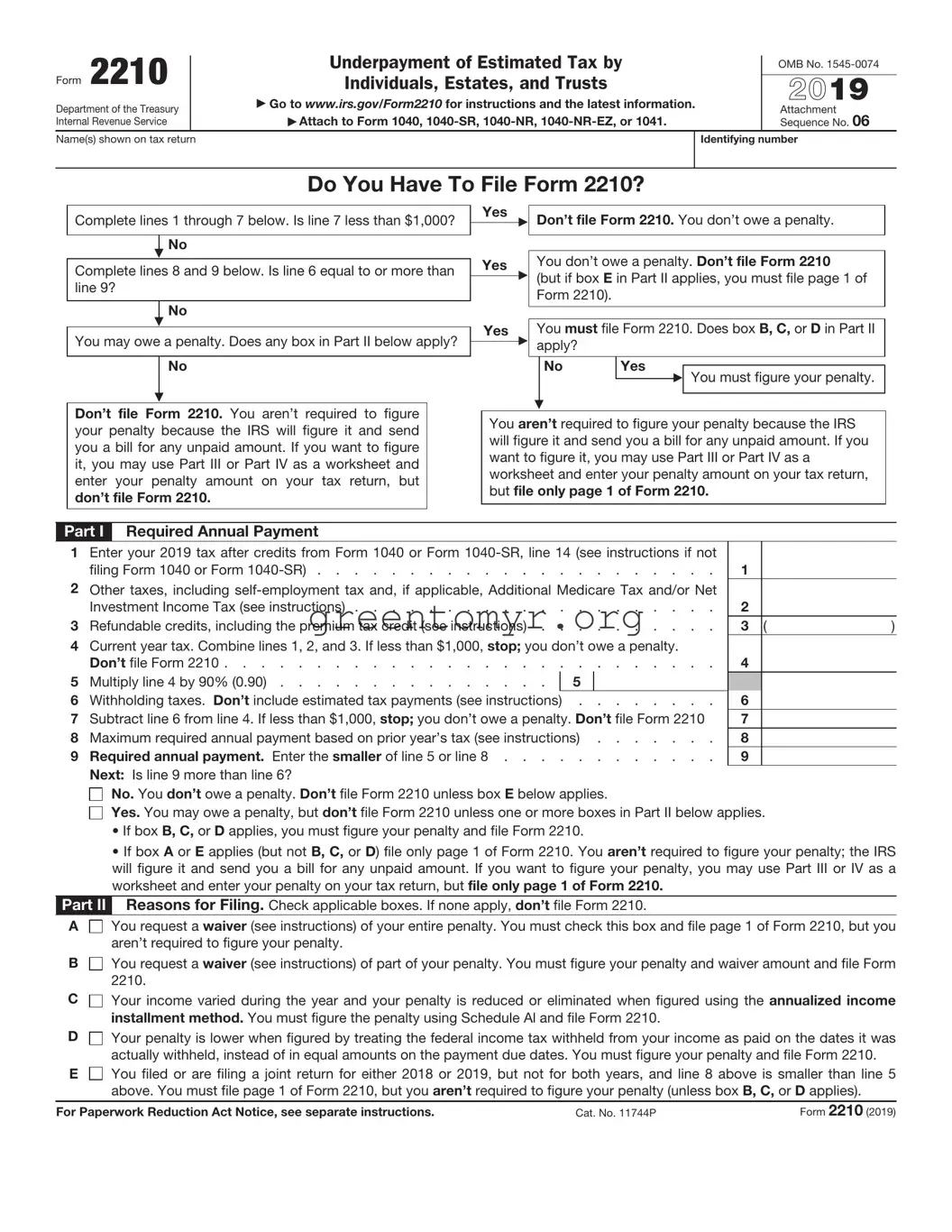

Complete lines 1 through 7 below. Is line 7 less than $1,000?

No

Complete lines 8 and 9 below. Is line 6 equal to or more than line 9?

No

You may owe a penalty. Does any box in Part II below apply?

No

Don’t file Form 2210. You aren’t required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use Part III or Part IV as a worksheet and enter your penalty amount on your tax return, but don’t file Form 2210.

