DECLARATION OF CONTRACTOR RE: AUTOMOBILE INSURANCE COVERAGE

|

Regarding the Agreement between the City of San Diego, a municipal corporation [City] |

and |

, [Contractor] |

Contractor declares as follows:

1.Contractor does not currently own any vehicles;

2.Contractor has obtained, and shall maintain during the term of the Agreement, automobile insurance coverage for “hired autos” and “non-owned autos”; and

3.In the event Contractor subsequently acquires any vehicle(s) during the term of the Agreement, the Contractor shall immediately obtain, and provide to the City the required evidence of, automobile insurance coverage for “any auto,” as required in Section 6.a of the Agreement.

For the purpose of this Declaration, automobile insurance coverage for “any auto,” “hired autos,” and “non-owned autos” are defined as follows:

Any Auto: Coverage is provided for any auto, including autos owned by the insured, autos the named insured hires or borrows from others, and other non-owned autos used in the insured's business.

Hired Autos: Coverage is provided only for autos leased, hired, rented, or borrowed for use in the named insured's business.

Non-owned Autos: Coverage is provided only for autos not owned, leased, hired, or borrowed by the named insured. Coverage includes autos owned by the insured's employees or members of their households, but only while used in the named insured's business or personal affairs.

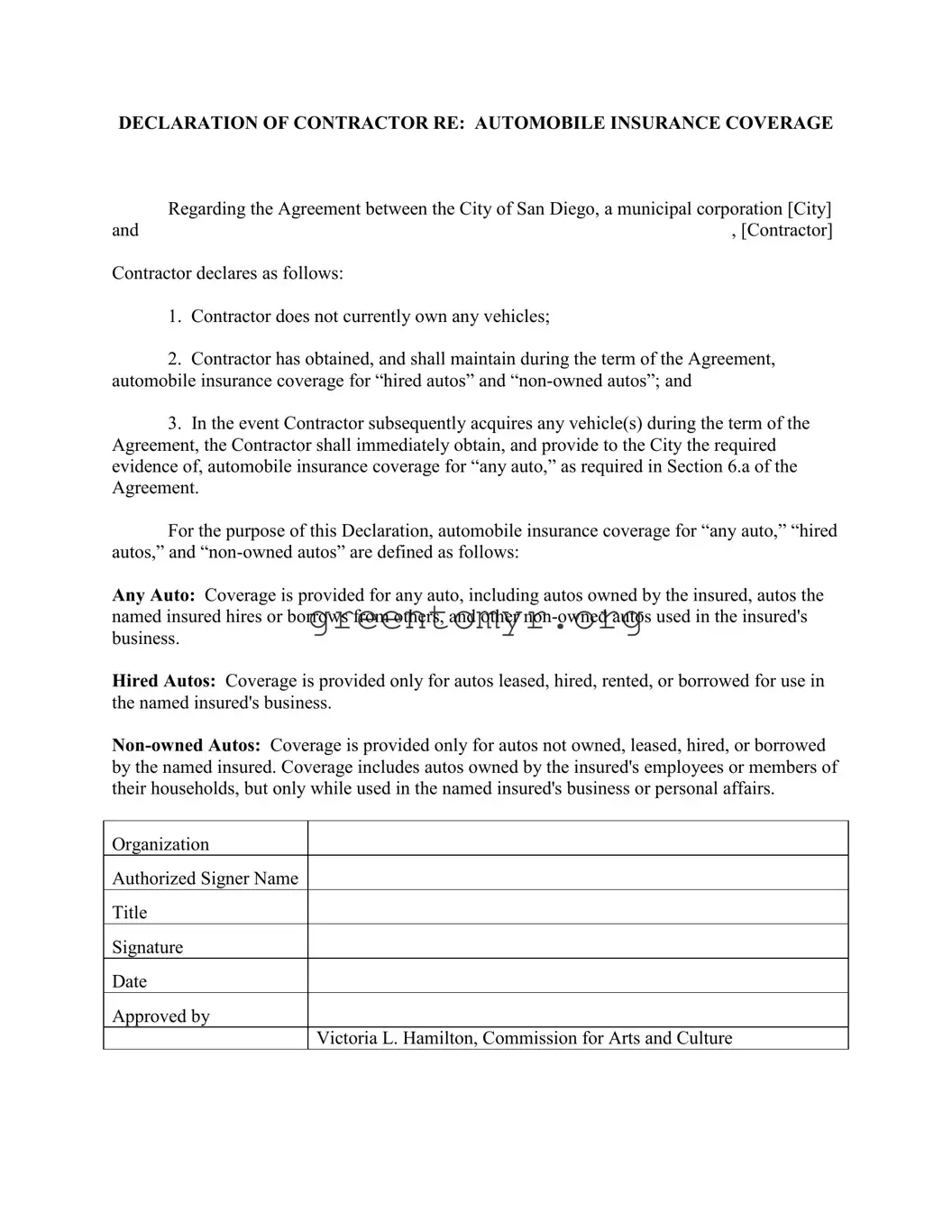

Organization

Authorized Signer Name

Title

Signature

Date

Approved by

Victoria L. Hamilton, Commission for Arts and Culture