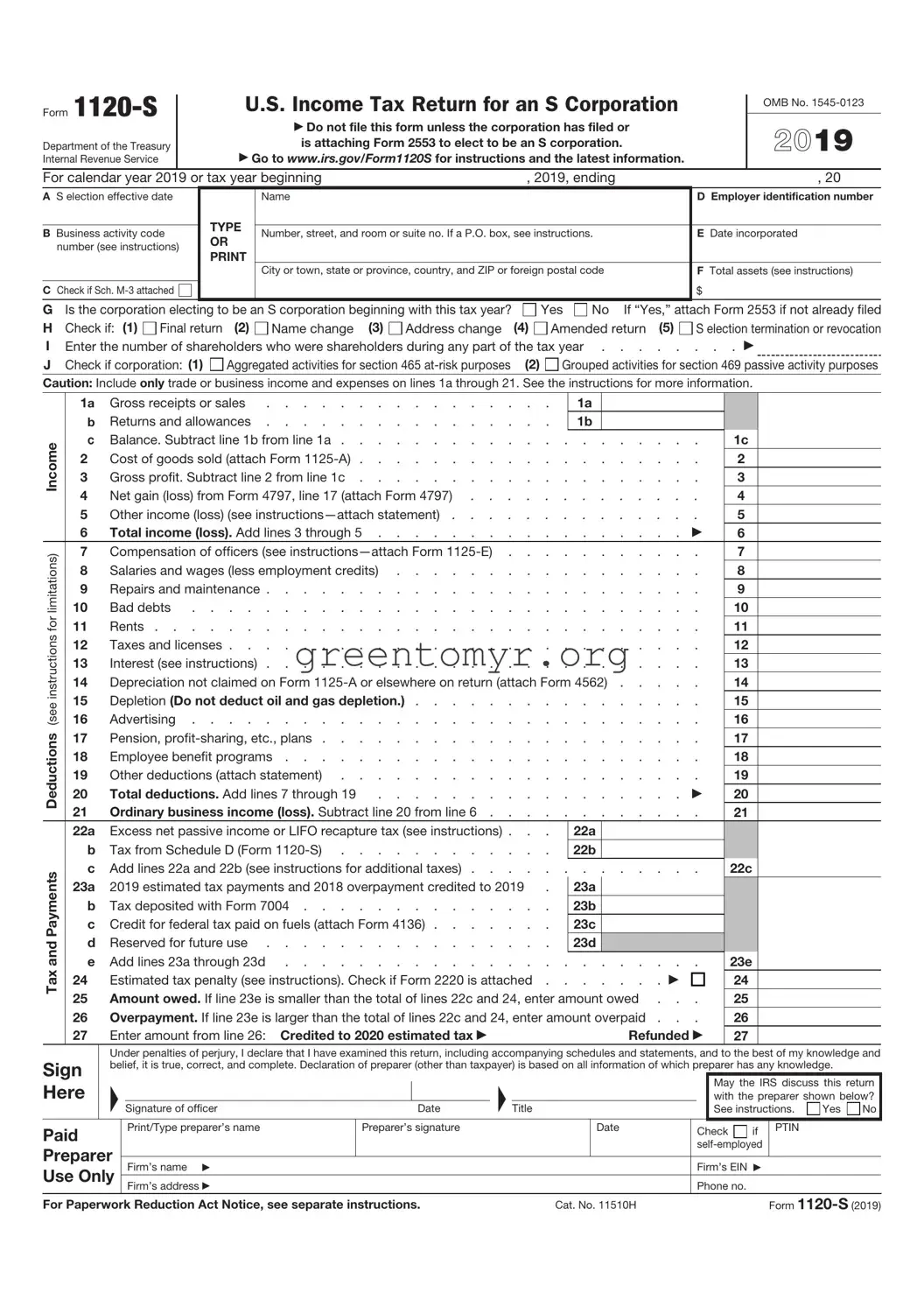

|

|

|

|

|

|

Form 1120-S (2019) |

|

|

|

Page 2 |

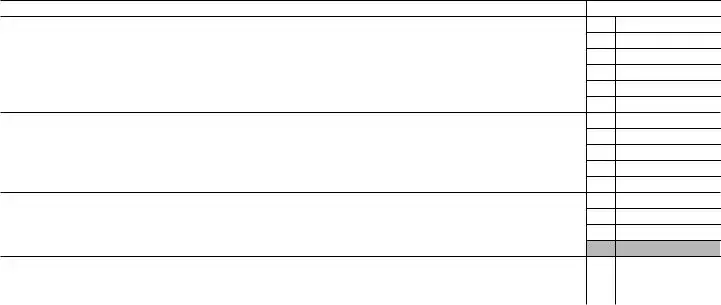

Schedule B |

Other Information (see instructions) |

|

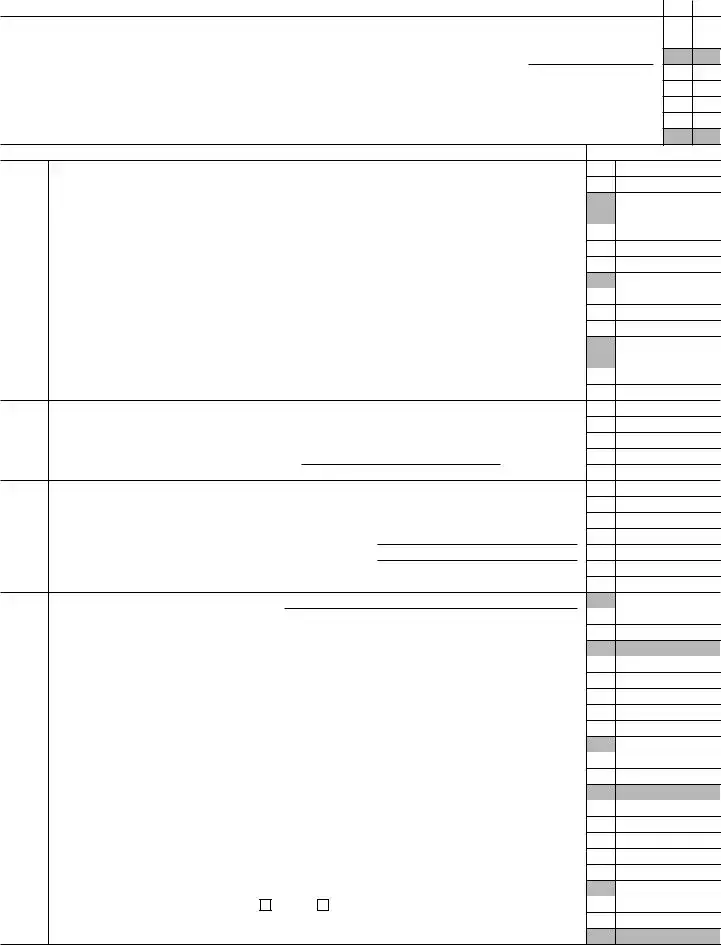

1 Check accounting method: a |

Cash |

b |

Accrual |

Yes No |

c

Other (specify)

Other (specify)

2 See the instructions and enter the:

a Business activity |

b Product or service |

3At any time during the tax year, was any shareholder of the corporation a disregarded entity, a trust, an estate, or a nominee or similar person? If “Yes,” attach Schedule B-1, Information on Certain Shareholders of an S Corporation . .

4At the end of the tax year, did the corporation:

aOwn directly 20% or more, or own, directly or indirectly, 50% or more of the total stock issued and outstanding of any foreign or domestic corporation? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v)

below . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(i) Name of Corporation |

(ii) Employer |

(iii) Country of |

(iv) Percentage of |

(v) If Percentage in (iv) Is 100%, Enter |

|

Identification |

Incorporation |

Stock Owned |

the Date (if any) a Qualified Subchapter |

|

Number (if any) |

|

|

S Subsidiary Election Was Made |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

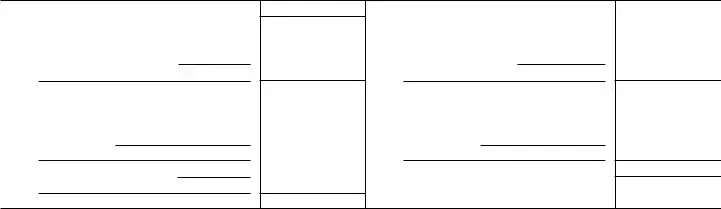

bOwn directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital in any foreign or domestic partnership (including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions. If “Yes,” complete (i) through (v) below . . . . . . .

(i) Name of Entity |

(ii) Employer |

(iii) Type of Entity |

(iv) Country of |

(v) Maximum Percentage Owned |

|

Identification |

|

Organization |

in Profit, Loss, or Capital |

|

Number (if any) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5a At the end of the tax year, did the corporation have any outstanding shares of restricted stock? . . . . . . . .

If “Yes,” complete lines (i) and (ii) below.

(i) |

Total shares of restricted stock |

(ii) |

Total shares of non-restricted stock |

bAt the end of the tax year, did the corporation have any outstanding stock options, warrants, or similar instruments? . If “Yes,” complete lines (i) and (ii) below.

