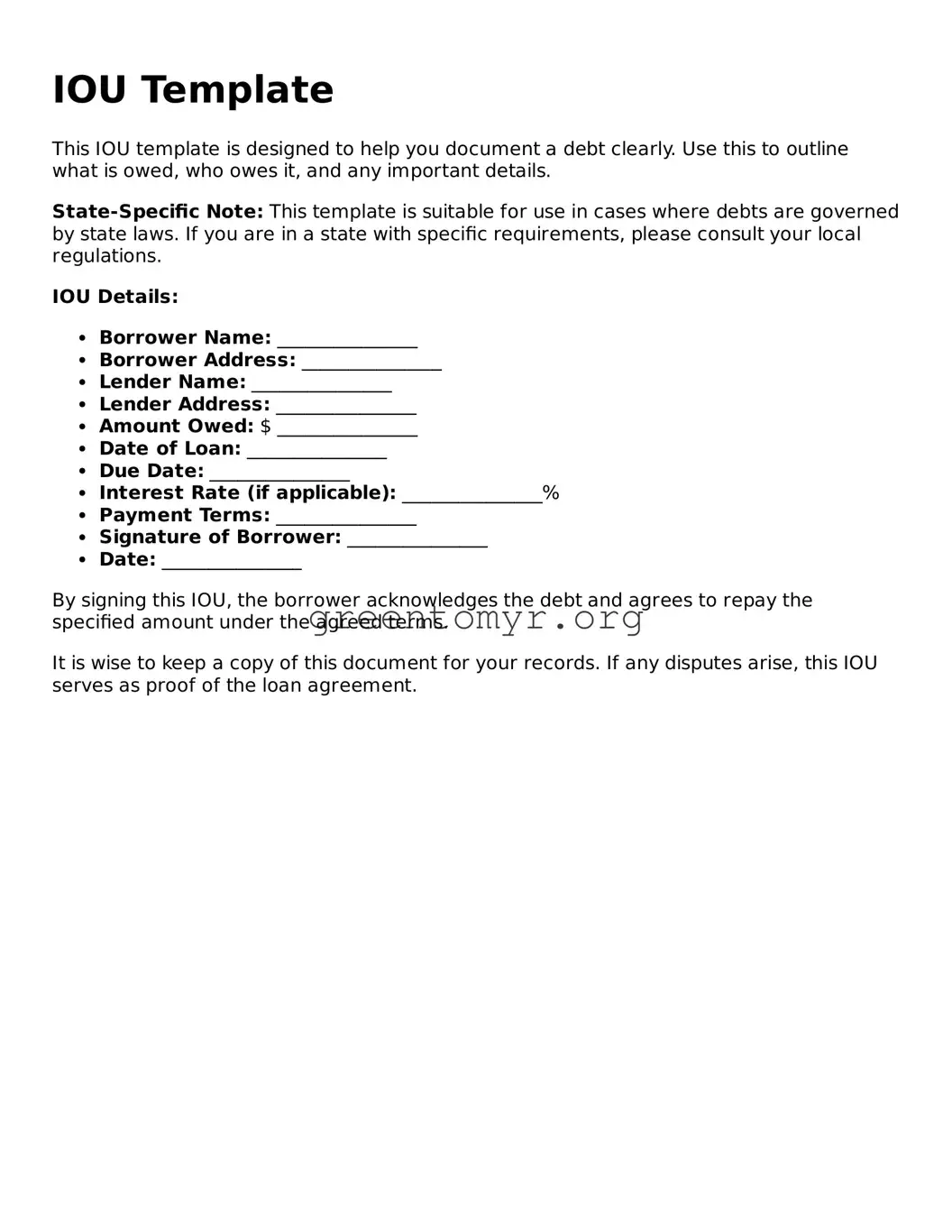

When filling out an IOU form, clarity is essential. One common mistake is being vague about the amount owed. Clearly stating the exact sum can eliminate confusion later on. If you write “a few dollars” instead of specifying “$50,” you create room for miscommunication. Precision is key in financial agreements.

Another frequent error is omitting the date of the loan. Without a specific date, establishing a timeline for repayment becomes difficult. The absence of this detail can lead to disputes over when the money was exchanged, leaving both parties in a bind over expectations.

Many individuals forget to include their full names. Simply signing your initials or using casual nicknames can create complications if the agreement needs to be enforced later. Full legal names ensure that both parties can be properly identified, aiding in any future references to the transaction.

Not adding a clear repayment schedule is yet another pitfall. When you agree on how and when the money will be paid back, you set specific expectations. Without this, one party might assume repayment is expected immediately, while the other thinks they have months to pay back the debt. This lack of communication can lead to unnecessary tension.

In addition, failing to state the purpose of the loan can lead to misunderstandings. Describing the reason for the loan can help clarify the terms under which the money was borrowed and provide context for both parties involved. Commitment to transparency helps avoid potential disputes.

Signing without a witness is also often overlooked. While not legally required in every state, having a third party witness the transaction can provide an additional layer of security. If issues arise later, a witness can help confirm the details of the agreement.

People may also neglect to keep a copy of the IOU for themselves. A written record helps ensure that both parties are on the same page and can refer back to the agreement as needed. Without a copy, one party may forget the terms of the repayment, leading to potential conflicts.

Another frequent oversight is disregard for interest rates or fees. If applicable, including these elements can prevent misunderstandings regarding the amount owed at repayment. This becomes especially important if the loan is expected to carry interest over time; clarity in this area can help maintain trust between parties.

People sometimes rush through the form without reading it thoroughly. This can lead to errors that might seem minor but can greatly affect the validity of the document. Taking your time to review all information carefully can save a lot of trouble down the line.

Finally, failing to clarify what happens in case of default is a mistake many make. Having a clear understanding of the consequences of not paying back the loan can help both parties feel secure in their agreement. It sets expectations and establishes a protocol for addressing payment issues if they arise.