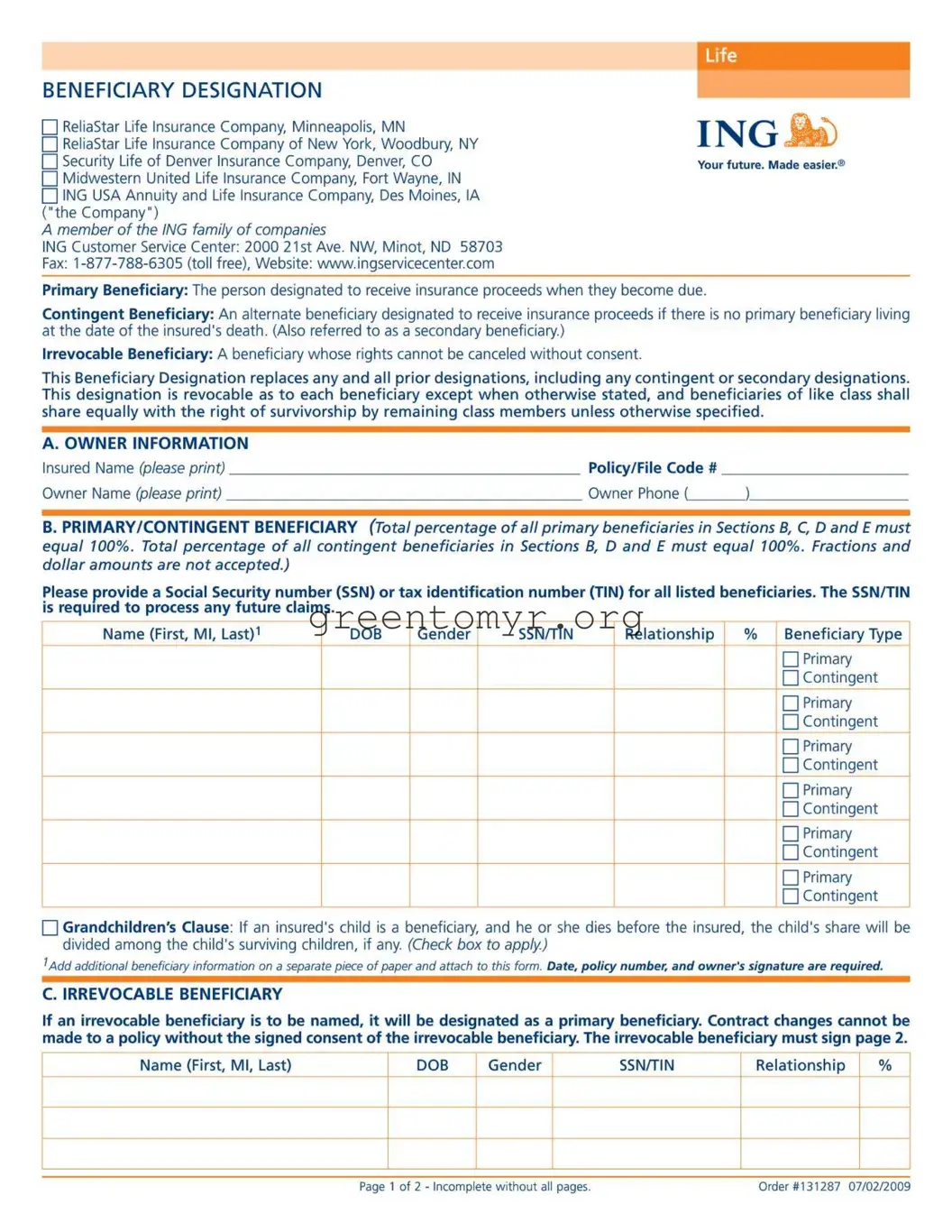

One common mistake is failing to provide complete information for each beneficiary. Every beneficiary should have their name, date of birth, gender, Social Security number, and relationship to the insured clearly filled out. Incomplete information can lead to processing delays or the rejection of the form.

Another frequent error involves not assigning the correct percentages to primary and contingent beneficiaries. The total percentage for primary beneficiaries must equal 100%, and the same applies to contingent beneficiaries. Neglecting to ensure these totals can create complications in the distribution of proceeds after the insured's death.

