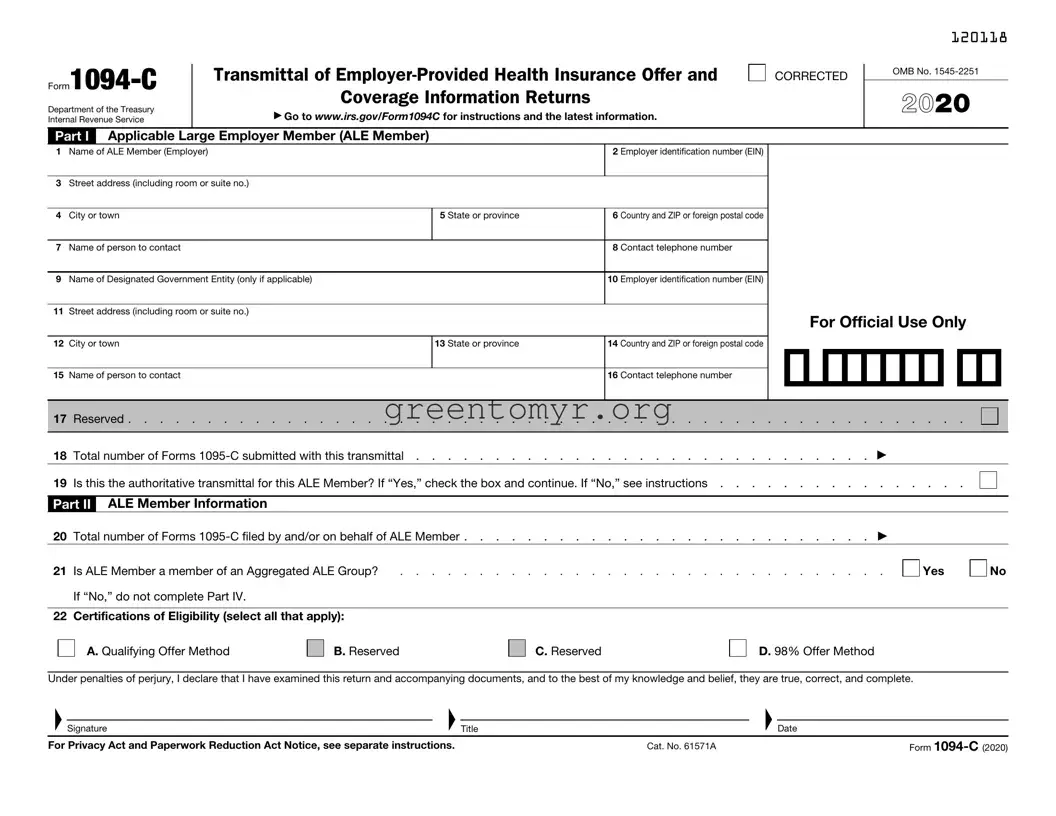

The IRS 1094-C form serves as a transmittal document for employers to report information about their offers of health coverage to employees. This form is particularly important for applicable large employers (ALEs), those with 50 or more full-time employees, as part of the Affordable Care Act (ACA) requirements.

Applicable large employers, defined as those with 50 or more full-time employees or full-time equivalent employees, are required to file the 1094-C form. This also includes any entity that is part of a controlled group of corporations or affiliated service groups, which share membership for health coverage purposes.

The deadline for filing the 1094-C form is generally the last day of February of the year following the calendar year to which the form pertains. If filing electronically, this deadline extends to March 31. It's crucial to check the IRS website for any specific updates on deadlines.

The 1094-C form requests various pieces of information, including:

-

The employer's name, address, and Employer Identification Number (EIN).

-

Information regarding the number of full-time employees.

-

Any health coverage offered to full-time employees.

-

Details about the months during which coverage was offered.

This data helps the IRS assess compliance with ACA regulations concerning health coverage.

The form can be filed either on paper or electronically. If filing on paper, a completed 1094-C must be mailed to the IRS. When filing electronically, employers can use the IRS’s e-file system or third-party software that supports ACA reporting.

Failing to file the 1094-C form can lead to penalties from the IRS. These penalties may vary based on the number of days late and the size of the employer. It's essential to file on time to avoid these financial consequences.

Yes, if you discover an error after filing, you can submit a corrected form. Be sure to follow the IRS instructions for corrections, which may require marking the corrected form appropriately to indicate changes.

Employers must provide a copy of the 1095-C form, which is related to the 1094-C, to each full-time employee. This can be done electronically or by mailing paper copies, but employees must consent to receive electronic forms.

For further assistance, visit the IRS website, where detailed instructions and resources are available. You may also consult a tax professional or legal expert for specific questions related to your situation.