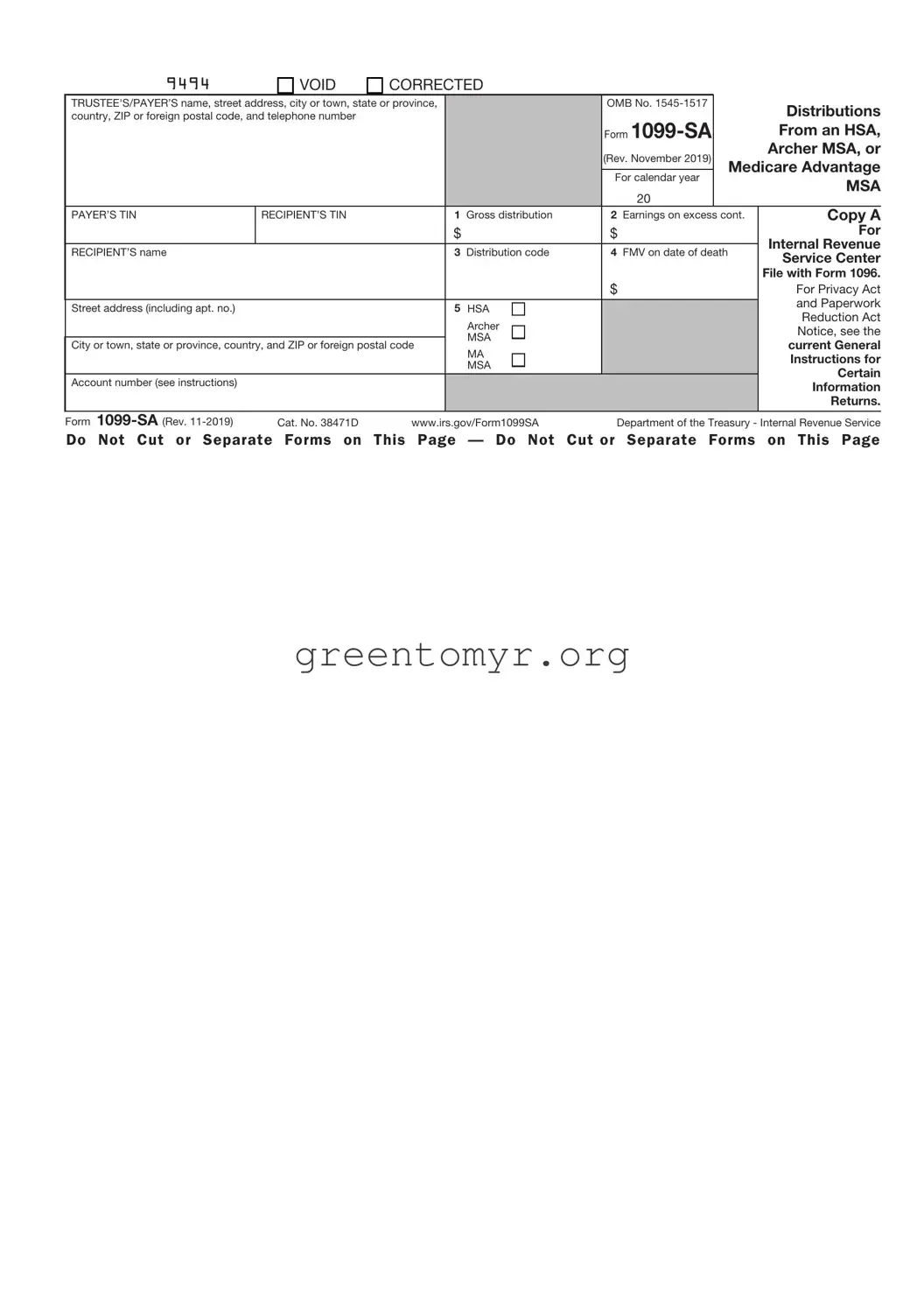

The IRS 1099-SA form is used to report distributions from Health Savings Accounts (HSAs), Archer Medical Savings Accounts (MSAs), and Medicare Advantage MSAs. This form provides information that helps taxpayers understand the amounts distributed from these accounts during a tax year.

Individuals who receive distributions from their HSA, Archer MSA, or Medicare Advantage MSA will receive a 1099-SA form. Financial institutions or administrators of these accounts are responsible for issuing the form to account holders, typically by January 31 of the following year.

The 1099-SA form contains several important pieces of information:

-

Box 1: Total distributions made during the year.

-

Box 2: Indicates the type of account from which the distribution was made.

-

Box 3: Identifies the purpose of the distribution, such as a qualified medical expense or other reasons.

-

Box 4: Reports any earnings on the original contribution, if applicable.

How do I report my 1099-SA distributions on my tax return?

When filing your tax return, the amount from Box 1 of the 1099-SA should be reported on IRS Form 8889 if it's an HSA. For Archer MSAs and Medicare Advantage MSAs, if you have distributions to report, you will need to use the appropriate forms specific to those accounts. Be sure to keep the form for your records even if the distributions were used for qualified medical expenses.

If you had distributions from an HSA or similar account but did not receive a 1099-SA, you should first contact your account administrator or financial institution. They may have not yet issued the form or it might have been sent to the wrong address. Regardless, you are still responsible for accurately reporting the distributions on your tax return, even without the form.

Yes, many financial institutions offer the option to receive electronic versions of tax documents, including the 1099-SA. Check with your account provider to see if they offer this option and how to sign up for electronic delivery.

If you notice any errors on your 1099-SA, such as incorrect amounts or personal information, contact the issuer of the form immediately. They can issue a corrected form, known as a 1099-SA corrected form, to ensure that the information reported to the IRS is accurate.

How does a distribution from an HSA affect my taxes?

Distributions from an HSA are generally tax-free if they are used for qualified medical expenses. If the funds are used for non-qualified expenses, those distributions may be subject to income tax and a possible penalty, typically 20%. It's important to keep records of how distributions are used to avoid tax complications.