What is an Irrevocable Documentary Credit?

An Irrevocable Documentary Credit is a financial instrument used in international trade to guarantee payment to the beneficiary, typically the seller, once specific conditions are met. This means that once it is issued, it cannot be altered or canceled without the agreement of all parties involved. It assures the seller of payment while providing the buyer with secure terms for shipment and delivery of goods.

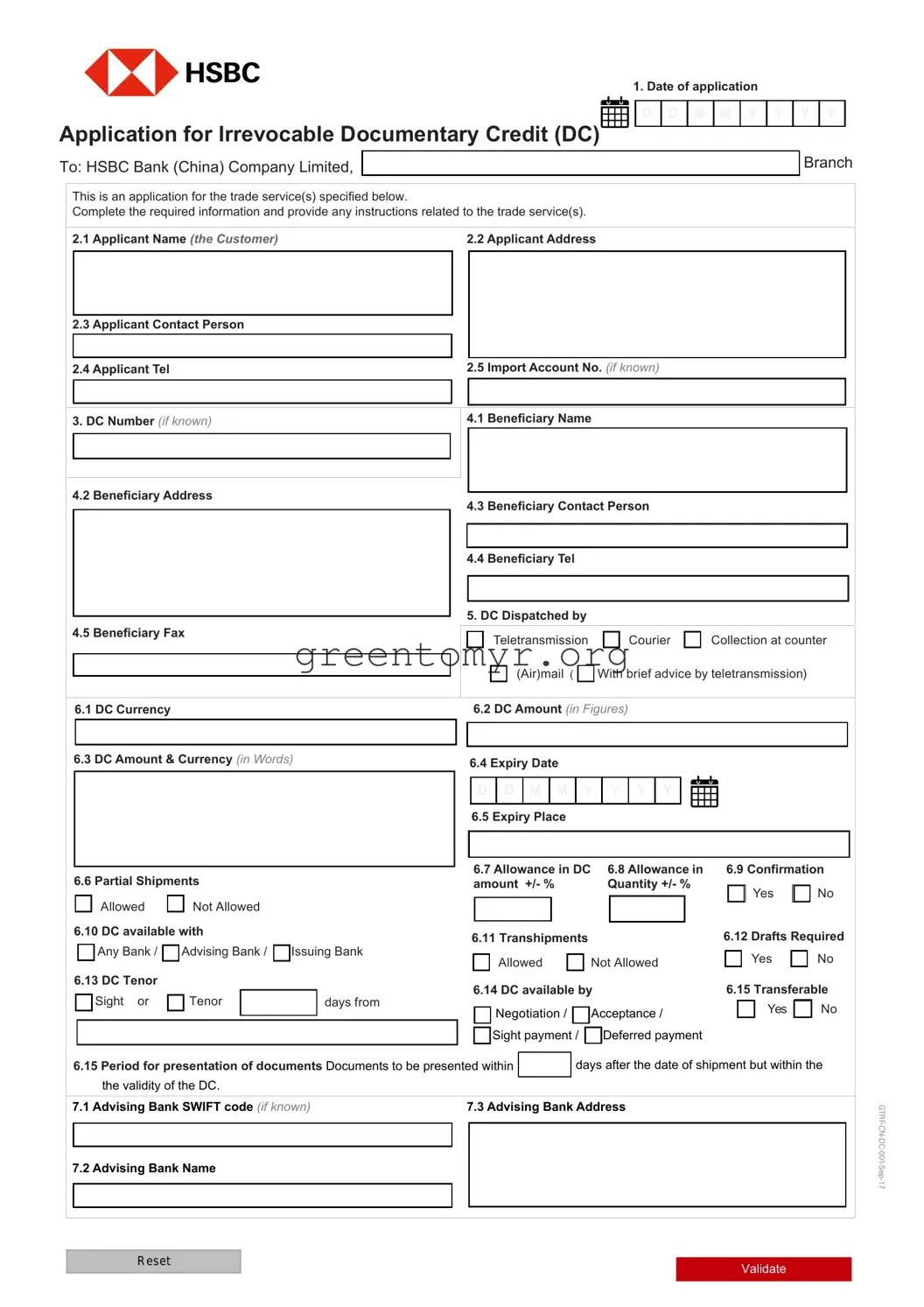

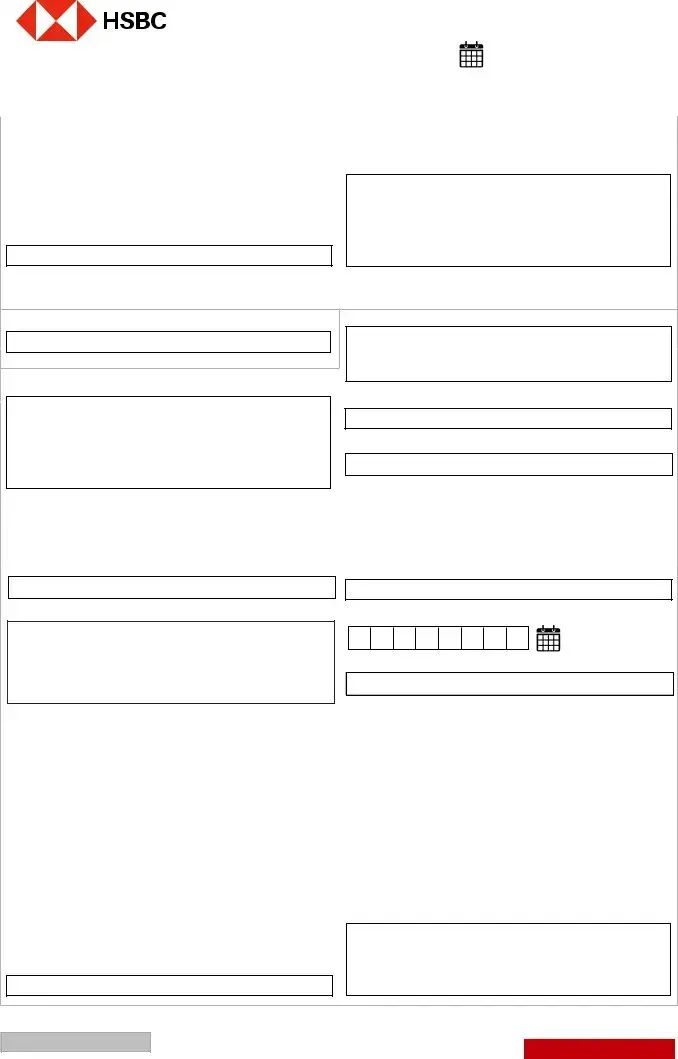

To fill out the application form, follow these steps:

-

Begin with the date of application.

-

Provide your details as the applicant, including your name, address, contact person, and contact number.

-

Identify the beneficiary's details: their name, address, and contact information.

-

Specify the details of the documentary credit, including the amount, currency, expiry date, and whether partial shipments are allowed.

-

Outline the shipping conditions, such as the description of goods, shipment dates, and transportation methods.

-

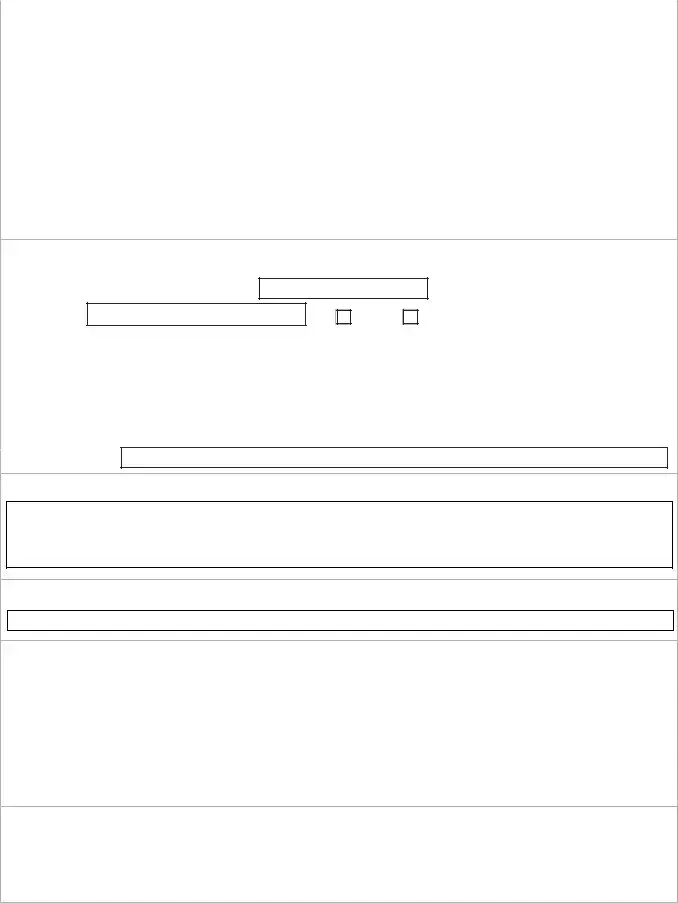

List any required documents to accompany the shipping, like the commercial invoice and packing list.

What documents are typically required for an Irrevocable Documentary Credit?

The documentation needed varies based on terms but generally includes:

-

Signed commercial invoice (originals and copies)

-

Packing List (originals and copies)

-

Original clean “On Board” bills of lading or Air Waybill

-

Cargo Receipt signed by an authorized person from the applicant

-

Marine/ Air Insurance Policy

-

Beneficiary’s certificate of document dispatch

What is the significance of the expiry date on the documentary credit?