People often overlook the requirement for Social Security numbers (SSNs) or tax identification numbers (TINs) for all listed beneficiaries. The form cannot be processed without this critical information, which is necessary for processing any future claims.

Not checking the Grandchildren's Clause box can also be a mistake. If an insured’s child dies before them, failing to check this option may prevent the deceased child's share from being automatically distributed to their surviving children.

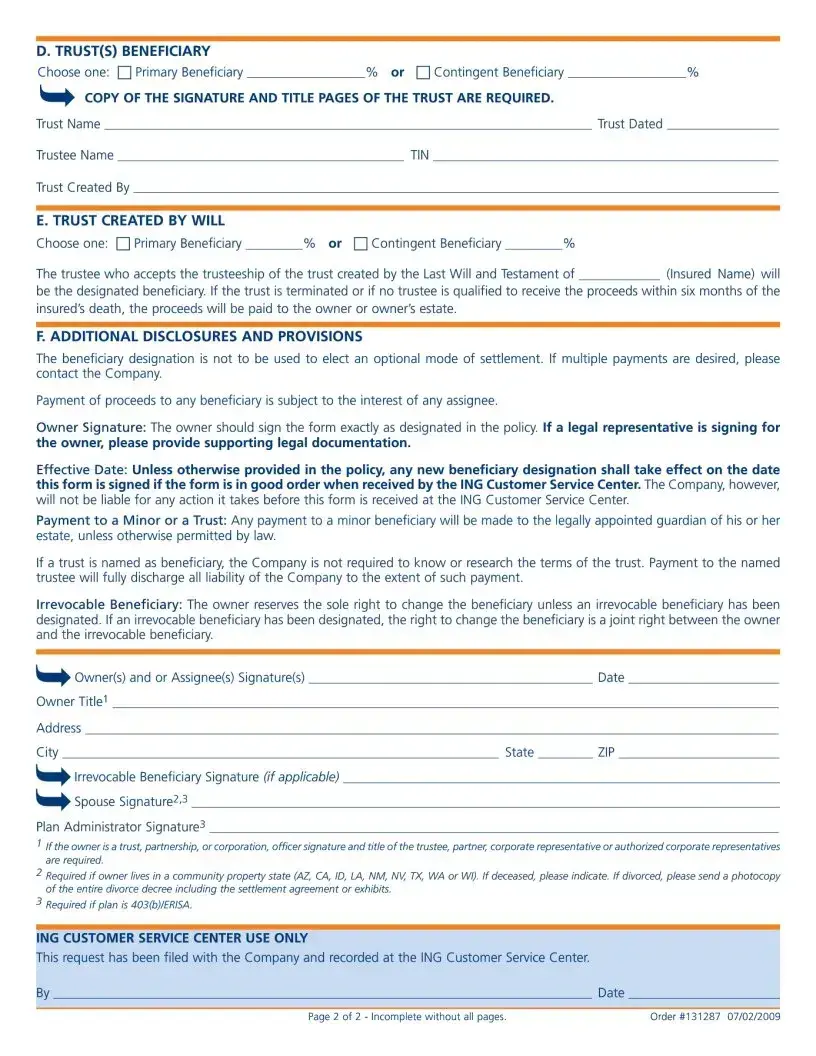

Another issue arises when an irrevocable beneficiary is named. If an irrevocable beneficiary is to be included, they must be designated as a primary beneficiary, and their consent is required for any changes to the policy. Failing to understand this can lead to unexpected complications.

People frequently forget or neglect to sign the form. The owner must sign exactly as designated in the policy. If there is a legal representative, supporting legal documentation should accompany the signature to avoid any ambiguity.

Failure to attach additional beneficiary information on a separate piece of paper can also cause issues. If there are more beneficiaries than can be listed on the form, this additional information is necessary and must include the policy number and owner's signature for accuracy.

Lastly, not recognizing the provisions for payments to minors or trusts can create serious issues. Payments to minors should be directed to a legally appointed guardian unless stated otherwise. If a trust is named, the company is not required to research its terms, so clarity in naming the trustee is essential.