Note: The form, instructions, or publication you are looking

for begins after this coversheet.

Please review the updated information below.

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040, 1040-SR, and 1040-NR for Tax Year 2018 and Tax Year 2019

Under Proposed Regulations 113295-18, an excess deduction on termination of an estate or trust allowed in arriving at adjusted gross income (Internal Revenue Code (IRC) section 67(e) expenses) is reported as an adjustment to income on Forms 1040, 1040-SR, and 1040-NR; non-miscellaneous itemized deductions are reported, as applicable, on Schedule A (Form 1040 or 1040-SR) or Schedule A (Form 1040-NR); and miscellaneous itemized deductions are not deductible. Taxpayers may rely on the proposed regulations for tax years of beneficiaries beginning after 2017 and before the final regulations are published.

For tax year 2019, an excess deduction for IRC section 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040 or 1040-SR), Part II, line 22, or Form 1040-NR, line 34. On the dotted line next to line 22 or line 34 (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ED67(e)”. Include the amount of the adjustment in the total amount reported on line 22 or line 34.

For tax year 2018, an excess deduction for IRC section 67(e) expenses is reported as a write-in on Schedule 1 (Form 1040), line 36, or Form 1040-NR, line 34. On the dotted line next to line 36 or line 34, (depending on which form is filed), enter the amount of the adjustment and identify it using the code “ED67(e)”. Include the amount of the adjustment in the total amount reported on line 36 or line 34.

