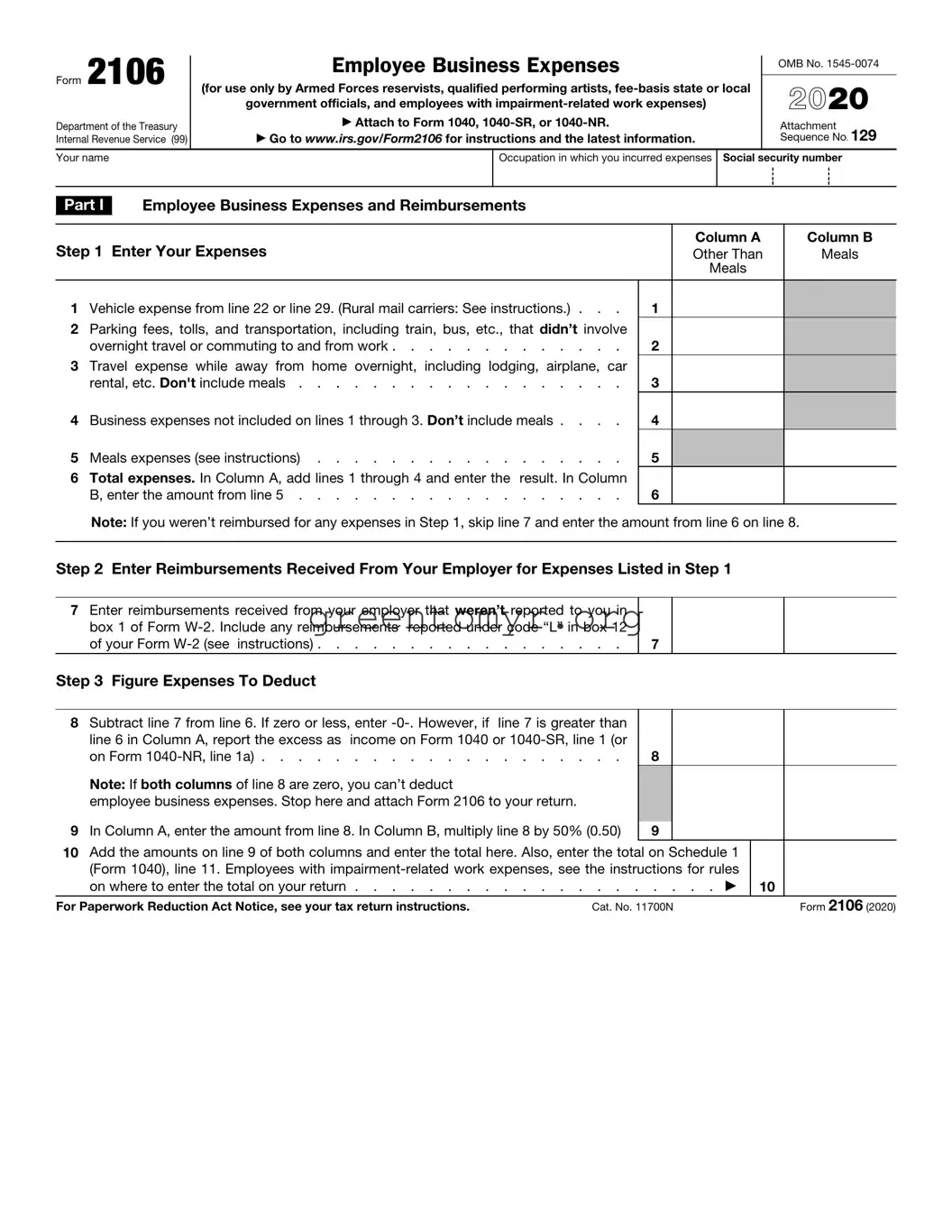

Form 2106 |

|

Employee Business Expenses |

|

|

|

OMB No. 1545-0074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(for use only by Armed Forces reservists, qualified performing artists, fee-basis state or local |

|

2020 |

|

|

|

|

government officials, and employees with impairment-related work expenses) |

|

Department of the Treasury |

|

▶ Attach to Form 1040, 1040-SR, or 1040-NR. |

|

|

|

Attachment |

Internal Revenue Service (99) |

|

▶ Go to www.irs.gov/Form2106 for instructions and the latest information. |

|

Sequence No. 129 |

Your name |

|

|

|

|

Occupation in which you incurred expenses |

Social security number |

|

|

|

|

|

|

|

|

|

|

|

Employee Business Expenses and Reimbursements |

|

|

|

|

|

Part I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Step 1 Enter Your Expenses |

