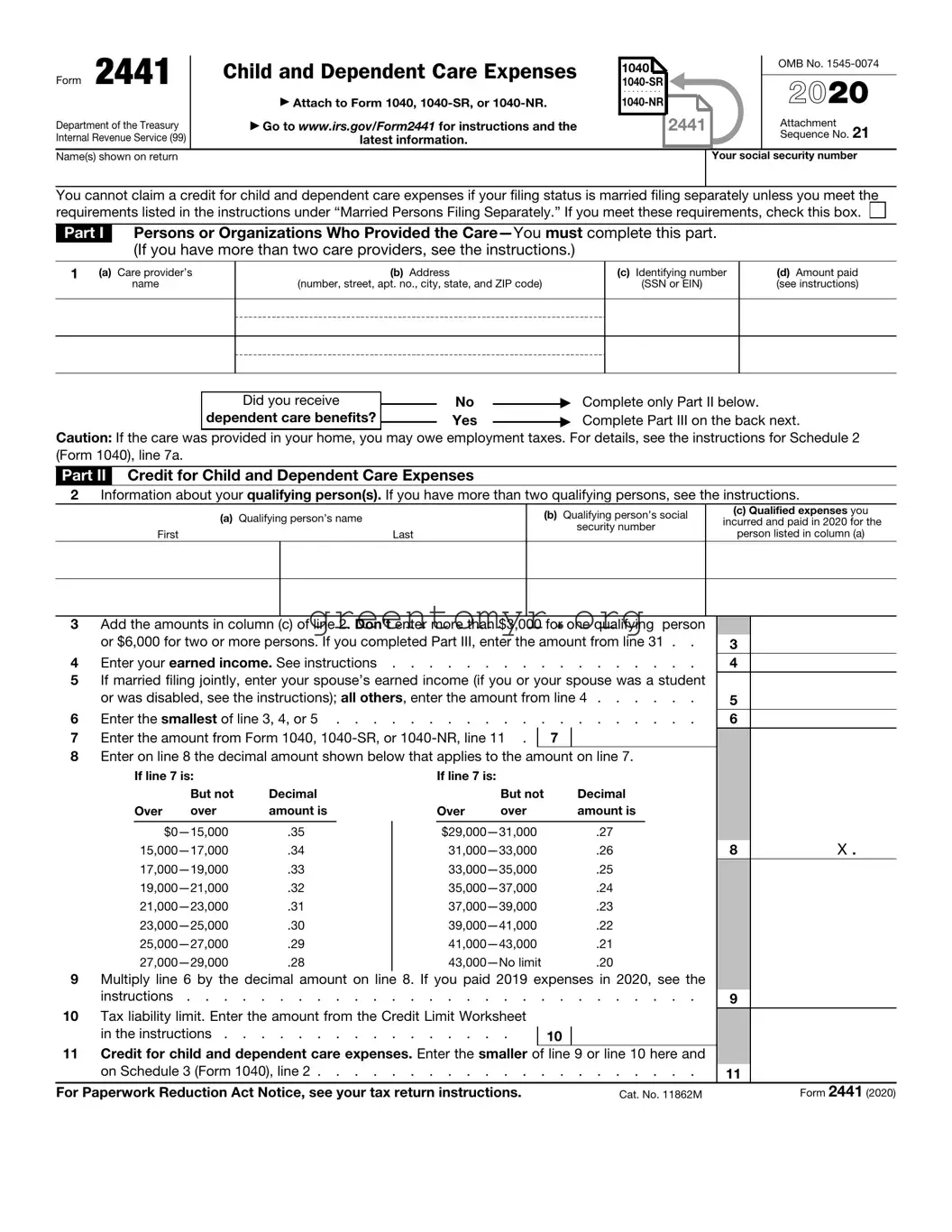

Filling out the IRS 2441 form for Child and Dependent Care Expenses can be a straightforward process. However, many individuals encounter common pitfalls that can lead to errors in their submissions. One mistake often made involves failing to provide correct taxpayer identification numbers (TINs). It is essential to ensure that the Social Security Numbers (SSNs) for both the taxpayer and dependents are accurate and clearly written. Incorrect numbers may result in processing delays or the rejection of the claim.

Another common error is omitting essential information about the care provider. The IRS requires specific details such as the name, address, and TIN of the care provider. If this information is left blank or incomplete, it can trigger complications with the submission. Care providers must also be eligible, so verifying their qualifications beforehand is necessary to avoid any issues.

People often miscalculate their qualifying expenses, which is another mistake. The form requires a precise total of eligible expenses incurred for the care of qualifying individuals. Failure to keep thorough records of these expenses can lead to inaccuracies. Receipts and statements should be retained to substantiate these claims, ensuring that the amounts claimed align with actual expenses.

The selection of the correct number of qualifying individuals can also lead to confusion. Claiming expenses for more dependents than allowed can result in penalties. The IRS specifies guidelines on how many children or dependents can qualify. This understanding is crucial, as any misrepresentation can affect the accuracy of the claim.

Additionally, disregarding the limits on the care costs deduction is a common oversight. There are caps on the amount that can be claimed for care based on the age and number of dependents. People should familiarize themselves with these limits to avoid overestimating their claim, which could lead to a potential audit.

Some individuals neglect to sign and date the form correctly. This step may seem minor, but it is essential for the validation of the form. An unsigned form is deemed incomplete, which can delay processing or result in rejection. Promptly ensuring everything is signed at the end of the submission can save time and prevent frustration.

Another frequent mistake occurs when taxpayers fail to double-check the form for consistency. All figures and statements should align with those provided on other tax documents. Discrepancies can lead to complications or scrutiny by the IRS. It is advisable to review the completed form against other tax records for accuracy.

Finally, misunderstanding the filing deadlines can result in missed opportunities for potential credits. The IRS has set dates for when this form must be submitted. Being aware of these deadlines helps in planning and ensures the form is submitted timely, maximizing potential benefits for eligible expenses.