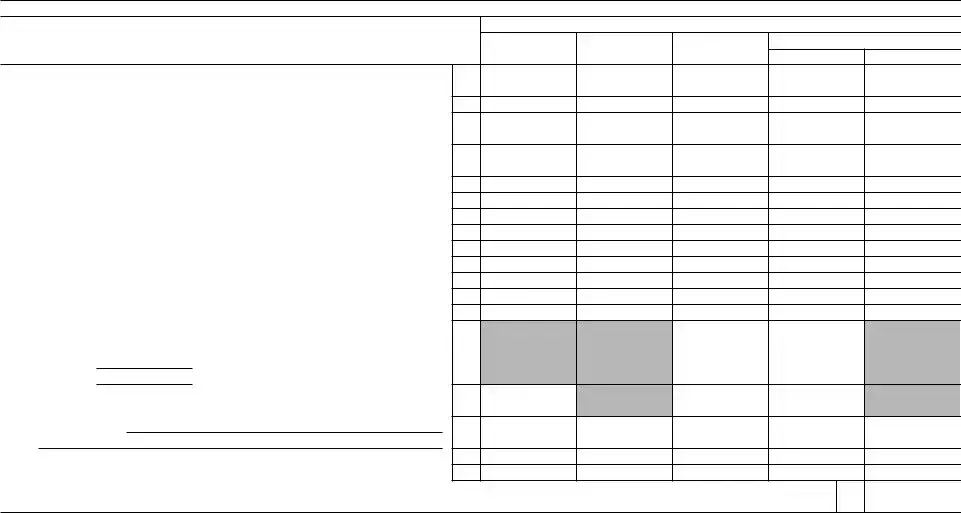

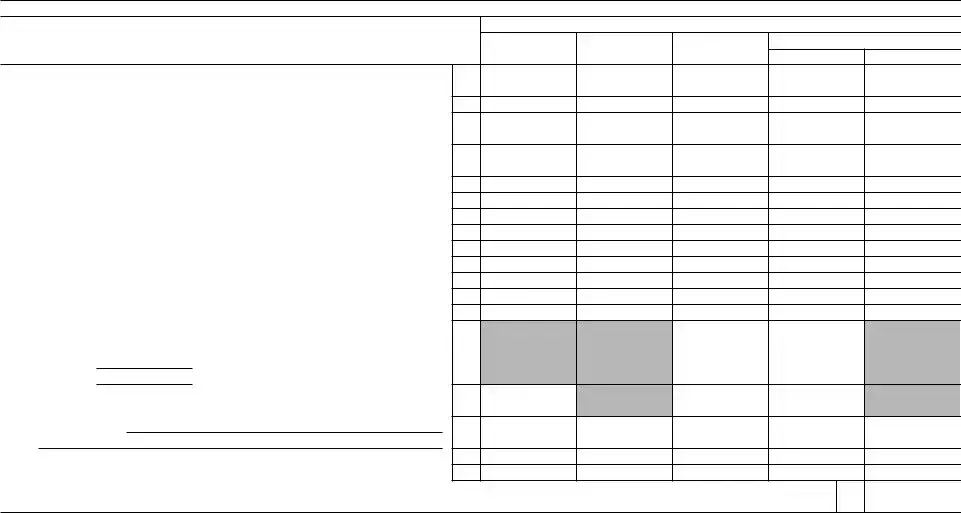

Form 1040-NR (2019) |

Page 4 |

Schedule NEC—Tax on Income Not Effectively Connected With a U.S. Trade or Business (see instructions)

Enter amount of income under the appropriate rate of tax (see instructions)

Nature of income |

(d) Other (specify) |

|

|

|

(a) 10% |

(b) 15% |

(c) 30% |

% |

% |

|

|

|

|

|

|

1 |

Dividends and dividend equivalents: |

|

|

|

|

|

a |

Dividends paid by U.S. corporations |

1a |

|

|

|

|

b |

Dividends paid by foreign corporations |

1b |

|

|

|

|

c |

Dividend equivalent payments received with respect to section 871(m) |

|

|

|

|

|

|

transactions |

1c |

|

|

|

|

2 |

Interest: |

|

|

|

|

|

|

a |

Mortgage |

2a |

|

|

|

|

b |

Paid by foreign corporations |

2b |

|

|

|

|

c |

Other |

2c |

|

|

|

|

3 |

Industrial royalties (patents, trademarks, etc.) |

3 |

|

|

|

|

4 |

Motion picture or T.V. copyright royalties |

4 |

|

|

|

|

5 |

Other royalties (copyrights, recording, publishing, etc.) |

5 |

|

|

|

|

6 |

Real property income and natural resources royalties |

6 |

|

|

|

|

7 |

Pensions and annuities |

7 |

|

|

|

|

8 |

Social security benefits |

8 |

|

|

|

|

9 |

Capital gain from line 18 below |

9 |

|

|

|

|

10 |

Gambling—Residents of Canada only. Enter net income in column (c). |

|

|

|

|

|

|

If zero or less, enter -0-. |

|

|

|

|

|

|

a |

Winnings |

|

|

|

|

|

|

b |

Losses |

. . . . . . . . . . . . . . . |

10c |

|

|

|

|

11 |

Gambling winnings—Residents of countries other than Canada. |

|

|

|

|

|

|

Note: Losses not allowed |

11 |

|

|

|

|

12 |

Other (specify) |

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

13 |

Add lines 1a through 12 in columns (a) through (d) |

13 |

|

|

|

|

14 |

Multiply line 13 by rate of tax at top of each column |

14 |

|

|

|

|

15 |

Tax on income not effectively connected with a U.S. trade or business. Add columns (a) through (d) of line 14. Enter the total here and on Form |

|

|

|

1040-NR, line 54 |

. . . . . . . . . . . . . |

. . . . . . . . . . |

15 |

|

Capital Gains and Losses From Sales or Exchanges of Property

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enter only the capital gains and |

16 |

(a) Kind of property and description |

|

|

|

|

|

|

|

|

(f) LOSS |

|

(g) GAIN |

losses |

from |

property sales |

or |

|

(b) Date acquired |

(c) Date sold |

|

(d) Sales price |

(e) Cost or |

|

|

|

(if necessary, attach statement of |

|

|

|

If (e) is more than (d), |

If (d) is more than (e), |

exchanges |

that |

are |

from |

|

|

(mo., day, yr.) |

(mo., day, yr.) |

|

other basis |

|

|

descriptive details not shown below) |

|

|

|

|

subtract (d) from (e) |

subtract (e) from (d) |

sources |

within |

the |

United |

|

|

|

|

|

|

|

|

|

States |

and |

not |

effectively |

|

|

|

|

|

|

|

|

|

|

|

|

|

connected with a U.S. business. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Do not include a gain or loss on |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