(i) |

Total shares of stock outstanding at the end of the tax year |

. |

(ii)Total shares of stock outstanding if all instruments were executed

6Has this corporation filed, or is it required to file, Form 8918, Material Advisor Disclosure Statement, to provide

|

information on any reportable transaction? |

. . . . . . . . . . . . . . . . . . . . . . . . |

7 |

Check this box if the corporation issued publicly offered debt instruments with original issue discount . . . . |

|

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount |

|

Instruments. |

|

8If the corporation (a) was a C corporation before it elected to be an S corporation or the corporation acquired an asset with a basis determined by reference to the basis of the asset (or the basis of any other property) in the hands of a C corporation and

(b) has net unrealized built-in gain in excess of the net recognized built-in gain from prior years, enter the net unrealized built-in

gain reduced by net recognized built-in gain from prior years. See instructions |

$ |

9Did the corporation have an election under section 163(j) for any real property trade or business or any farming business

|

in effect during the tax year? See instructions |

10 |

Does the corporation satisfy one or more of the following? See instructions |

aThe corporation owns a pass-through entity with current, or prior year carryover, excess business interest expense.

bThe corporation’s aggregate average annual gross receipts (determined under section 448(c)) for the 3 tax years preceding the current tax year are more than $26 million and the corporation has business interest expense.

cThe corporation is a tax shelter and the corporation has business interest expense. If “Yes,” complete and attach Form 8990.

11 Does the corporation satisfy both of the following conditions? . . . . . . . . . . . . . . . . . .

aThe corporation’s total receipts (see instructions) for the tax year were less than $250,000. b The corporation’s total assets at the end of the tax year were less than $250,000.

If “Yes,” the corporation is not required to complete Schedules L and M-1.

Other (specify)

Other (specify)