Column A |

|

Column B |

Other Than |

|

Meals |

|

|

|

|

|

|

Meals |

|

|

|

|

|

|

|

|

1 Vehicle expense from line 22 or line 29. (Rural mail carriers: See instructions.) . . . |

1 |

|

|

|

|

2Parking fees, tolls, and transportation, including train, bus, etc., that didn’t involve

overnight travel or commuting to and from work |

2 |

3Travel expense while away from home overnight, including lodging, airplane, car

|

rental, etc. Don't include meals |

3 |

|

|

4 |

Business expenses not included on lines 1 through 3. Don’t include meals . . . . |

4 |

|

|

5 |

Meals expenses (see instructions) |

5 |

|

|

6Total expenses. In Column A, add lines 1 through 4 and enter the result. In Column

B, enter the amount from line 5 |

6 |

Note: If you weren’t reimbursed for any expenses in Step 1, skip line 7 and enter the amount from line 6 on line 8.

Step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

7Enter reimbursements received from your employer that weren’t reported to you in box 1 of Form W-2. Include any reimbursements reported under code “L” in box 12 of your Form W-2 (see instructions) . . . . . . . . . . . . . . . . .

Step 3 Figure Expenses To Deduct

8 |

Subtract line 7 from line 6. If zero or less, enter -0-. However, if line 7 is greater than |

|

|

|

line 6 in Column A, report the excess as income on Form 1040 or 1040-SR, line 1 (or |

|

|

|

on Form 1040-NR, line 1a) |

8 |

|

|

Note: If both columns of line 8 are zero, you can’t deduct |

|

|

|

employee business expenses. Stop here and attach Form 2106 to your return. |

|

|

|

|

|

|

9 |

In Column A, enter the amount from line 8. In Column B, multiply line 8 by 50% (0.50) |

9 |

|

10Add the amounts on line 9 of both columns and enter the total here. Also, enter the total on Schedule 1 (Form 1040), line 11. Employees with impairment-related work expenses, see the instructions for rules