Yes |

Don’t file Form 2210. You don’t owe a penalty. |

|

|

Yes |

|

You don’t owe a penalty. Don’t file Form 2210 |

|

|

|

|

|

|

(but if box E in Part II applies, you must file page 1 of |

|

|

|

|

|

|

|

|

Form 2210). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

You must file Form 2210. Does box B, C, or D in Part II |

|

|

|

|

|

apply? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No |

Yes |

|

|

|

|

|

|

You must figure your penalty. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

You aren’t required to figure your penalty because the IRS will figure it and send you a bill for any unpaid amount. If you want to figure it, you may use Part III or Part IV as a worksheet and enter your penalty amount on your tax return, but file only page 1 of Form 2210.

Part I Required Annual Payment

1Enter your 2019 tax after credits from Form 1040 or Form 1040-SR, line 14 (see instructions if not

filing Form 1040 or Form 1040-SR) |

1 |

2Other taxes, including self-employment tax and, if applicable, Additional Medicare Tax and/or Net

Investment Income Tax (see instructions) |

2 |

|

|

3 Refundable credits, including the premium tax credit (see instructions) |

3 |

( |

) |

4Current year tax. Combine lines 1, 2, and 3. If less than $1,000, stop; you don’t owe a penalty.

|

Don’t file Form 2210 |

4 |

|

5 |

Multiply line 4 by 90% (0.90) |

5 |

|

|

|

6 |

Withholding taxes. Don’t include estimated tax payments (see instructions) |

6 |

|

7 |

Subtract line 6 from line 4. If less than $1,000, stop; you don’t owe a penalty. Don’t file Form 2210 |

7 |

|

8 |

Maximum required annual payment based on prior year’s tax (see instructions) |

8 |

|

9 |

Required annual payment. Enter the smaller of line 5 or line 8 |

9 |

|

|

Next: Is line 9 more than line 6? |

|

|

|

|

|

No. You don’t owe a penalty. Don’t file Form 2210 unless box E below applies. |

|

|

|

Yes. You may owe a penalty, but don’t file Form 2210 unless one or more boxes in Part II below applies. |

•If box B, C, or D applies, you must figure your penalty and file Form 2210.

•If box A or E applies (but not B, C, or D) file only page 1 of Form 2210. You aren’t required to figure your penalty; the IRS will figure it and send you a bill for any unpaid amount. If you want to figure your penalty, you may use Part III or IV as a worksheet and enter your penalty on your tax return, but file only page 1 of Form 2210.

Part II Reasons for Filing. Check applicable boxes. If none apply, don’t file Form 2210.

A

You request a waiver (see instructions) of your entire penalty. You must check this box and file page 1 of Form 2210, but you aren’t required to figure your penalty.

You request a waiver (see instructions) of your entire penalty. You must check this box and file page 1 of Form 2210, but you aren’t required to figure your penalty.

B

You request a waiver (see instructions) of part of your penalty. You must figure your penalty and waiver amount and file Form 2210.

You request a waiver (see instructions) of part of your penalty. You must figure your penalty and waiver amount and file Form 2210.

C

Your income varied during the year and your penalty is reduced or eliminated when figured using the annualized income installment method. You must figure the penalty using Schedule Al and file Form 2210.

Your income varied during the year and your penalty is reduced or eliminated when figured using the annualized income installment method. You must figure the penalty using Schedule Al and file Form 2210.

D

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

E

You filed or are filing a joint return for either 2018 or 2019, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you aren’t required to figure your penalty (unless box B, C, or D applies).

You filed or are filing a joint return for either 2018 or 2019, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you aren’t required to figure your penalty (unless box B, C, or D applies).

You request a

You request a

You request a

You request a

Your income varied during the year and your penalty is reduced or eliminated when figured using the

Your income varied during the year and your penalty is reduced or eliminated when figured using the

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

Your penalty is lower when figured by treating the federal income tax withheld from your income as paid on the dates it was actually withheld, instead of in equal amounts on the payment due dates. You must figure your penalty and file Form 2210.

You filed or are filing a joint return for either 2018 or 2019, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you

You filed or are filing a joint return for either 2018 or 2019, but not for both years, and line 8 above is smaller than line 5 above. You must file page 1 of Form 2210, but you