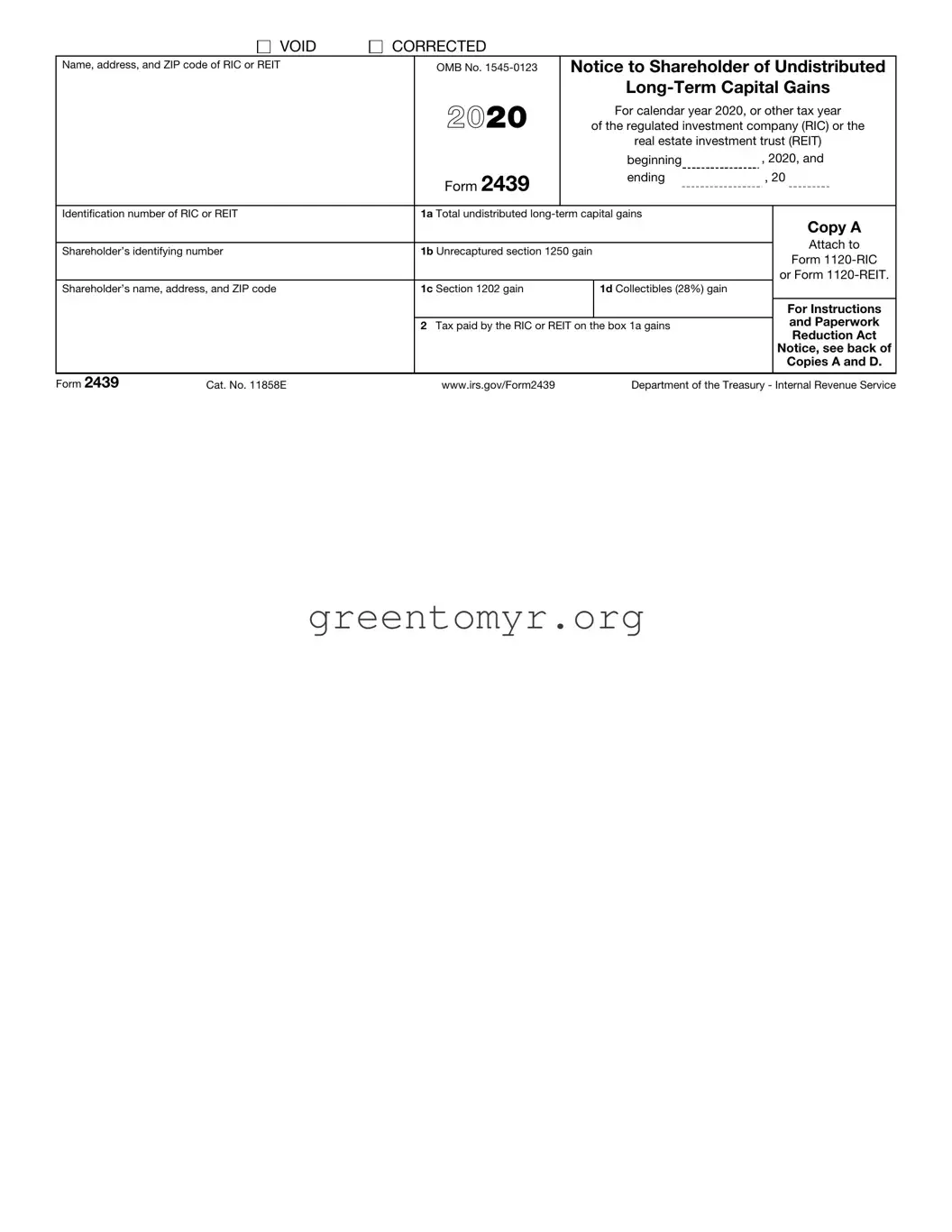

The IRS Form 2439 is a tax form used by shareholders of a Mutual Fund or a Regulated Investment Company (RIC). It primarily reports undistributed long-term capital gains that you may have received from these investments. This form is essential for properly calculating and reporting your tax liability related to these gains, ensuring you are aware of the amount that may need to be included on your tax return.

Only shareholders who have received this form need to take action. If you hold shares in a mutual fund or regulated investment company that reports undistributed gains to you, you will receive Form 2439. It’s important for taxpayers who have had dividends reinvested or received distributions that were not immediately taxed.

To report the information from Form 2439 on your tax return, follow these steps:

-

Locate the Form 2439 you received.

-

Identify the amounts reported in Box 1a (Undistributed Capital Gains) and Box 2a (Your Share of the Fund’s Loss).

-

Use the amount from Box 1a to report the undistributed long-term capital gains on your tax return, generally on Schedule D (Capital Gains and Losses).

-

If applicable, use the amount from Box 2a to report losses, which may help offset any gains.

Always double-check your entries and consider seeking assistance from a tax professional if you’re unsure about the process.

Receiving Form 2439 indicates that you have undistributed capital gains, which can affect your tax liability. The amount listed in Box 1a is typically taxed as long-term capital gain, regardless of how long you have held the shares. This may lead to a higher tax bill, so it’s crucial to plan accordingly. Understanding these implications allows you to factor potential taxes into your investment decisions.

If you believe you should have received Form 2439 but did not, start by checking with your mutual fund or investment company. They can confirm whether there were any undistributed gains during the tax year. If they indicate that gains exist, request a copy of the form. It’s always better to ensure you have all necessary documents to avoid potential issues with tax reporting.

For more detailed information, you can visit the official IRS website. They provide comprehensive guidance, including instructions for completing Form 2439 and related forms. Additionally, you can consult tax professionals or resources like tax preparation software that often feature integrated instructions for dealing with various IRS forms.