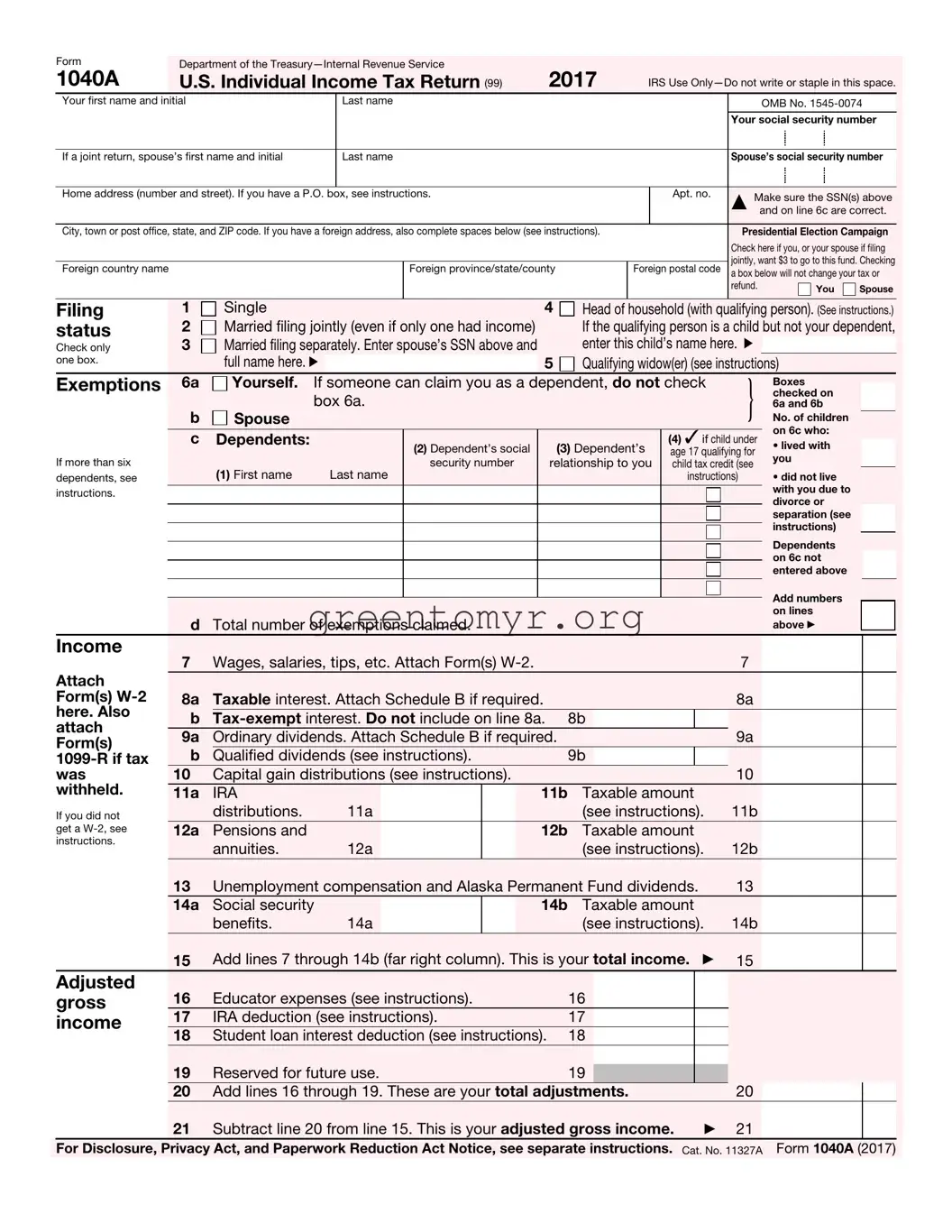

When filling out the IRS 1040A form, individuals often make simple yet significant mistakes that can lead to delays or complications. One common error is incorrectly entering Social Security numbers (SSNs). This includes typos in one’s own SSN or that of a spouse or dependent. It’s imperative to double-check these numbers since inaccuracies may trigger a rejection of the return, leading to unnecessary hassle.

Another frequent mistake involves selecting the wrong filing status. Taxpayers might overlook the implications of each status—such as opting for “Married Filing Separately” instead of “Married Filing Jointly.” Understanding the differences can impact the deductions and credits available. Ensuring the correct status not only streamlines processing but also maximizes potential refunds or reduces taxes owed.

Many individuals also neglect to claim all eligible exemptions. For instance, if a taxpayer qualifies to claim dependents, failing to do so could result in higher taxable income. Accurately completing the exemptions section helps lower the tax burden. This section should be reviewed carefully, especially to confirm if someone else can claim you as a dependent, which affects your ability to claim exemptions for yourself.

People frequently skip over the income section, particularly when it comes to attaching all necessary forms, such as W-2s and 1099s. Omitting this crucial information can lead to inaccurate income reporting. It’s essential to list all sources of income, as the IRS cross-references this with reported income from employers and financial institutions.

Incorrect calculation of adjustments to income is another prevalent mistake. Many filers fail to account for deductions such as educator expenses or student loan interest. When taxpayers overlook these opportunities, they end up with a higher adjusted gross income than necessary, affecting their overall tax liability. Each line should be filled out with care, as even small errors can snowball into larger issues.

Additionally, misunderstanding the standard deduction can cause problems. Some filers may mistakenly enter amounts or confuse the standard deduction with itemized deductions. It’s crucial to know which deduction applies to your situation. For many individuals, a standard deduction simplifies the filing process and minimizes the risk of errors.

Lastly, a significant number of taxpayers forget to sign their return. Without a signature, the IRS cannot process the return, leading to delays or unintentional penalties. Ensure to verify whether both taxpayers have signed if filing jointly, as this compliance is non-negotiable for successful submission.