on where to enter the total on your return |

. . . . . . . . . . . . ▶ |

10 |

For Paperwork Reduction Act Notice, see your tax return instructions. |

Cat. No. 11700N |

Form 2106 (2020) |

|

|

|

|

|

|

|

|

|

|

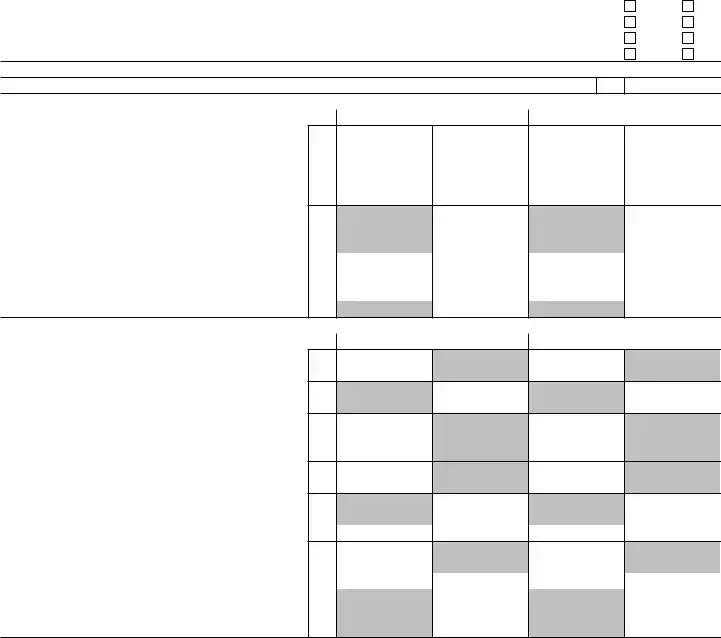

Form 2106 (2020) |

|

|

|

|

|

|

Page 2 |

|

|

Vehicle Expenses |

|

|

|

|

|

|

Part II |

|

|

|

|

|

|

|

|

|

|

|

|

|

Section A—General Information (You must complete this section if you are |

|

(a) |

Vehicle 1 |

|

(b) Vehicle 2 |

claiming vehicle expenses.) |

|

|

|

|

|

|

|

|

11 |

Enter the date the vehicle was placed in service |

11 |

/ |

/ |

|

/ |

/ |

12 |

Total miles the vehicle was driven during 2020 |

12 |

|

miles |

|

|

miles |

13 |

Business miles included on line 12 |

13 |

|

miles |

|

|

miles |

14 |

Percent of business use. Divide line 13 by line 12 |

14 |

|

% |

|

|

% |

15 |

Average daily roundtrip commuting distance |

15 |

|

miles |

|

|

miles |

16 |

Commuting miles included on line 12 |

16 |

|

miles |

|

|

miles |

17 |

Other miles. Add lines 13 and 16 and subtract the total from line 12 . . |

17 |

|

miles |

|

|

miles |

18 |

Was your vehicle available for personal use during off-duty hours? |

Yes |

No |

19 |

Do you (or your spouse) have another vehicle available for personal use? |

Yes |

No |

20 |

Do you have evidence to support your deduction? |

Yes |

No |

21 |

If “Yes,” is the evidence written? |

Yes |

No |

Section B—Standard Mileage Rate (See the instructions for Part II to find out whether to complete this section or Section C.)

22Multiply line 13 by 57.5¢ (0.575). Enter the result here and on line 1 . . . . . . . . . . . .

Section C—Actual Expenses

(a) Vehicle 1 |

(b) Vehicle 2 |

23 |

Gasoline, oil, repairs, vehicle insurance, etc. . |

23 |

|

|

|

|

24a |

Vehicle rentals |

24a |

|

|

|

b |

Inclusion amount (see instructions) . . . . |

24b |

|

|

|

c |

Subtract line 24b from line 24a |

24c |

|

|

|

|

25Value of employer-provided vehicle (applies only if 100% of annual lease value was included on

|

Form W-2—see instructions) |

25 |

|

|

|

|

26 |

Add lines 23, 24c, and 25 |

26 |

|

|

|

|

27 |

Multiply line 26 by the percentage on line 14 . |

27 |

|

|

|

|

28 |

Depreciation (see instructions) |

28 |

|

|

|

|

29 |

Add lines 27 and 28. Enter total here and on line 1 |

29 |

|

|

|

|

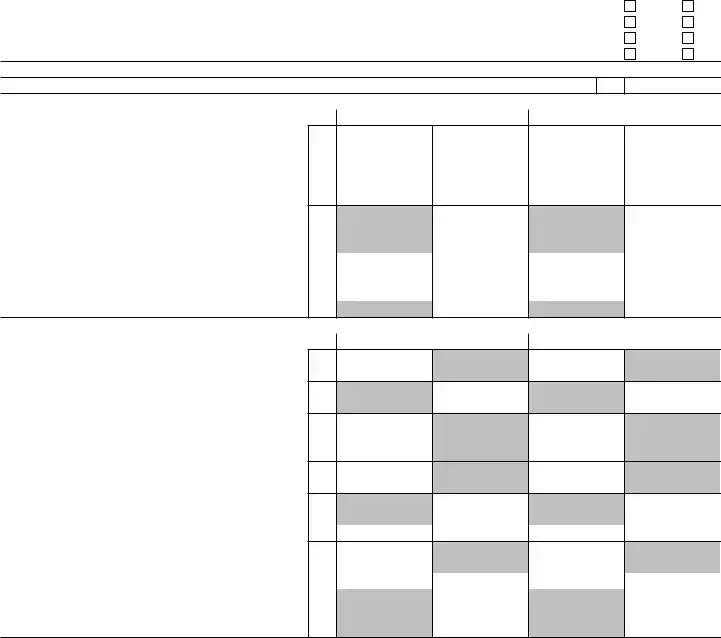

Section D—Depreciation of Vehicles (Use this section only if you owned the vehicle and are completing Section C for the vehicle.)

(a) Vehicle 1 |

(b) Vehicle 2 |

30 |

Enter cost or other basis (see instructions) . . |

30 |

31Enter section 179 deduction and special allowance

32Multiply line 30 by line 14 (see instructions if you claimed the section 179 deduction or special

allowance) |

. . . . . . . . . . . . |

32 |

33Enter depreciation method and percentage (see

34Multiply line 32 by the percentage on line 33 (see

instructions) |

34 |

|

|

|

|

35 Add lines 31 and 34 |

35 |

|

|

|

|

36Enter the applicable limit explained in the line 36

|

instructions |

36 |

|

|

|

|

37 |

Multiply line 36 by the percentage on line 14 . |

37 |

|

|

|

|

38 |

Enter the smaller of line 35 or line 37. If you |

|

|

|

|

|

|

skipped lines 36 and 37, enter the amount from |

|

|

|

|

|

|

line 35. Also enter this amount on line 28 above |

38 |

|

|

|

|

Form 2106 (2020)