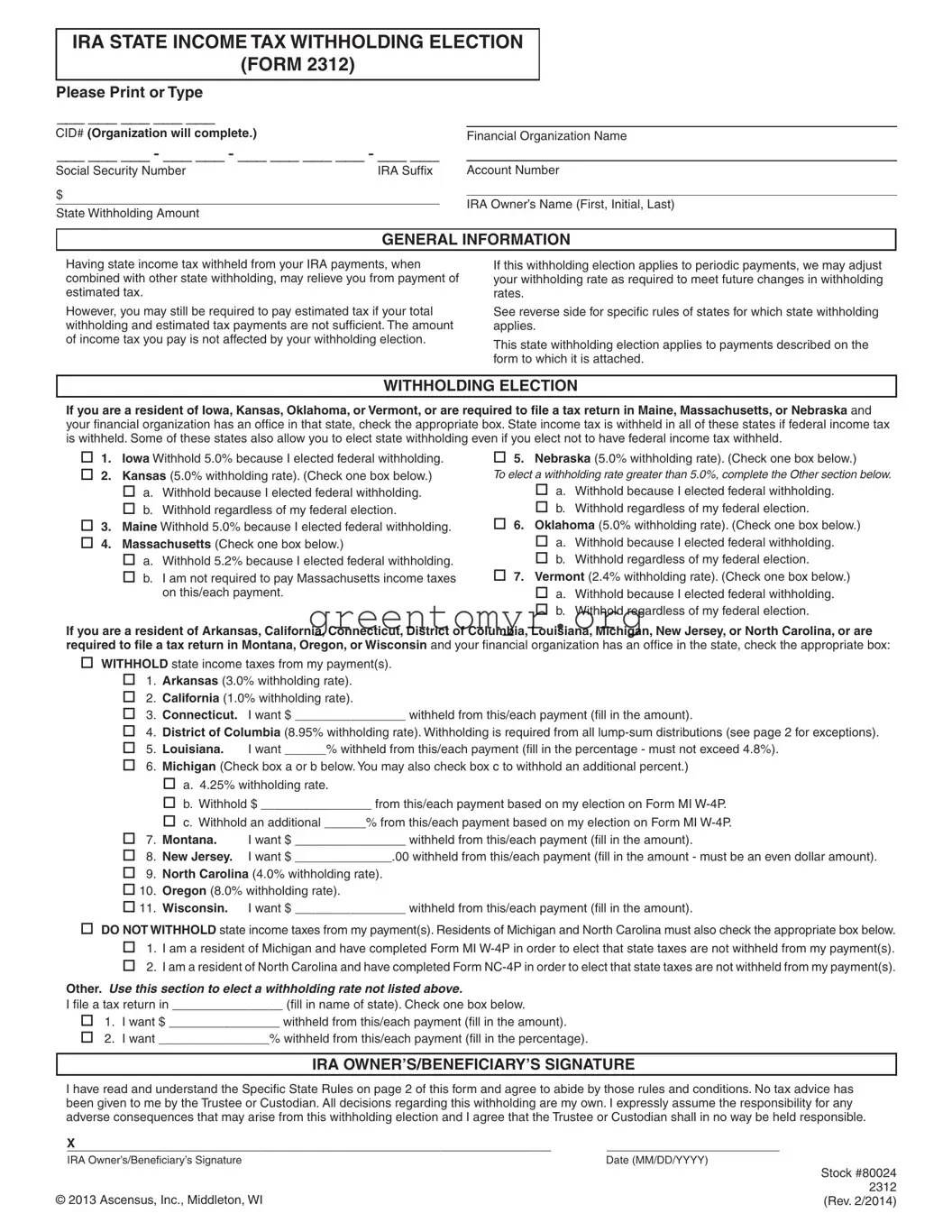

WITHHOLDING ELECTION

If you are a resident of Iowa, Kansas, Oklahoma, or Vermont, or are required to file a tax return in Maine, Massachusetts, or Nebraska and your financial organization has an office in that state, check the appropriate box. State income tax is withheld in all of these states if federal income tax is withheld. Some of these states also allow you to elect state withholding even if you elect not to have federal income tax withheld.

o1. Iowa Withhold 5.0% because I elected federal withholding.

o2. Kansas (5.0% withholding rate). (Check one box below.) o a. Withhold because I elected federal withholding. o b. Withhold regardless of my federal election.

o3. Maine Withhold 5.0% because I elected federal withholding.

o4. Massachusetts (Check one box below.)

oa. Withhold 5.2% because I elected federal withholding.

ob. I am not required to pay Massachusetts income taxes on this/each payment.

o5. Nebraska (5.0% withholding rate). (Check one box below.)

To elect a withholding rate greater than 5.0%, complete the Other section below.

oa. Withhold because I elected federal withholding.

ob. Withhold regardless of my federal election.

o6. Oklahoma (5.0% withholding rate). (Check one box below.) o a. Withhold because I elected federal withholding.

o b. Withhold regardless of my federal election.

o7. Vermont (2.4% withholding rate). (Check one box below.) o a. Withhold because I elected federal withholding. o b. Withhold regardless of my federal election.

If you are a resident of Arkansas, California, Connecticut, District of Columbia, Louisiana, Michigan, New Jersey, or North Carolina, or are required to file a tax return in Montana, Oregon, or Wisconsin and your financial organization has an office in the state, check the appropriate box:

oWITHHOLD state income taxes from my payment(s). o 1. Arkansas (3.0% withholding rate).

o 2. California (1.0% withholding rate).

o 3. Connecticut. I want $ ________________ withheld from this/each payment (fill in the amount).

o 4. District of Columbia (8.95% withholding rate). Withholding is required from all lump-sum distributions (see page 2 for exceptions).

o5. Louisiana. I want ______% withheld from this/each payment (fill in the percentage - must not exceed 4.8%).

o6. Michigan (Check box a or b below. You may also check box c to withhold an additional percent.)

oa. 4.25% withholding rate.

ob. Withhold $ ________________ from this/each payment based on my election on Form MI W-4P.

oc. Withhold an additional ______% from this/each payment based on my election on Form MI W-4P.

o7. Montana. I want $ ________________ withheld from this/each payment (fill in the amount).

o 8. New Jersey. I want $ |

.00 withheld from this/each payment (fill in the amount - must be an even dollar amount). |

o9. North Carolina (4.0% withholding rate).

o10. Oregon (8.0% withholding rate).

o11. Wisconsin. I want $ ________________ withheld from this/each payment (fill in the amount).

oDO NOT WITHHOLD state income taxes from my payment(s). Residents of Michigan and North Carolina must also check the appropriate box below. o 1. I am a resident of Michigan and have completed Form MI W-4P in order to elect that state taxes are not withheld from my payment(s). o 2. I am a resident of North Carolina and have completed Form NC-4P in order to elect that state taxes are not withheld from my payment(s).

Other. Use this section to elect a withholding rate not listed above.

I file a tax return in ________________ (fill in name of state). Check one box below.

o1. I want $ ________________ withheld from this/each payment (fill in the amount).

o2. I want ________________% withheld from this/each payment (fill in the percentage).

IRA OWNER’S/BENEFICIARY’S SIGNATURE

I have read and understand the Specific State Rules on page 2 of this form and agree to abide by those rules and conditions. No tax advice has been given to me by the Trustee or Custodian. All decisions regarding this withholding are my own. I expressly assume the responsibility for any adverse consequences that may arise from this withholding election and I agree that the Trustee or Custodian shall in no way be held responsible.

X |

_________________________ |

IRA Owner’s/Beneficiary’s Signature |

Date (MM/DD/YYYY) |