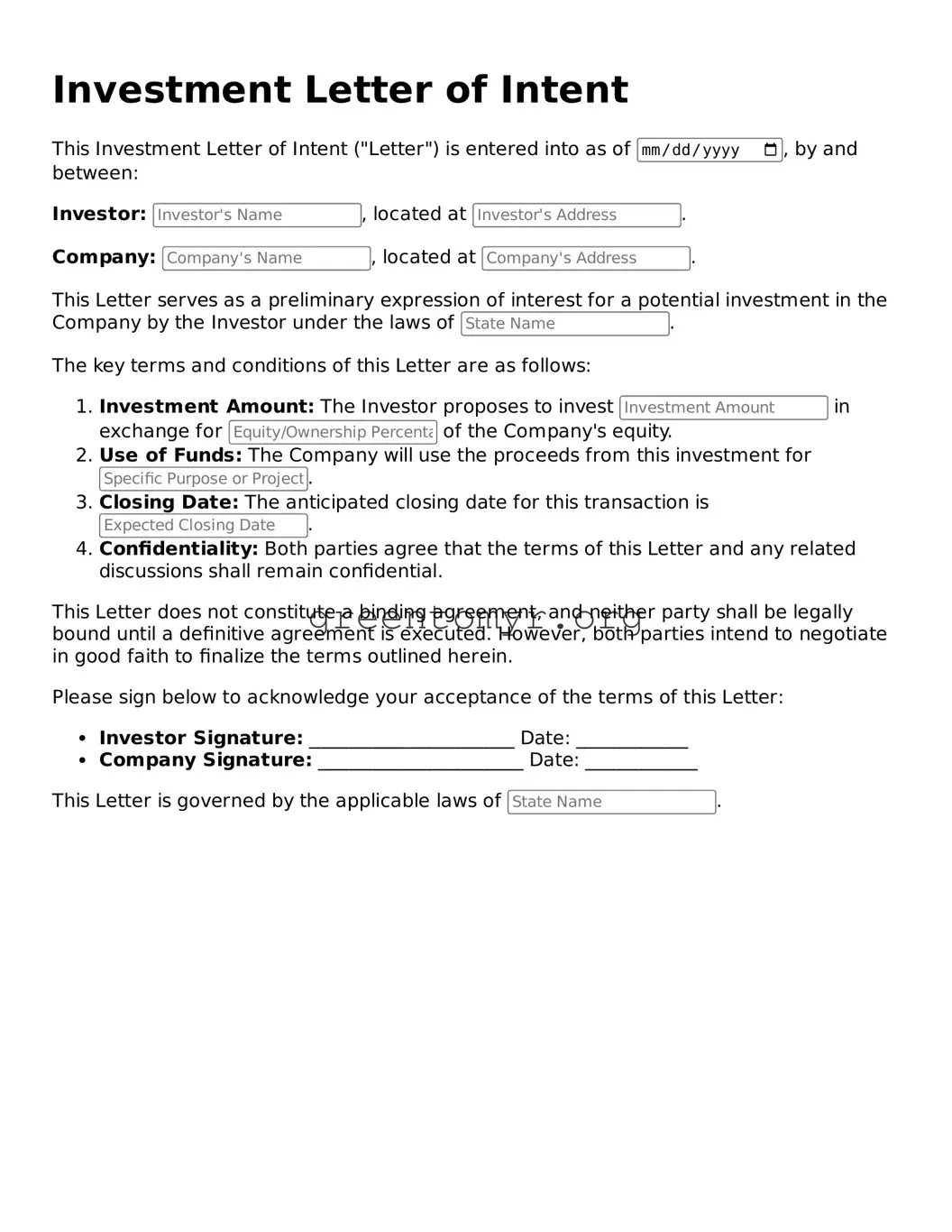

Valid Investment Letter of Intent Form

The Investment Letter of Intent form is a document that outlines the preliminary terms and conditions between parties interested in embarking on an investment opportunity. This document serves as a key step in formalizing the intentions of involved parties before final agreements are made. By clearly stating the expectations and framework for the investment, it helps to reduce misunderstandings later in the process.

If you are ready to move forward, fill out the form by clicking the button below.