disposing |

of |

a |

U.S. |

real |

|

|

|

|

|

|

|

|

|

|

|

|

|

property |

interest; |

report |

these |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

gains and losses on Schedule D |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Form 1040 or 1040-SR). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report |

|

property |

sales |

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

exchanges that |

are effectively |

|

|

|

|

|

|

|

|

|

|

|

|

|

connected with a U.S. business |

17 |

Add columns (f) and (g) of line 16 |

. . . . . . . . . . . . |

. . . . . . . |

. . . . |

|

17 |

( |

) |

|

on Schedule D (Form 1040 or |

|

|

|

|

|

|

|

|

|

|

|

|

|

1040-SR), Form 4797, or both. |

|

18 |

Capital gain. Combine columns (f) and (g) of line 17. Enter the net gain here and on line 9 above (if a loss, enter -0-) . |

18 |

|

Page 5

No

No

No

No

Form 1040-NR (2019)

Schedule OI—Other Information (see instructions)

Answer all questions

AOf what country or countries were you a citizen or national during the tax year?

B In what country did you claim residence for tax purposes during the tax year?

C Have you ever applied to be a green card holder (lawful permanent resident) of the United States? . . . . .

D Were you ever:

1. |

A U.S. citizen? |

2. |

A green card holder (lawful permanent resident) of the United States? |

|

If you answer “Yes” to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that apply to you. |

EIf you had a visa on the last day of the tax year, enter your visa type. If you did not have a visa, enter your U.S. immigration status on the last day of the tax year.

F |

Have you ever changed your visa type (nonimmigrant status) or U.S. immigration status? |

|

If you answered “Yes,” indicate the date and nature of the change. |

GList all dates you entered and left the United States during 2019. See instructions.

Note: If you are a resident of Canada or Mexico AND commute to work in the United States at frequent intervals,

check the box for Canada or Mexico and skip to item H |

Canada |

Mexico |

Date entered United States |

Date departed United States |

mm/dd/yy |

mm/dd/yy |

|

|

|

|

|

|

|

|

|

|

Date entered United States |

Date departed United States |

mm/dd/yy |

mm/dd/yy |

|

|

|

|

|

|

|

|

|

|

HGive number of days (including vacation, nonworkdays, and partial days) you were present in the United States during:

|

2017 |

, 2018 |

, and 2019 |

. |

|

|

I |

Did you file a U.S. income tax return for any prior year? |

. . . . . . . |

Yes |

No |

|

If “Yes,” give the latest year and form number you filed . . . |

|

|

|

|

J |

Are you filing a return for a trust? |

. . . . . . . |

Yes |

No |

|

If “Yes,” did the trust have a U.S. or foreign owner under the grantor trust rules, make a distribution or loan to a |

|

|

|

U.S. person, or receive a contribution from a U.S. person? |

. . . . . . . |

Yes |

No |

K |

Did you receive total compensation of $250,000 or more during the tax year? |

. . . . . . . |

Yes |

No |

|

If “Yes,” did you use an alternative method to determine the source of this compensation? |

. . . . . . . |

Yes |

No |

LIncome Exempt from Tax—If you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country, complete (1) through (3) below. See Pub. 901 for more information on tax treaties.

1.Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required. See instructions.

|

(a) Country |

(b) Tax treaty article |

(c) Number of months |

(d) Amount of exempt |

|

claimed in prior tax years |

income in current tax year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e) Total. Enter this amount on Form 1040-NR, line 22. Do not enter it on line 8 or line 12 . . |

|

|

|

2. |

Were you subject to tax in a foreign country on any of the income shown in 1(d) above? |

Yes |

No |

3. |

Are you claiming treaty benefits pursuant to a Competent Authority determination? |

Yes |

No |

|

If “Yes,” attach a copy of the Competent Authority determination letter to your return. |

|

|

MCheck the applicable box if:

1.This is the first year you are making an election to treat income from real property located in the United States as effectively connected

with a U.S. trade or business under section 871(d). See instructions . . . . . . . . . . . . . . . . . .

2.You have made an election in a previous year that has not been revoked, to treat income from real property located in the United

States as effectively connected with a U.S. trade or business under section 871(d). See instructions . . . . . . . .

Form 1040-NR (2019)