The expiry date is essential as it defines the time frame in which the beneficiary must present the necessary documentation to the bank for payment. If the documents are not presented by the expiry date, the credit becomes invalid. Therefore, both parties must be aware of this date to ensure compliance and timely payment.

Can I request partial shipments under an Irrevocable Documentary Credit?

Yes, partial shipments can be allowed or disallowed based on the terms set in the documentary credit. It is important to indicate your preference clearly in the application form. Allowing partial shipments can provide flexibility in delivery but may complicate documentation and accounting for payments.

What is the role of the Advising Bank?

The Advising Bank acts as an intermediary that communicates the terms of the Irrevocable Documentary Credit to the beneficiary. This bank verifies the authenticity of the credit and adds its confirmation, which also assures the beneficiary regarding payment reliability. Its involvement adds an additional layer of security for both parties.

What happens if there are discrepancies in the shipping documents?

Any discrepancies between the shipping documents and the terms outlined in the Irrevocable Documentary Credit may lead to non-payment or payment delays. Banks are obligated to follow the strict terms of the credit, so it's crucial to ensure all documents are accurate and match the requirements specified in the credit.

How does insurance work within the context of the Irrevocable Documentary Credit?

Insurance can be arranged by the seller or the bank. If the bank is to arrange it, indicate this clearly in the application, as costs will be charged to your account. Insurance policies must cover the goods for the correct value and risks during transport. It’s advisable to review the insurance arrangements to ensure they meet the documentary credit requirements.